It’s easy to get caught up in the excitement of “property hunting”; scrolling through beautiful renderings and visiting open houses. But there’s a massive gap between liking a house and being ready for a mortgage.

In real estate, “ghosting” your responsibilities doesn’t just result in an awkward conversation; it results in financial loss. Let us bridge the gap between casual interest and serious ownership.

Time to Get Serious

The real estate market can be intimidating, especially for first-time homebuyers, with terms like earnest money deposit and inspection contingency. Buyers often get cold feet due to uncertainty about the housing market and the homebuying process. Working with a reputable real estate agent can help alleviate concerns and guide buyers through the process. Understanding key concepts, such as the difference between a buyer’s agent and a listing agent, is crucial for a successful transaction. Additionally, researching the local market and understanding current trends, including interest rates, can help buyers make informed decisions.

1. The “Window Shopping” Phase

The excitement of browsing through listings, scrolling through beautiful renderings, and visiting open houses can feel like a thrilling adventure. However, this initial enthusiasm often gives way to hesitation when it comes time to make a serious financial commitment, such as paying a reservation fee or earnest money deposit.

Many buyers approach real estate like casual window shopping, treating it like a fleeting interest instead of a long-term commitment. This mindset can lead to cold feet and missed opportunities.

Real estate success isn’t about finding the “perfect” house; it’s about cultivating the “perfect” mindset to see the payment and ownership process through to the end.

Consider this: you spent months touring homes without making an offer. When you finally found a property you liked, you hesitated to pay the deposit, fearing you might find something better. Unfortunately, the home was sold to another buyer who was ready to commit.

2. Why We Hesitate: The Psychology of Property Cold Feet

Buying a home is one of the biggest financial and emotional commitments most people will ever make. It’s natural to experience hesitation or “cold feet” during the process, and understanding the psychology behind these feelings can help buyers move forward with confidence.

- Fear of “The One”: Many buyers worry that a better deal or a more suitable location might appear just after they commit. This fear of missing out can cause buyers to hesitate, delaying decisions or pulling back from an accepted offer. The reality is that no property is perfect, and waiting for an ideal home can mean missing out on good opportunities.

- Emotional vs. Logical Decision-Making: Often, buyers are torn between emotional impulses and logical considerations. A property may look appealing on social media or in marketing materials, but it’s crucial to evaluate if it fits long-term financial goals, lifestyle needs, and budget constraints. Emotional attachment to aesthetics or trends can cloud judgment, while logical factors like affordability, neighborhood quality, and inspection reports should guide the decision.

- Fear of Financial Strain: The total cost of homeownership goes beyond the asking price. Buyers must consider mortgage payments, property taxes, insurance, maintenance, and unexpected repairs. This comprehensive financial responsibility can be overwhelming, especially for first-time homebuyers who may experience sticker shock when seeing the full picture. Concerns about sustaining these expenses over time often trigger cold feet.

- Commitment Anxiety: Committing to a mortgage means locking into a long-term financial obligation, which can feel daunting. Buyers may worry about job security, future income changes, or market fluctuations that could affect their ability to keep up with payments. This uncertainty can cause hesitation at the critical point of signing a contract or putting down earnest money.

- Overwhelm from the Process: The homebuying journey involves multiple steps—research, inspections, negotiations, financing, and closing. The complexity and volume of information can overwhelm buyers, making them second-guess their readiness to proceed. Without clear guidance from a trusted real estate agent or financial advisor, buyers may feel lost and tempted to back out.

- Social Influence and Comparison: In today’s connected world, buyers often compare their experiences and choices with those of others on social media or among their peers. Seeing others’ seemingly perfect purchases or hearing about better deals can foster doubt about their own decisions, leading to cold feet.

Understanding these psychological factors helps buyers recognize that hesitation is a normal part of the process. By addressing fears with facts, focusing on long-term goals, and seeking professional advice, buyers can overcome cold feet and move confidently from interest to ownership.

Table 1: Emotional vs. Logical Factors in Homebuying

| Emotional Factors | Logical Factors |

|---|---|

| Fear of missing out on a better home | Affordability within budget |

| Attachment to ideal aesthetics | Proximity to workplace and amenities |

| Anxiety about long-term commitment | Inspection report and property condition |

| Influence of social media trends | Market conditions and interest rates |

3. The Repercussions: What Happens When You “Ghost” Your Mortgage?

Inconsistency in real estate has tangible, expensive consequences. If your plans are pabago-bago (constantly changing), you aren’t just losing a house; you’re losing a financial foundation.

- Financial Fallout: Failing to commit can have serious financial consequences.

- Foreclosure: If payments are missed, buyers risk losing the asset and any equity already built.

- Unfinished Payments: Reservation fees and down payments are often non-refundable, resulting in financial loss.

- Credit Damage: Walking away from a purchase can negatively affect credit scores, impacting future loan approvals for homes, cars, or business ventures.

- The Opportunity Cost: Time spent hesitating can mean missing out on market appreciation and wealth-building opportunities.

- Lost Trust and Reputation: Repeatedly backing out of deals or showing hesitation can damage a buyer’s reputation among real estate agents, sellers, and brokers. This loss of trust can make it harder to negotiate favorable terms or have offers seriously considered in the future.

- Emotional Stress: The uncertainty and anxiety caused by indecision can take a toll on mental well-being. The stress of dealing with potential financial penalties, legal consequences, and the fear of missing out can compound, making the homebuying experience overwhelming.

- Legal Consequences: Depending on the terms of the purchase contract, buyers who back out without valid contingencies may face lawsuits for breach of contract. Sellers may seek to retain earnest money deposits or pursue damages, leading to costly legal battles.

- Impact on Sellers and the Market: When buyers get cold feet and back out, sellers often face delays and additional costs, such as relisting fees and extended time on the market. This can disrupt market dynamics, affecting pricing and availability for other buyers.

- Missed Personal Milestones: Hesitation can delay important life events tied to homeownership, such as starting a family, relocating for a job, or building long-term financial security. Every delay can push back these milestones, affecting overall life plans.

The Cost of Inconsistency

| Action | Consequence | Financial Impact |

| Stopping Payments | Foreclosure | Loss of all previous equity and the property itself. |

| Canceling Mid-Way | Forfeiture | Most developers won’t refund reservation fees or early downpayments. |

| Late Remittances | Penalty Fees | Interest rates and surcharges that compound monthly. |

| Inconsistent Record | Poor Credit Score | Difficulty securing future loans for cars or businesses. |

By understanding these repercussions, buyers can better appreciate the importance of commitment in real estate transactions. Being prepared, informed, and confident can help avoid these costly consequences and pave the way to successful ownership.

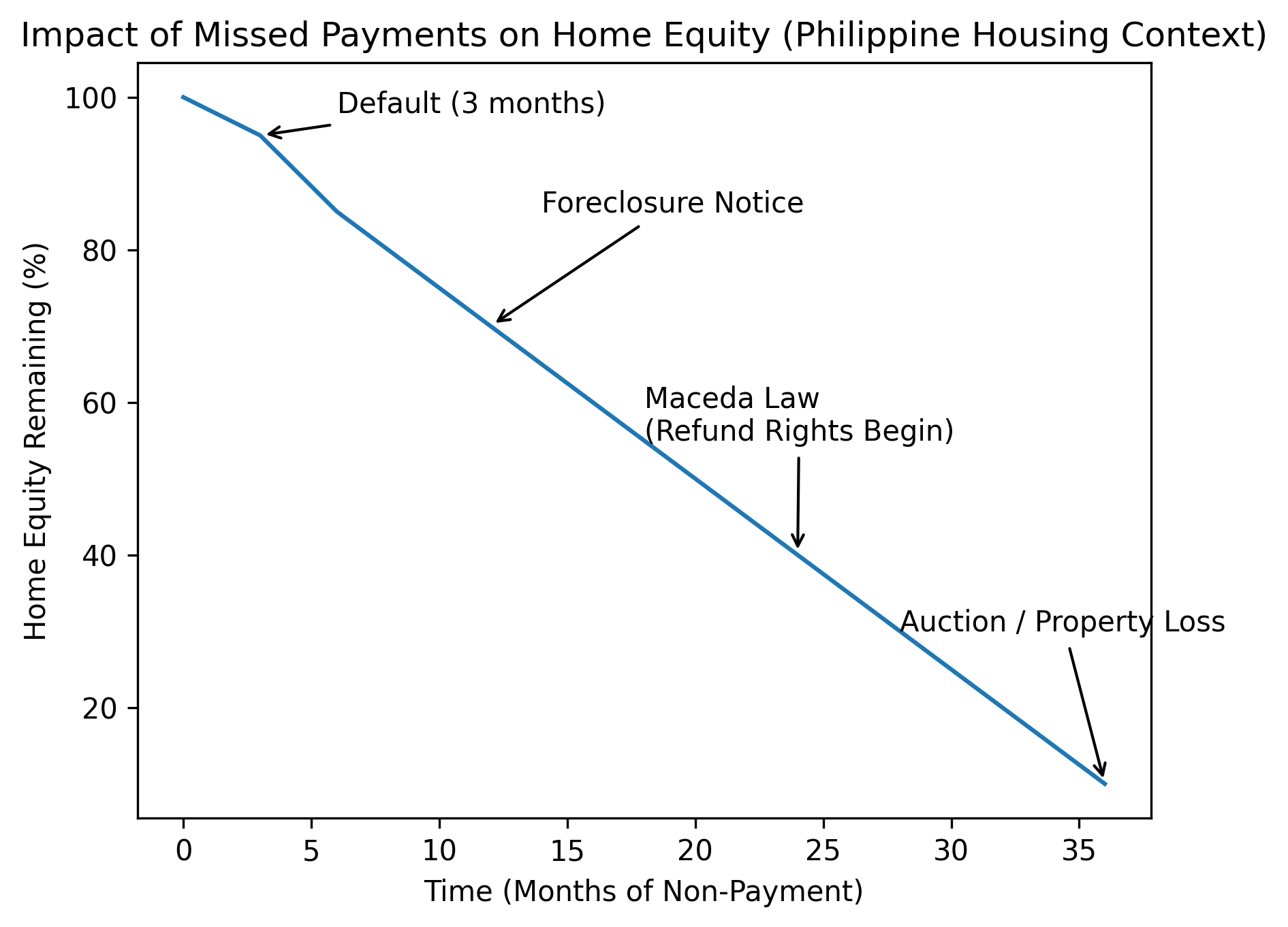

Graph 1: Impact of Missed Payments on Home Equity Over Time

This graph would illustrate how missed payments lead to loss of equity and potential foreclosure.

- X-axis (Time in Months): Represents the duration of missed or unresolved payments.

- Y-axis (Home Equity Remaining %): Shows how much equity the homeowner still has.

- Downward trend: Illustrates that as missed payments continue, equity is reduced due to penalties, interest, legal fees, and foreclosure risk.

- Near-zero equity: Signals a high likelihood of foreclosure, where the homeowner may lose most or all ownership value.

The typical timeline for default and foreclosure in the Philippines begins with accounts being classified as in default after approximately three months. Around twelve months in, banks usually initiate foreclosure notices as part of the legal process. After about twenty-four months, the Maceda Law provides buyers with refund rights following long-term installment payments. Finally, at roughly thirty-six months, judicial or extrajudicial foreclosure proceedings may result in the auction and loss of the property.

4. Strategy: Aligning Your “Why” With Your “Buy.”

Making a successful transition from cold feet to confident ownership requires more than just financial readiness—it demands a deep alignment between your personal motivations and your purchasing decisions. Here are key strategies to help you solidify that connection and move forward with confidence:

- Long-Term Vision: When buying a property, it’s important to look beyond your current circumstances. Consider your plans, such as starting a family, changing careers, or retiring. A home should support your life goals over time, not just fit your present lifestyle. This perspective helps you commit to a purchase that truly serves your evolving needs.

- Budgetary Honesty: One of the biggest sources of cold feet is financial uncertainty. Being honest with yourself about what you can comfortably afford—and factoring in all the associated costs like mortgage payments, property taxes, insurance, maintenance, and unexpected repairs—makes commitment easier. When your monthly payments fit well within your budget, you can avoid the stress that leads to hesitation.

- Consistency is King: Real estate ownership is a long-term relationship, much like any other commitment in life. It requires steady dedication, from making timely mortgage payments to maintaining the property and planning for future expenses. Consistency builds equity, trust with lenders, and ultimately leads to full ownership. Embracing this mindset helps you push through moments of doubt.

- Revisit Your “Why”: Regularly remind yourself why you decided to buy in the first place. Whether it’s building wealth, securing a stable home for your family, or investing in your future, keeping your goals front and center can motivate you to stay the course.

- Visualize Your Future: Imagine yourself living in the home, creating memories, and achieving your long-term objectives. Visualization can turn abstract fears into tangible excitement, helping to overcome cold feet by connecting emotionally with your purchase.

- Seek Professional Guidance: A trusted real estate agent or financial advisor can help you align your motivations with your purchase. They can provide clarity, answer questions, and offer reassurance when doubts arise, making the commitment process less daunting.

By aligning your “why” with your “buy,” you transform hesitation into confidence, setting the foundation for a successful journey from cold feet to proud homeownership.

5. Best Practices for Staying the Course

Committing to real estate ownership requires discipline, planning, and a proactive mindset. Here are some best practices to help you stay the course from cold feet to confident ownership:

- Automate Your Discipline: One of the most effective ways to avoid missed mortgage payments is to set up automatic payments. Whether through post-dated checks or auto-debits from your bank account, automating your payments removes the temptation to delay or forget, ensuring your ownership stays on track and your credit remains healthy.

- The “Emergency Buffer”: Financial setbacks can happen unexpectedly. To cushion against unforeseen hardships such as job loss, medical emergencies, or urgent repairs, maintain an emergency fund that covers 3 to 6 months of mortgage payments and related housing expenses. This buffer provides peace of mind and helps prevent default or foreclosure during difficult times.

- Regular Portfolio Reviews: Owning property is a long-term commitment that benefits from periodic reflection. Regularly revisit your reasons for purchasing the property—whether it’s wealth building, retirement planning, family stability, or rental income—to reinforce your motivation. This practice helps you stay aligned with your goals and maintain confidence through market fluctuations or personal challenges.

- Stay Informed and Communicate: Keep open lines of communication with your real estate agent, lender, and financial advisor. Staying informed about market trends, interest rate changes, and property management issues can help you anticipate challenges and make timely decisions. Additionally, discussing any concerns early on can prevent small issues from escalating into major problems.

- Maintain Your Property: Consistent upkeep of your home or investment property protects your asset’s value and prevents costly repairs down the line. Develop a maintenance schedule and budget for routine expenses such as landscaping, HVAC servicing, and minor repairs. Taking care of your property not only preserves your investment but also contributes to your peace of mind as an owner.

- Focus on Long-Term Benefits: Remember that real estate ownership is a marathon, not a sprint. Short-term market fluctuations or temporary discomforts are often outweighed by the benefits of building equity, achieving stability, and creating a home or income stream. Keeping your eyes on the long-term rewards can help you push through moments of doubt.

- Seek Support When Needed: If you experience persistent anxiety or uncertainty, consider consulting a financial advisor or counselor who can provide objective advice and emotional support. Sometimes, external guidance is key to overcoming cold feet and making informed decisions that align with your best interests.

By adopting these best practices, you can transform hesitation into confidence, ensuring that your journey from initial interest to full ownership is smooth, informed, and successful.

Table 2: Sample Emergency Fund Calculation

| Monthly Mortgage Payment | Recommended Emergency Fund (3 months) | Recommended Emergency Fund (6 months) |

|---|---|---|

| Php1,200 | Php3,600 | Php7,200 |

| Php2,000 | Php6,000 | Php12,000 |

The “Serious Buyer” Checklist

Before you sign that Reservation Agreement, ask yourself these three questions to see if you are truly ready to get serious.

- Am I buying for the right reasons? (Investment/Shelter vs. Peer Pressure/Trend)

- Can I sustain this for the next 120+ months? (Consistency check)

- Is my “Why” stronger than my “Fear”? (Motivation check)

Pro-Tip: If the thought of paying every month for 10 years scares you, start smaller. Commitment is a muscle—build it with a property that fits comfortably within your budget so you aren’t constantly tempted to quit.

Stop Dating, Start Owning

Real estate is a marathon, not a sprint. The people who build massive wealth through property aren’t necessarily the luckiest; they are the most consistent. They stayed when the market was boring, they paid when they wanted to travel instead, and they committed when others had cold feet.

Are you ready to stop scrolling and start signing?

Let’s sit down and look at your 5-year plan. I can help you find a property that aligns with your goals so that “committing” feels like the smartest move you’ve ever made.

HousingInteractive: Your Partner in Long-Term Commitment

We believe that building wealth requires moving past the “window shopping” phase and into a strategy of consistency. As the country’s pioneer portal, we provide the stability and high-quality listings you need to confidently transition from a browser to a builder of legacy.

HousingInteractive, the Philippines’ first property portal, delivers property solutions that turn your “scrolling” into “signing.” Stop dating the market and start owning your future—find your long-term investment with us today!

| HousingInteractive’s article series, “Why Real Estate Must Be Handled Like One’s Love Life,“ presents a unique and practical guide to investment serendipity by drawing direct parallels between finding the perfect romantic partner and securing the ideal property. The articles guide investors through crucial emotional and strategic checkpoints, emphasizing that when one learns to choose with wisdom, check with diligence, and commit with confidence, they don’t simply find the right property; they actively build a successful, long-term investment. Ready to apply these principles? Check out the full series on HousingInteractive for actionable steps to secure your next perfect property match. Next: The Sweet Talker Developer |