Source references are listed at the end of the report.

Executive Summary

Malate, Ermita, & Binondo: Manila’s Enduring Heritage Meets Urban Evolution

Manila City, the Philippines’ historic capital in the region, presents a diverse and complex real estate landscape. This analysis zeroes in on Malate, Ermita, and Binondo, districts rich in history and culture. Malate and Ermita are known for their government offices, universities, and dynamic urban scene, while Binondo, the world’s oldest Chinatown, thrives as a commercial and financial hub. These areas feature a blend of historic buildings and new condominium developments, providing a distinct urban experience amidst challenges like aging infrastructure, congestion, and varying stages of urban decay and renewal.

Office Market Overview

Compared to major Central Business Districts (CBDs), the office market in Manila City’s focused districts (Malate, Ermita, Binondo) generally consists of older building stock and a population with fewer Grade A office spaces.

Vacancy Trends:

While specific vacancy rates for these districts aren’t consistently reported, they contribute to Metro Manila’s overall office vacancy rate, which hovered around 17-20% in Q4 2024/Q1 2025. Given the older building stock and stiff economic competition from modern CBDs, vacancy rates in Manila City are likely moderate to high, especially for non-prime spaces. For global context, Beijing reported an 18.8% office vacancy rate in Q1 2024.

Rental Rates:

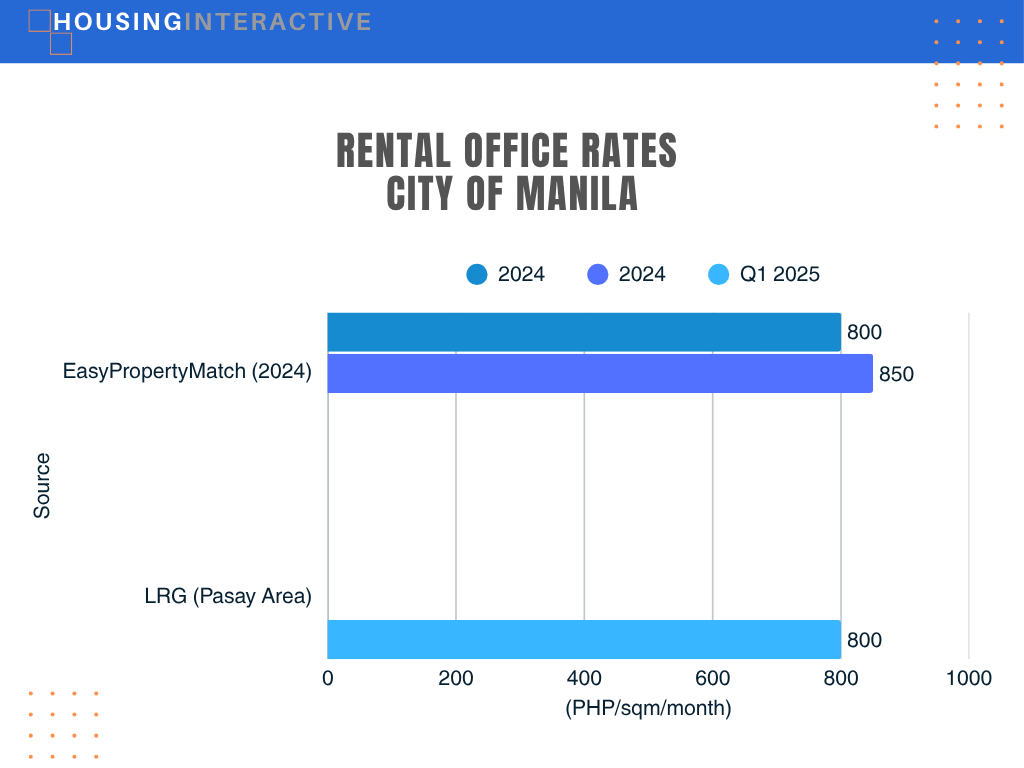

Office rental rates in Manila City, part of the national capital region, are generally lower than in prime CBDs like Makati or Bonifacio Global City (BGC).

- EasyProperty Match estimated the 2024 average office lease rate in Manila City at PHP 800-850 per square meter per month.

- Lobien Realty Group (LRG) data for Q1 2025 didn’t provide a specific Manila City average but listed nearby Pasay at PHP 800 per square meter per month for comparison.

Rates likely vary significantly based on building age, quality, and specific location (e.g., Roxas Boulevard frontage versus inner streets). General office listings across Metro Manila show wide variations.

Key Drivers & Trends:

- Affordability: Lower rental rates attract specific business types.

- Proximity: Ermita’s closeness to government offices and the Port Area appeals to related industries.

- Binondo Commerce: Sustained traditional Chinese-Filipino business activity drives demand.

- Urban Renewal Initiatives: Sporadic redevelopment projects are influencing micro-markets within these districts.

Residential Market Overview

Manila City’s residential market is marked by a significant inventory of condominium units, particularly in the mid-market segment, and faces considerable vacancy challenges, but also presents opportunities.

Vacancy Trends:

Colliers identified Manila City as having a significant share of unsold Ready-For-Occupancy (RFO) condominium units, driven by various market factors, by year-end 2024, contributing to Metro Manila’s high overall residential vacancy rate of 23.9%. This suggests considerable vacancy pressure, particularly in the mid-market segment and potentially in student-oriented rentals near the University Belt. DMCI Homes has also noted the challenge of high vacancy rates in Metro Manila. Data Dictionary highlighted 74,000 unsold condo units across Metro Manila at year-end 2024.

Price Levels:

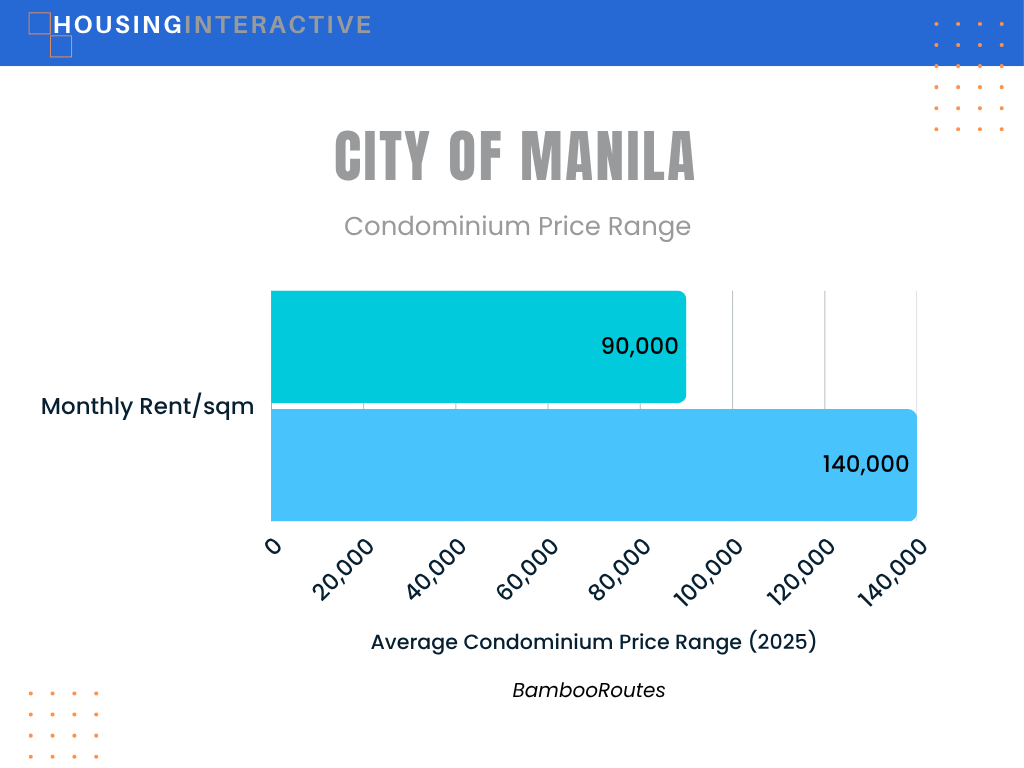

- Sale Prices: Residential sale prices are generally more affordable in Manila City than in prime CBDs. BambooRoutes estimates the 2025 average condominium price range for Manila City at PHP 90,000 – PHP 140,000 per square meter.

- Rental Rates: Detailed aggregated rental data is limited, but the high vacancy rates suggest that rental rates are likely under pressure, especially for standard units. Specific project pricing from developers such as DMCI or financial disclosures from corporations like Figaro Coffee Group or Maynilad (which may own or finance properties) are not provided in the available source materials, limiting detailed insights into condominium rental rates in these areas.

Infrastructure & Accessibility

Existing Infrastructure:

- Public Transport Network: Served by an extensive public transport system, including the LRT-1 line (with stations in Ermita and Malate), the PNR commuter rail (with stations nearby), and numerous jeepney and bus routes plying major thoroughfares.

- Key Roadways: Major arteries include Roxas Boulevard, Taft Avenue, Quirino Avenue, Recto Avenue, and España Boulevard, providing extensive connectivity across the city and other parts of Metro Manila.

- Port Facilities: Hosts major port facilities in the Port Area, a critical hub for logistics and shipping.

- Historical Infrastructure: Features significant historical infrastructure, most notably the walls of Intramuros.

Planned Developments:

- Pasig River Ferry System: Set to benefit from the revival and expansion of the Pasig River Ferry System, potentially integrating with the MAPALLA Ferry System project connecting to Laguna Lake (seeking approval mid-2025).

- Flood Mitigation: The ongoing Pasig-Marikina River Channel Improvement Project (Phase IV), partly funded by Japan, aims to mitigate flooding in vulnerable areas through dredging and structural works.

- Future Rail Integration: The city will benefit from proximity to future North-South Commuter Railway (NSCR) and Metro Manila Subway lines via interchange stations, particularly through connections with the LRT-1 line.

- General Upgrades: Manila City is subject to general infrastructure upgrades under various national programs.

Key Infrastructure & Developments

| Feature | Status | Key Detail |

| LRT-1 Line Access | Existing | Key light rail transit spine serving Ermita and Malate |

| Pasig River Ferry Revival/Expansion | Planned/Ongoing | Aims to enhance water-based transport options |

| Pasig-Marikina River Channel Improvement | Ongoing | Flood mitigation project |

| Port of Manila | Existing | Major international shipping gateway |

Key Business Presence & Amenities

Major Companies & Industries:

- Binondo: Continues to be a significant center for trade and finance (hosting numerous bank branches and head offices of some Filipino-Chinese banks), and a high concentration of Filipino-Chinese businesses.

- Ermita/Malate: Home to numerous government offices (e.g., Department of Justice, Supreme Court, National Bureau of Investigation nearby), embassies, hotels, tourism-related businesses, universities, and hospitals. Recruitment and manning agencies for overseas employment are also prevalent.

- Port Area: Dominated by shipping and logistics companies.

- Corporate Headquarters: Major corporations headquartered in Manila include Landbank and Puregold Price Club Inc.

- Retail: Apple resellers have a presence in locations like SM City Manila and Binondo.

Healthcare:

Manila City hosts several major and historically significant hospitals, including:

- Philippine General Hospital (PGH)

- Manila Doctors Hospital

- Medical Center Manila (formerly Manila Medical Center)

- Chinese General Hospital and Medical Center

- San Lazaro Hospital

- Ospital ng Maynila Medical Center

- University of Santo Tomas Hospital

- Mary Johnston Hospital

- Tondo Medical Centre

- Gat Andres Bonifacio Memorial Medical Centre

Dining & Lifestyle:

Manila City’s diverse and culturally rich dining scene includes numerous local and international brands.

- Binondo (Chinatown): Offers arguably the country’s best and most authentic Chinese cuisine, from historic restaurants and hole-in-the-wall eateries to street food. Lucky Chinatown Mall adds modern dining options to the traditional landscape.

- Malate and Ermita: Feature a mix of Filipino and international restaurants, cafes, and bars catering to students, office workers, tourists, and residents. The character of this area’s nightlife has evolved over the years.

Livability Assessment

Strengths:

- Rich History and Culture: Unparalleled historical and cultural attractions, including Intramuros, Rizal Park, the National Museum Complex, and the unique heritage of Binondo Chinatown.

- Educational Hub: Home to the University Belt, offering access to numerous prestigious universities and colleges.

- Healthcare Access: Numerous major hospitals and specialized medical centers are readily available.

- Diverse and Authentic Dining: Especially renowned for the culinary offerings in Binondo.

- Relative Affordability: Housing options are generally more affordable compared to prime CBDs.

- Vibrant Urban Life: Features bustling street life, traditional markets, and a palpable sense of history.

- Good Public Transport: Well-served by LRT, PNR, jeepneys, and buses, providing extensive connectivity.

Challenges:

- Urban Decay and Congestion: Significant traffic congestion, overcrowding, noise, and air pollution are prevalent in many areas.

- Safety and Cleanliness: Concerns about safety and cleanliness persist in certain districts, particularly at night.

- Aging Infrastructure: Older infrastructure and building stock in many parts require continuous upkeep and modernization.

- Residential Market Instability: High residential vacancy rates suggest potential market instability and oversupply.

- Flood Prone: Low-lying areas are susceptible to flooding, although mitigation projects are ongoing.

- Visible Socioeconomic Disparities: Stark contrasts in wealth and living conditions are evident.

HI’s Perspective / Our HI Five score

Manila City scores Medium (Variable) in terms of livability. It offers a unique and compelling blend of history, culture, education, and relative affordability that is unmatched by modern CBDs. Its livability, however, varies drastically by district. Areas like Binondo provide a vibrant cultural and culinary experience, while Ermita and Malate offer access to key institutions and a dynamic (though changed) nightlife. The presence of the University Belt is a major draw for students. However, significant challenges such as severe traffic congestion, pollution, safety concerns in certain areas, and limitations of aging infrastructure considerably impact the overall quality of life. Manila City appeals most to those who prioritize cultural immersion in the country, access to universities, historical significance, or specific traditional neighborhoods, but it requires a high tolerance for intense urban challenges and a recognition of its ongoing evolution.

This report is based on market data as of Q1 2025. HousingInteractive provides this analysis for informational purposes only.

References

[1] Metro Manila condo launches fell to lowest level in 5 years LPC BusinessWorld Online

[2] Colliers: Metro Manila land prices to drop 2-5% amid growing condo glut and office vacancies – Bilyonaryo

[3] Colliers: Property market worsens in 2024 – Manila Bulletin

[4] Office Market Outlook – Lobien Realty Group

[5] The condominium glut in Metro Manila – Data Dictionary

[6] What are the average condo prices in Manila in 2025? – Bamboo Routes

[7] Search Results | Office Space to Lease & Rent

[8] Average Office Lease Rates in Metro Manila, Philippines – 2024 – Easy Property Match

[9] Weighing the pros and cons of city life in the Philippines – Assetmart.Global

[10] 2020 Top 100 Corporations In The Philippines – Makati Web Portal

[11] Pros & Cons of Living in Metro Manila, Philippines – YouTube

[12] Manila – Data Science Lab

[13] Getting to know Chinatown one Tsinoy at a time – Philstar.com

[14] Q1 2024 – Beijing Grade-A Office Market Report

[15] How to Navigate Metro Manila’s Condo Vacancy Rates in 2025 – DMCI Leasing

[16] Q3/9M 2024 Analysts’ Briefing – DMCI Holdings

[17] 14-NOV-2024-SEC-17-A-Annex-E.pdf – The Figaro Coffee Group

[18] THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED THESE SECURITIES OR DETERMINED IF THIS PRELIMINARY PROSPECTUS IS ACCURATE – Maynilad Water Services, Inc.

[19] Infrastructure & PPPs in Philippines – Q1 2025 Update

[20] Funding secured for major infrastructure project in the Philippines – Dredging Today

[21] NEDA board approves P70.6B in new projects | The Manila Times

[22] Sales Find Locations – Apple

[23] pup.edu.ph

[24] National University | Education that works

[25] Pros and Cons of Living in Manila [WATCH BEFORE YOU MOVE] – YouTube