Thinking about buying property in the Philippines? You’ve got a big decision to make: pre-selling or Ready-for-Occupancy (RFO). This choice can significantly impact your finances down the road.

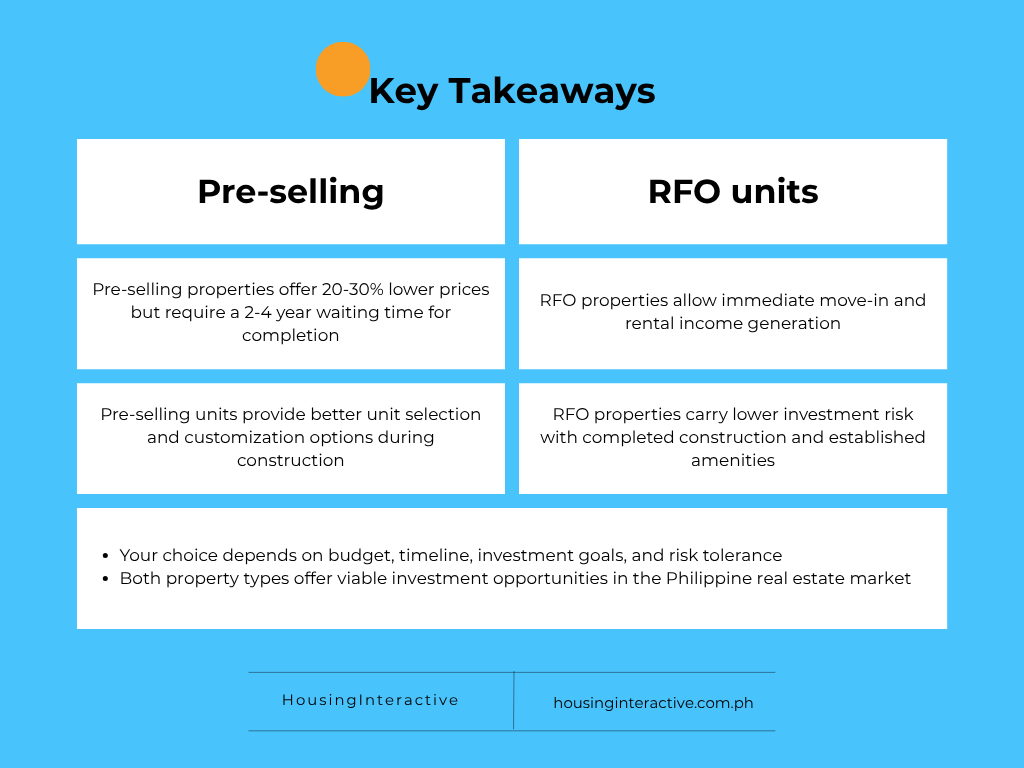

Here’s why it matters: Pre-selling units usually cost 20-30% less than RFO properties. Understanding the difference between these two is crucial for making informed decisions in today’s rapidly evolving market.

No matter if you’re an OFW saving for a future home, a local investor looking for rental income, or a first-time buyer, picking between pre-selling and RFO means looking closely at your finances, when you need the property, and what you hope to achieve.

This guide will walk you through pre-selling and RFO properties, helping you determine which option is perfect for you.

Pre-Selling vs RFO Properties: What’s the Difference?

When you’re looking to buy property in the Philippines, you’ll mainly come across two types: Pre-Selling and Ready-for-Occupancy (RFO). Each one works differently and suits different buyers.

- Pre-selling properties are units you buy while they’re still being planned or built. Developers offer these early to help fund the construction, and because you’re buying early, you often get a better price.

- RFO properties, on the other hand, are already finished. They’re ready for you to move into or rent out right away.

Both property types are highly sought after, particularly in vibrant cities such as Makati, Taguig, and Cebu, as well as in rapidly developing business hubs like Laguna and Cavite, where residential demand is strong. Real estate companies have refined their strategies to cater to both markets, with some focusing solely on one type, while others provide a broad range of options that include both pre-selling and RFO properties.

Your choice between pre-selling and RFO properties ultimately depends on your circumstances and objectives. Both options offer distinct benefits, and their attractiveness can vary based on current market conditions and your specific goals.

Key Takeaways

Before diving deep into the comparison, here are the essential points every property buyer should understand:

What Are Pre-Selling Properties?

Imagine buying your future home or investment before it’s even fully built. That’s exactly what pre-selling properties are.

Here’s a breakdown:

| When You Buy: | You purchase these units when they’re still in the planning stages or just starting construction. |

| Why Developers Do It: | Selling early helps real estate companies get the money they need to build the project. |

| Your Benefit: | Because you’re buying so early, you often get a much better price. You also get to pick from the best unit locations, like those with great views or on preferred floors. |

Timeline:

- Typical Waiting Period: You’ll generally wait anywhere from 18 months to 4 years for the project to be completed.

Examples: A large condo tower in a busy area like Fort BGC or Ortigas Center might take 2-3 years. Smaller projects could be finished sooner.

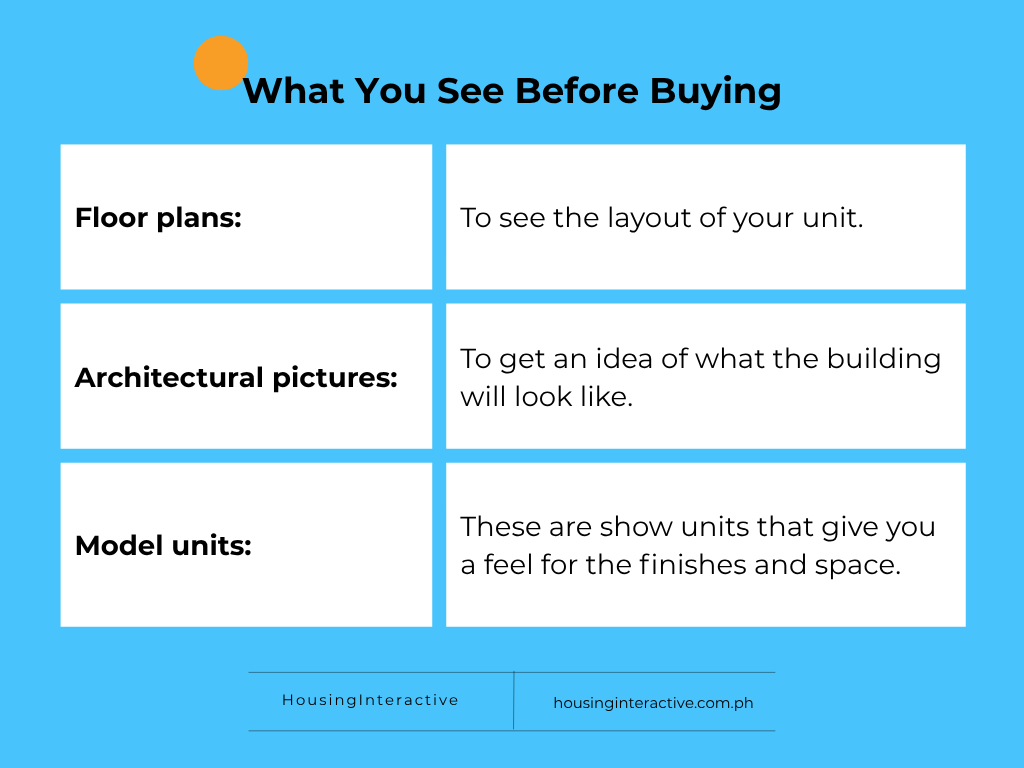

Since the building isn’t finished, you’ll rely on:

Buying pre-selling means you’re buying based on plans and promises. It’s really important to trust the developer and check their past projects to make sure they deliver. Some developers might even let you customize things like finishes or layouts while the unit is still being built.

Buying pre-selling is like getting in on the ground floor. It’s great for those looking for potential savings and the chance to personalize their space, as long as they’re prepared to wait for their new property.

Why Choose a Pre-Selling Property?

Pre-selling properties offers some great benefits, especially if you’re looking for value and future growth. Here’s a quick look at why many clients choose this option:

| Lower Initial Price: | You can often get a much better deal when you buy a unit during the pre-selling phase. Developers offer attractive prices early on, which means you’re buying at a discount compared to what the property will cost when it’s finished and ready for occupancy (RFO). This makes these units more affordable for many buyers. |

| Higher Potential for Growth: | This is a big one for investors. By buying early, you’re positioned to see your property’s value go up significantly. As the construction progresses, the surrounding area develops, and demand increases, your unit’s value can grow a lot from its initial pre-selling price to its RFO price, and even continue to appreciate after that. |

| Personalize Your Space: | Many developers let pre-selling buyers choose certain finishes or layouts for their units. Want a specific tile or a slightly different kitchen setup? You might be able to customize it, which is something you rarely get with an RFO unit. |

| Flexible Payments: | Instead of a huge upfront payment, pre-selling often comes with staggered down payment plans. These payments can be spread out over 3 to 5 years, making it much easier on your wallet and helping you manage your cash flow without a big lump sum needed all at once. |

| Brand New & Modern: | You’ll get a brand-new unit with the latest designs, modern amenities, and often, features that are energy-efficient. It’s like getting the newest model car right when it comes out! |

| Best Unit Choices: | When you buy pre-selling, you get first dibs on units. This means you can pick the ones with the best views, ideal floor levels, or corner spots, which are usually the first ones to be snapped up. |

What Are the Downsides of Pre-Selling Properties?

While pre-selling offers great benefits, there are also some risks and downsides you should know about. Since you’re buying a property that isn’t built yet, you’ll face a few uncertainties:

| Construction Delays: | This is a common issue. Things like problems getting permits, not enough workers, issues with getting building materials, or even natural disasters can delay when your unit is finished. These long delays can affect your plans and finances. |

| Developer Problems: | Although it’s rare with good developers, there’s always a small chance the developer might run into financial trouble or, in very rare cases, the entire project could be cancelled. This is why it’s super important to research the developer carefully. |

| Market Can Change: | The real estate market can shift while your property is being built. Economic slowdowns, changes in property values, or rising interest rates could impact how much your property is worth later or how much you’ll pay for your loan. |

| No Immediate Use or Income: | You won’t be able to live in or rent out your pre-selling unit right away. You’ll have to wait until it’s fully completed and turned over to you, meaning you won’t get any rental income immediately. |

| Could Look Different: | Sometimes, the finished unit might look a little different from the initial pictures, model units, or plans you saw when you bought it. This can sometimes lead to small disappointments. |

| Who is Pre-Selling For? Pre-selling is best for people who can wait a while before moving in or earning from their property. It’s great for investors looking to make money over time, first-time buyers who have some flexibility in their budget and timeline, and anyone who wants a brand-new home they can customize. Just make sure you trust the developer and are okay with waiting for your property to be finished. |

What Are Ready-for-Occupancy (RFO) Properties?

Ready-for-Occupancy (RFO) properties are pretty straightforward: they’re fully finished units that are ready for you to move into or rent out right away. They’re the opposite of pre-selling units, where you have to wait for construction.

Here’s what makes RFO properties different:

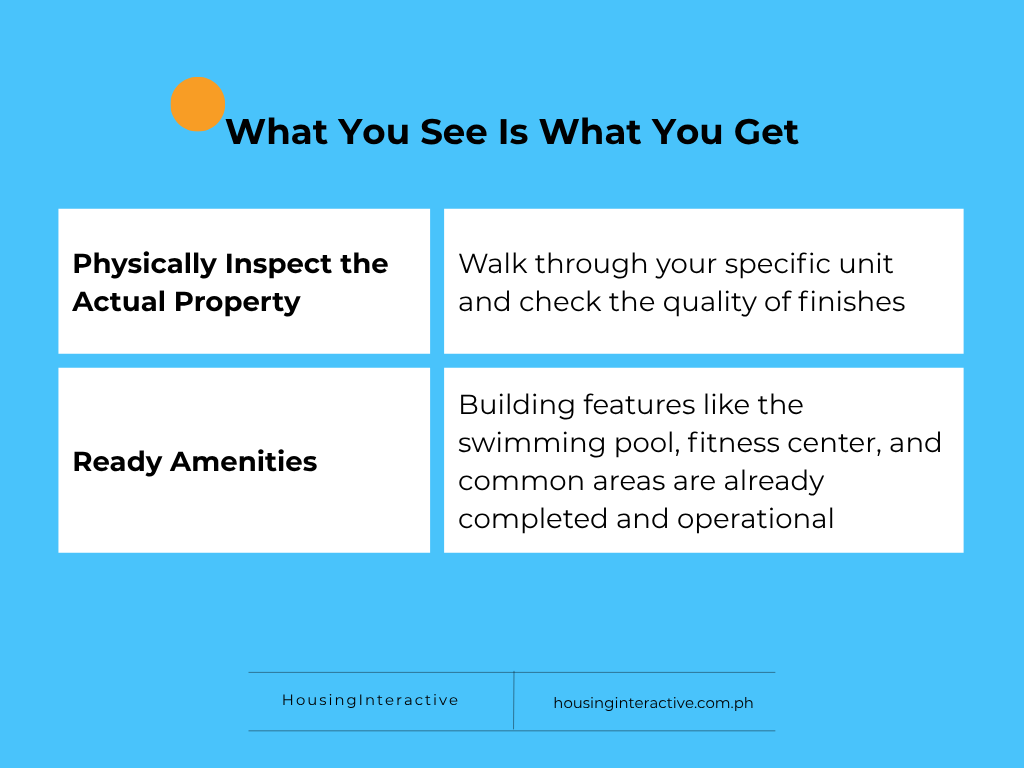

This means you can walk through your specific unit, check the quality of finishes, and see the amenities like the swimming pool or gym firsthand. You can see exactly what you’re getting and how well they’re maintained. No more guessing or relying on pictures!

Immediate Use:

- Need a place to live now? RFO is perfect.

- Want to start earning rental income right away? RFO lets you do that.

- All the paperwork for moving in, setting up utilities, and other logistics is usually streamlined because the building is already up and running.

Examples: Think of established condo buildings you see in busy areas along Roxas Boulevard, in the Mall of Asia Complex, or Aseana Avenue. These are often RFO properties with proven management and existing communities.

Choosing an RFO property means you get certainty and immediate access, making it a great option if you’re looking for a quick housing solution or fast returns on your investment.

Why Choose a Ready-for-Occupancy (RFO) Property?

RFO properties offer several clear advantages, especially if you need a property right away or want to start earning income quickly. Here are the main benefits:

| Move In or Rent Out Right Away: | This is the biggest perk! You can move into your RFO unit immediately, or if you’re an investor, you can start renting it out and earning money without any delay. This means “instant cash flow” for you. |

| No Waiting, Less Risk: | Since the property is already built, you won’t have to worry about construction delays. You know exactly when you can move in or when your rental income will start, which makes planning much easier and less risky. |

| See Before You Buy: | You can physically walk through the actual unit, check out the common areas like the pool or gym, and inspect the quality of everything before you commit. This means no surprises – what you see is what you get. |

| Quick Turnaround: | If you need a home fast, or if you’re looking to buy and then quickly sell (flip) a property, RFO units are perfect because they’re ready to go. |

| Easier to Get a Loan: | Banks often find RFO properties less risky because they’re already built. This can make it easier and quicker for you to get a home loan approved. |

| Clear Costs: | All the costs, like the exact price of the unit, monthly fees, and any immediate repair needs, are usually clear from the start. This helps you budget accurately without unexpected expenses popping up later. |

What Are the Downsides of Ready-for-Occupancy (RFO) Properties?

While RFO properties offer immediate benefits, there are also a few potential disadvantages you should be aware of:

| Higher Price Tag: | RFO units generally cost more than pre-selling units in the same building. This is because the developer has already covered all the construction costs, and the property’s value has already gone up during the building phase. |

| Less Initial Value Growth: | A big part of the property’s value increase happens while it’s being built. With an RFO unit, that initial “jump” in value has likely already happened, so your immediate profit from appreciation might be less dramatic compared to buying pre-selling. |

| Limited Personalization: | RFO units are sold “as is.” This means you usually can’t make changes to the layout or choose your finishes, like tiles or paint colors. What you see is what you get. |

| Possible Wear and Tear: | Even if an RFO unit is brand new, it might have been vacant for some time, or there could be minor scuffs or imperfections from the final stages of construction. |

| Fewer Choices: | The best units—like those with the best views or in prime spots within the building—are usually sold quickly during the pre-selling phase. This means you might have fewer desirable options to choose from when looking at RFO properties. |

| Who is RFO For? RFO properties are perfect for buyers who need a place to live right away, investors who want to start earning rental income immediately, those who have enough money upfront, and people who prefer a more certain and straightforward purchase without waiting. |

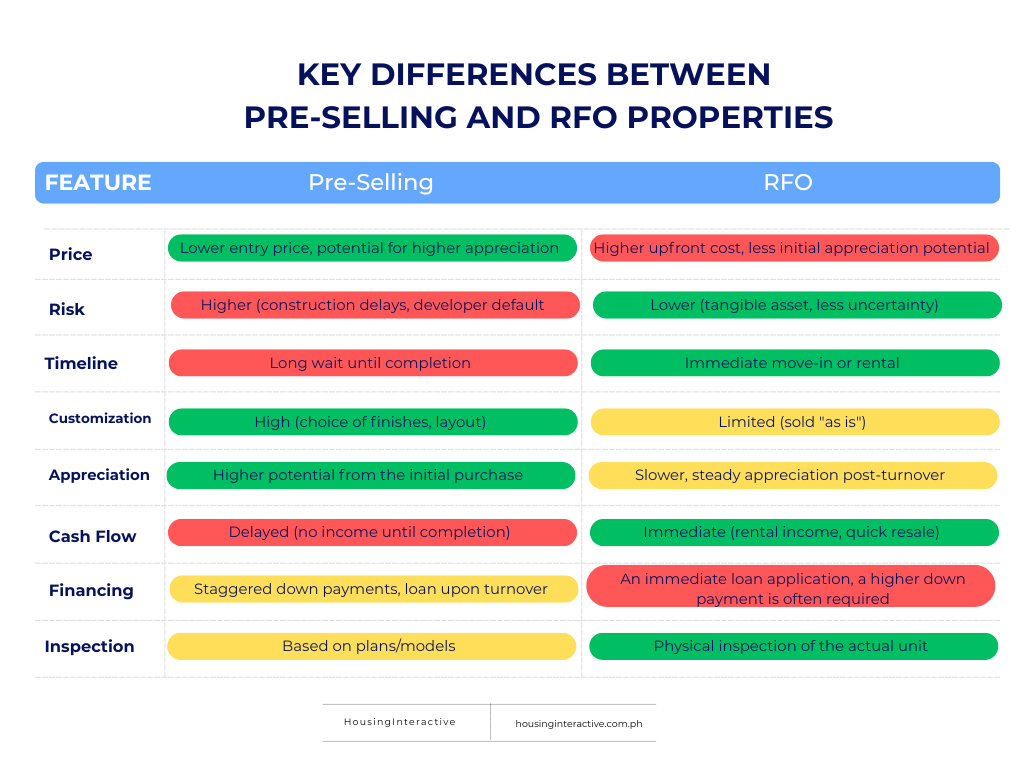

Key Differences

To help you visualize the key differences, here’s a direct comparison of pre-selling and RFO properties:

Understanding the Cost Difference: Pre-Selling vs. RFO

When it comes to your wallet, the biggest difference between pre-selling and RFO properties is the price tag.

| Pre-Selling Saves You Money Upfront: | RFO Costs More, But Offers Certainty: |

| Pre-selling units usually cost 20-30% less than similar RFO properties. | RFO properties are more expensive because they’re already built and ready. |

| Why cheaper? You’re getting a discount for being willing to wait for construction and for taking on a bit more uncertainty. | You’re paying extra for the convenience of moving in right away and having a completed property you can see and touch. |

| Developer Perks: | Think About Renovation Costs: |

| You’ll often find special deals like: – Early-bird discounts. – Promotional prices. – Flexible payment plans: This can mean a smaller down payment (sometimes just 10-20%) spread out over the construction time, making it easier on your budget. | While you’re paying a premium for RFO, remember to factor in any money you might spend on renovations. Even if it’s new, you might want to update or change things to fit your style. |

So, in short, pre-selling offers significant savings but requires patience, while RFO costs more but gives you immediate access and peace of mind.

How to Pick the Right Property Type for You

Choosing between a pre-selling or RFO property comes down to three main things: your money, your goals, and how comfortable you are with risk. Let’s break it down:

1. Look at Your Money

- What can you afford right now?

Think about how much you have for a down payment and what you can comfortably pay each month.

- Do you need money back quickly?

If you need a home or rental income right away, RFO might be better, even if it costs more upfront. If you can wait and want a lower starting price, pre-selling could offer better value.

- Are you ready for surprises?

Pre-selling can have unexpected delays or costs, so it helps to have some extra funds set aside. RFO means a bigger payment upfront, but usually fewer surprises afterward.

2. What Are Your Goals?

Your reason for buying helps a lot:

- Want your property to grow in value a lot over time?

Pre-selling is often favored for this, as you buy low and hope for bigger appreciation.

- Need rental income or a home immediately?

Focus on RFO properties. Getting income right away can make the higher price worth it.

- Long-term plan:

Think about how this property fits into your overall financial future. Different types of properties play different roles in a smart investment plan.

3. How Much Risk Can You Handle?

Your comfort level with risk is key:

- Prefer certainty and immediate use?

If you’re cautious, RFO is usually the safer bet, even if it costs more. You see what you get.

- Okay with waiting for a bigger payoff?

If you’re more adventurous and don’t mind some uncertainty (like construction delays), pre-selling could offer higher returns and more flexible payments.

- Can you handle issues?

Consider if you’re prepared for possible construction delays, extra costs, or market changes that could happen over a long building period.

By honestly assessing these points, you’ll be well on your way to deciding which property type is the best fit for your next real estate venture in Tanauan City or anywhere else in the Philippines!

Factors to Consider Before Making Your Choice

Your decision between pre-selling and RFO should be a well-thought-out one, aligning with your circumstances and financial objectives.

1. Define Your Goal First

Ask yourself:

Am I buying to invest or to live in?

Your goal determines what type of property fits best.

2. Know Your Budget

- Pre-selling: Lower upfront cost. Payment terms are usually spread over time.

- RFO: Requires a bigger upfront payment or bank loan right away.

| Tip: Be realistic about your cash flow and your ability to get financing. |

3. Assess Your Risk Comfort

| Pre-selling involves: | RFO offers: |

| – Waiting 2–4 years (or more) – Potential construction delays – Reliance on developer performance | – Instant results – Higher price, but less uncertainty |

Ask yourself:

Am I okay with waiting and taking on some risk for future gains?

4. Urgency of Need

- Need it now? Go for RFO.

- Can you wait a few years? Consider pre-selling for better pricing and flexibility.

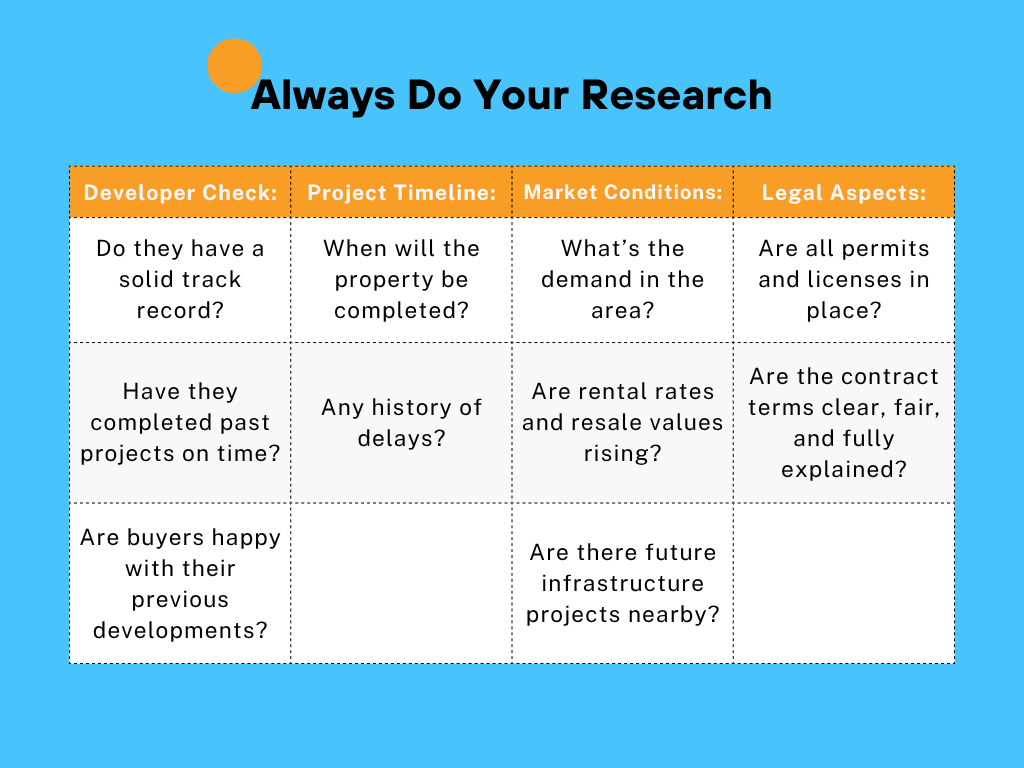

5. Always Do Your Research

No matter which property type you choose, due diligence is critical:

Final Tip:

There’s no one-size-fits-all answer. Choose what aligns with your:

- Goals

- Budget

- Timeline

- Risk tolerance

Always buy from a trusted developer with a proven record.

Frequently Asked Questions

What is the typical price difference between pre-selling and RFO properties?

Pre-selling properties typically cost 20-30% less than comparable RFO units. This discount reflects the waiting time and construction risks involved in purchasing incomplete properties. The exact difference varies based on location, developer, and current market conditions.

How long does it take for pre-selling properties to be completed?

Construction timelines range from 18 months to 4 years, depending on project complexity and scale. High-rise condominium projects typically require 2-3 years for completion, while house and lot developments may finish sooner, at 12-24 months. Delays can extend these timelines beyond original projections.

Can I get a refund if I change my mind about a pre-selling purchase?

The Maceda Law provides some protection for buyers who have made payments for at least two years, allowing refunds under certain conditions. However, specific refund terms depend on your contract with the real estate company. Early cancellation may result in penalty fees and partial forfeiture of payments made.

Is financing easier for RFO or pre-selling properties?

Banks typically prefer financing completed RFO properties due to established market values and clear collateral. Pre-selling financing may require higher down payments and often relies on developer financing options or bridge loans. Traditional mortgages become available once pre-selling properties reach completion.

Which property type offers better investment returns?

Pre-selling properties often provide higher capital appreciation potential upon completion, while RFO properties offer immediate rental income opportunities. The better choice depends on your investment timeline, cash flow needs, and market conditions. Both property types can deliver strong returns when properly selected and managed.

Choosing between pre-selling and RFO properties ultimately depends on your circumstances, financial capacity, and investment objectives. Take time to evaluate all factors, conduct thorough due diligence on developers and locations, and consider consulting with qualified real estate professionals to make the most informed decision for your specific situation.

Your Smart Real Estate Move

In the vibrant Philippine real estate market, both pre-selling and RFO properties offer distinct pathways to achieving your financial and lifestyle goals. While pre-selling beckons with the promise of higher appreciation and flexible terms, RFO delivers immediate gratification and reduced risk.

Your ultimate choice hinges on a clear understanding of your investment goals, financial capacity, and risk tolerance. Remember to always conduct thorough research, scrutinize developer reputations, and analyze market conditions.

This detailed guide comparing Pre-Selling and RFO properties highlights essential factors to help you choose the ideal property for your needs. We invite you to share your preferred option in the comments below and subscribe to HousingInteractive’s YouTube channel for expert tips on savvy real estate investing. As the Philippines’ leading property portal, HousingInteractive is your reliable partner for the latest updates, innovative solutions, and valuable insights into the Philippine real estate market.