For many Filipinos, the dream of homeownership represents a significant milestone. It signifies stability, security, and a place to build a future. But turning that dream into reality often involves taking out a home loan.

A home loan is a loan that banks and other lending organizations provide that enables you to take out a loan to buy a property. You repay the loan principal (the original amount borrowed) with interest over a set period, typically 15 to 30 years.

Unveiling the Maze of Bank Rates for Home Loans

The interest rate on your home loan is a crucial factor to consider, as it significantly impacts the total cost of ownership. It’s the fee you pay the bank for borrowing their money. Here’s why understanding bank rates for home loans in the Philippines is essential:

A. Significant Cost Impact

A small difference in interest rates can translate to a substantial difference in the total amount you repay over the loan term. For example, a 1% difference in interest on a Php5 million, 20-year loan can amount to hundreds of thousands of pesos in savings.

B. Long-Term Commitment

Home loans are long-term financial commitments. Choosing a loan with a favorable interest rate ensures you manage your finances comfortably throughout the loan repayment period.

C. Competitive Market

The Philippine banking sector offers a variety of home loan products with varying interest rates. Understanding these variations empowers you to shop around and find the best deal for your financial situation.

By demystifying bank rates for home loans, you can make informed decisions, save a significant amount of money, and ultimately achieve your dream of homeownership with greater financial peace of mind.

Who Offers the Best Deals in the Philippines?

The Philippines has a robust financial sector that caters to a wide range of financial needs. From universal banks to thrift banks and trust corporations, Filipinos have options to choose from when it comes to managing their money. Here’s a look at the top 20 financial institutions in the Philippines, based on a combination of factors such as asset size, brand reputation, and product offerings:

1. Asia United Bank Corporation (AUB)

Established Presence and Universal Banking License:

- Founded in 1997 and publicly listed since 2013, AUB boasts a long-standing reputation in the Philippine financial sector.

- Holding a universal banking license, AUB offers a comprehensive suite of financial services beyond traditional banking, encompassing investment and leasing activities.

Steady Growth and Financial Performance:

- AUB has consistently grown trajectory across key metrics like assets, net income, and branch network over the past three years (2021-2023).

- In 2023, the bank achieved a net income of P8.2 billion, representing a significant 32% increase year-on-year. Similarly, total assets reached P355 billion, reflecting 4% growth.

Strategic Expansion and Diversification:

- AUB has strategically expanded its operations through subsidiaries like rural banks and a leasing/financing company, demonstrating a commitment to diversifying its revenue streams.

Transparency and Accessibility:

- AUB prioritizes transparency by providing easy access to its financial disclosures on its investor relations website.

A. AUB Home Loan Features

B. AUB Home Loan Requirements

Overall, Asia United Bank Corporation emerges as a well-established and continuously growing financial institution in the Philippines. Their universal banking license, impressive performance, and strategic expansion solidify their position as a strong contender in the market.

2. Bank of Commerce (BOC)

Established and Licensed

- Founded in 1963, BOC boasts a long history and holds a universal banking license from the Bangko Sentral ng Pilipinas (BSP), ensuring regulatory compliance.

- Since 2008, BOC has been part of the San Miguel Corporation, a well-established Philippine conglomerate, potentially signifying financial backing and stability.

Comprehensive Offerings

- BOC caters to diverse financial needs with different products and services, including deposits, loans, credit cards, consumer banking solutions, corporate banking options, and investment opportunities.

- Embracing digital convenience, BOC offers online banking platforms like BankCom Personal and BankCom Business, alongside a mobile banking app, for seamless banking experiences.

Widespread Network & Financial Strength

- BOC maintains a broad reach with 140 branches and over 260 ATMs strategically located across the Philippines, providing accessibility for various banking needs.

- As of 2020, BOC demonstrated financial progress with a net income of PHP784.4 million, total assets of PHP170.9 billion, and increasing deposits and loans, indicating potential stability and growth.

BOC prioritizes its customers, attributing its success to their loyalty. The bank continuously strives to improve the customer experience, ensuring satisfaction.

A. BOC Home Loan Features

B. BOC Home Loan Requirements

3. Bank of the Philippine Islands (BPI)

About BPI

- Bank of the Philippine Islands, established in 1851, is the first bank in the Philippines and Southeast Asia, boasting a long history.

- BPI operates as a universal bank, offering a diverse range of financial products and services for retail and corporate clients.

- BPI extends its services beyond the Philippines with a global presence, catering to overseas Filipinos.

Local and Global Presence

- BPI has an extensive network of 1,173 branches and over 2,700 ATMs/CAMs nationwide.

- BPI partners with 139 international institutions across key locations like Hong Kong, Tokyo, and Dubai.

- BPI offers various financial services, including consumer banking, lending, asset management, payments, insurance, investments, foreign exchange, leasing, and corporate/investment banking.

Financial Highlights

- In 2023, BPI achieved its highest net income of Php51.7 billion, reflecting a 30.5% year-on-year increase.

- BPI’s total assets reached Php2.9 trillion, a 10.9% growth year-on-year.

- BPI’s total loans stood at Php1.9 trillion, a 10.5% increase, while total deposits reached Php2.3 trillion, up 9.5% year-on-year.

- BPI maintains a healthy NPL ratio of 1.84% with sufficient NPL coverage.

A. BPI Home Loan Features

B. BPI Home Loan Requirements

4. BDO Unibank, Inc. (BDO)

Services and Products

- BDO is a full-service universal bank, offering a comprehensive range of financial products and services for personal and business needs. These include lending, deposits, foreign exchange, brokerage, trust and investments, credit cards, cash management, remittances, and more.

- Through its subsidiaries, BDO extends its services to include investment banking, private banking, leasing and finance, rural banking, life insurance, and online/non-online brokerage services.

Network and Presence

- BDO boasts the most extensive distribution network in the Philippines, with over 1,500 operating branches and offices and more than 4,500 ATMs nationwide.

- BDO’s international presence extends beyond the Philippines with 16 international offices spread across Asia, Europe, North America, and the Middle East.

- BDO prioritizes customer convenience by offering digital banking solutions alongside its physical network.

Leadership and Performance

- As of March 31, 2022, BDO holds the top position in the Philippines for consolidated resources, loans, deposits, assets under management, and branch/ATM network.

- BDO maintains a strong financial position with a robust balance sheet achieved through strategic acquisitions and organic growth.

- Despite being part of the SM Group, BDO operates with a team of professional managers and a distinguished Board of Directors, ensuring independent and experienced leadership.

A. BDO Home Loan Features

B. BDO Home Loan Requirements

5. China Banking Corporation (China Bank)

Profile and History

- Established as a private universal bank with over 100 years of experience in the Philippines, China Banking Corporation is headquartered in Makati City, with a nationwide presence of 648 branches.

- Listed on the Philippine Stock Exchange as CHIB, it is a member of the SM Group conglomerate.

- Achieved significant growth through strategic acquisitions like Manila Bank, which was relaunched as China Bank Savings, Unity Bank, and Planters Development Bank.

Services and Network

- CHIB Offers a comprehensive range of personal and business banking products and services.

- Provides convenient access to banking 24/7 through a network of ATMs, Cash Accept Machines, Chinabank TellerPhone, Chinabank Online, and Chinabank Mobile App.

Recognition and Performance

- CHIB was recognized as the “Best Bank in the Philippines” (2021) and emerged as a leader in the Asia Pacific region.

- Became the 4th largest private universal bank in the Philippines by assets (2022) and surpassed the 1 trillion peso mark in deposits.

- China Bank also won the prestigious “Five Golden Arrows” award for excellence in governance (2024) and was named 2023 Employer of the Year.

A. CHIB Home Loan Features

B. CHIB Home Loan Requirements

6. CityState Savings Bank (CSBank)

Profile and History

- CityState Savings Bank was established as a thrift bank licensed by the Bangko Sentral ng Pilipinas (BSP) in 1997.

- Became a publicly listed company on the Philippine Stock Exchange in January 2002.

- Primarily caters to the Filipino middle market.

Products and Services

- CSBank offers a range of savings and investment products for long-term goals like education and entrepreneurship.

- Provides various loan products including consumer loans, SME loans, corporate loans, auto loans, and home loans to address immediate needs.

Network and Availability

- Operates more than 30 branches strategically located in Metro Manila and key provinces.

- CSBank expanded its capabilities in March 2004. The Bangko Sentral ng Pilipinas (BSP) authorized them to engage in quasi-banking activities. This means CSBank can now issue various debt instruments, potentially attracting more investment and developing new financial products and loan programs, offering a wider range of services to its clients.

A. CSBank Home Loan Features

B. CSBank Home Loan Requirements

7. Development Bank of the Philippines (DBP)

Mission and Role

- DBP is the Philippines’ leading development bank, aiming to drive sustainable economic growth through strategic financing initiatives.

- It prioritizes the well-being of Filipinos by providing resources for long-term agricultural and industrial enterprise needs, with a focus on small and medium-scale industries.

Structure and Governance

- DBP operates under a government charter, classified as both a development and thrift bank.

- A Board of Directors appointed by the President oversees the bank’s operations, with a President elected by the Board acting as CEO and Vice Chairman.

Financial Performance and Status

- As of 2023, DBP ranked as the 8th largest bank in the Philippines by assets.

- It is the second-largest state-owned bank alongside Land Bank, Overseas Filipino Bank, and Al-Amanah Islamic Bank.

- As a GOCC (Government-Owned and Controlled Corporation), DBP contributes at least half of its annual net earnings to the National Government.

A. DBP Home Loan Features

B. DBP Home Loan Requirements

8. EastWest Banking Corporation (EastWest)

Growth and Focus

- Established in 1994, EastWest Bank is one of the fastest-growing banks in the Philippines.

- It caters to a diverse clientele, including consumers, middle-market corporates, and the mass affluent.

- EastWest prioritizes customer service excellence and aims to become a world-class bank.

Network and Products

- EastWest boasts a vast network of 490 stores nationwide, including EastWest Rural Bank, making it the 5th largest in the industry.

- It offers a comprehensive suite of banking products and services, along with allied services like insurance brokerage, bancassurance, and leasing.

- EastWest complements its physical presence with convenient 24/7 channels like ATMs, online banking, and customer service.

Financial Performance as of 2023

- EastWest ranks as the 10th largest privately-owned domestic bank by assets.

- It holds a strong position in the industry, being the 5th biggest credit card issuer and 4th largest auto loan provider.

- Key financial highlights include:

- Net Income: 6,083 million

- Assets: 464,205 million

- Deposits: 356,535 million

- Net Loans: 296,615 million

- Net Revenue: 35,660 million

- Equity: 67,175 million

A. EastWest Bank Home Loan Features

B. EastWest Bank Home Loan Requirements

9. Hongkong and Shanghai Banking Corporation (HSBC)

Global Presence and Services:

- One of the world’s largest banking and financial services organizations.

- Serves over 42 million customers through Wealth & Personal Banking, Commercial Banking, and Global Banking & Markets.

- Extensive global network covering 62 countries and territories across various continents.

Mission and Values:

- Purpose: “Opening up a world of opportunity” – utilizing expertise and global reach to unlock new possibilities for customers.

- Focus: Connecting people, ideas, and capital to foster progress and growth for a better world.

Publicly Listed and Established in the Philippines:

- Listed on major stock exchanges (London, Hong Kong, New York, Bermuda).

- Approximately 175,000 shareholders worldwide.

- Over 140 years of experience in the Philippines with branches in key cities.

A. HSBC Home Loan Features

B. HSBC Home Loan Requirements

10. Land Bank of the Philippines (Land Bank)

Mission and Function

- Acts as a government financial institution with a unique dual role.

- Promotes rural development while maintaining financial viability.

- Profits from commercial banking fund its development programs.

Focus and Reach

- Prioritizes loans for small farmers, fishermen, microbusinesses, and SMEs.

- Supports agri/aqua projects, infrastructure, and social initiatives.

- Holds the position of the largest formal credit institution in rural areas.

Financial Performance

- Ranks among the top five commercial banks in the Philippines.

- Maintains strong performance in deposits, assets, and loans.

A. Land Bank Home Loan Features

B. Land Bank Home Loan Requirements

11. Maybank Philippines Incorporated (Maybank)

Services and Network

- Full-service commercial bank offering a comprehensive suite of financial products and services for retail, commercial, and corporate clients.

- Extensive branch network across the Philippines with over 60 branches, 15 lending centers, and close to 80 ATMs.

Commitment and Growth

- Established presence with over 25 years of experience serving Filipino clients.

- Focused on continuous improvement, striving to progress from “good to great.”

- Commitment to exceptional service and a clear sense of direction for future growth.

Global Presence and Backing

- Part of the Maybank Group, one of Asia’s leading banking groups and Southeast Asia’s fourth largest bank.

- Maybank Group boasts a vast presence across 10 ASEAN countries and key financial centers worldwide.

- Deep understanding of the ASEAN market, fostering economic growth and financial inclusion in the region.

A. Maybank Home Loan Features

B. Maybank Home Loan Requirements

12. Metropolitan Bank and Trust Company (Metrobank)

Profile and History

- Established in 1962, Metrobank is a premier universal bank in the Philippines.

- Offers a diverse range of financial products and services catering to individuals and businesses.

- Publicly owned, with GT Capital Holdings as a major shareholder.

Services and Network

- Provides comprehensive banking solutions, including investment banking, thrift banking, leasing, and insurance.

- Boasts a vast network of over 950 branches, 2,300 ATMs, and 170 cash-accept machines nationwide.

- Has an international presence with over 30 foreign branches, subsidiaries, and offices.

Ownership and Market Position

- Publicly listed on the Philippine Stock Exchange since 1981.

- GT Capital Holdings holds a significant stake (37.2%) in the bank.

- Ranks among the top financial institutions in the Philippines.

A. Metrobank Home Loan Features

B. Metrobank Home Loan Requirements

13. Philippine National Bank (PNB)

History and Ownership

- Established in 1916 as a government bank, PNB became fully privatized in 2007.

- Pioneered various banking innovations and played a key role in Philippine economic development.

- Currently one of the largest privately-owned commercial banks in the country.

Services and Network

- Offers a comprehensive range of banking services, including deposit-taking, lending, trade finance, and retail banking.

- Has a vast domestic network with over 630 branches and 1,600 ATMs.

- Maintains the largest international presence among Philippine banks with over 70 overseas locations.

Financial Performance and Growth

- Successfully recovered from financial challenges and achieved significant growth since privatization.

- Exceeded rehabilitation program targets and reported substantial profit increases.

- Maintains a strong market position with a large customer base and diverse product offerings.

A. PNB Home Loan Features

B. PNB Home Loan Requirements

14. The Philippine Savings Bank (PSBank)

Financial Performance

- Consistent growth in net income: Php1.11 billion in 2020, Php3.68 billion in 2022, and a record-breaking Php4.53 billion in 2023.

- Strong return on equity of 11.7% in 2023.

- Increased net interest income by 7% year-on-year to Php11.83 billion in 2023.

- Managed to reduce operating expenses by 1% through cost optimization efforts.

Market Conditions and Consumer Behavior

- Despite economic challenges, consumer spending remained resilient, with household spending increasing by 5.3% year-on-year in 2023.

- Vehicle sales surged to an all-time high of 430,000 units in 2023.

- The property sector showed positive signs of growth with new project launches and expansion.

Bank Performance and Growth Drivers

- PSBank emerged as a leading consumer bank, benefiting from robust consumption.

- Gross loan portfolio grew by 12% to Php 125 billion in 2023, driven by strong auto loan demand.

- Improved asset quality, with the non-performing loans ratio decreasing to 3.3% in 2023.

- Higher investment revenues contributed to the overall financial performance.

A. PSBank Home Loan Features

B. PSBank Home Loan Requirements

15. Philippine Trust Company (Philtrust)

Company Profile

Philtrust Bank is a long-standing Philippine bank with a strong focus on retail, middle-market, and corporate clients. It offers a wide range of banking products and services, including deposits, loans, trust services, and foreign currency transactions. Known for its conservative approach and stable financial performance, Philtrust Bank has cultivated a loyal customer base over the years.

International Services

Philtrust Bank provides a range of international banking services to cater to the needs of its clients engaged in cross-border transactions. These services typically include:

- Foreign currency exchange

- Foreign letters of credit

- Remittances

These services enable clients to manage their foreign currency requirements efficiently and securely.

Institutional Trust Services

Philtrust Bank offers a comprehensive suite of trust services designed to meet the specific needs of institutional clients. These services may include:

- Fund management

- Escrow arrangements

- Guardianship services

- Investment management for institutional trust accounts

These services are tailored to the unique requirements of corporations, institutions, and organizations, providing them with specialized trust solutions.

A. Philtrust Home Loan Features

B. Philtrust Home Loan Requirements

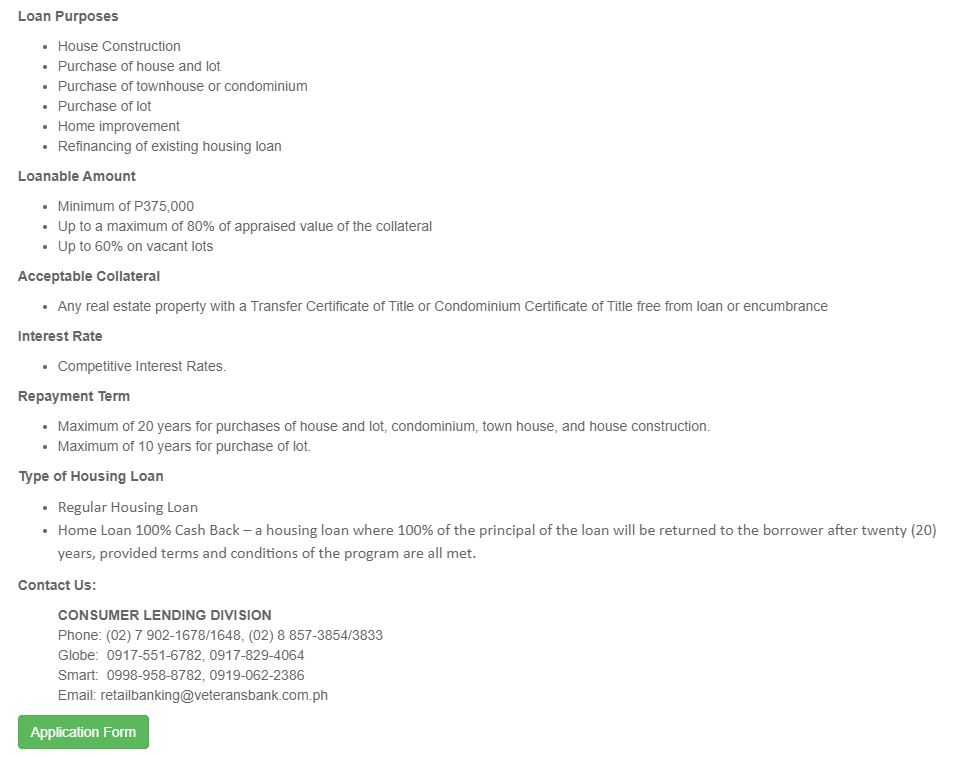

16. Philippine Veterans Bank (Veterans Bank)

Profile and Mission

- A commercial bank primarily serving Filipino World War II veterans, their heirs, and AFP retirees.

- Offers a range of banking products and services for both retail and corporate clients.

- Supports government agencies and local government units as an authorized government depository bank.

- Committed to supporting veterans through grants and financial assistance.

Services and Network

- Operates 60 branches and 1 branch-lite unit nationwide.

- Provides deposit and loan products, cash management, treasury, and trust services.

- Offers salary loans to active AFP personnel.

- Expands retail loan offerings with new salary and auto loans.

Financial Performance and Growth

- Achieved record-high total assets of Php 64.5 billion in 2023.

- Deposits reached an all-time high of Php 57.5 billion.

- Loans reached Php 26 billion.

- Reduced losses to Php 72 million through improved resource management.

- Experienced impressive growth in salary loans, exceeding Php 1 billion in gross bookings.

- Institutional Banking Group achieved a record-high loan portfolio of Php 15.07 billion.

A. Veterans Bank Home Loan Features

17. Rizal Commercial Banking Corporation (RCBC)

Profile and Services

- A leading private universal bank in the Philippines with over Php1.2 trillion in total resources.

- Offers a comprehensive range of banking products and services catering to individuals, businesses, and corporations.

- Has a strong focus on retail, commercial, and corporate banking segments.

- Provides specialized services for high-net-worth individuals, Chinese markets, and microenterprises through dedicated units.

Network and Reach

- Extensive branch network of 458 branches and 1,465 ATMs nationwide.

- Strong digital presence with the Internet and mobile banking platforms.

- Reaches underserved markets through innovative digital solutions like DiskarTech.

Customer Focus and Innovation

- Prioritizes customer experience and satisfaction across all segments.

- Offers tailored solutions for high-net-worth individuals and corporate clients.

- Continuously innovates to meet the evolving needs of customers, such as the launch of DiskarTech.

- Demonstrates commitment to financial inclusion through microfinance initiatives.

A. RCBC Home Loan Features

B. RCBC Home Loan Requirements

18. Security Bank Corporation (Security Bank)

Profile and History

- Established in 1951, Security Bank is a pioneer in the Philippine banking industry.

- Publicly listed since 1995 and is known for its stability and commitment to customers.

- Offers a wide range of banking and financial services through its subsidiaries.

Services and Network

- Caters to retail, commercial, corporate, and institutional clients.

- Offers financing, leasing, foreign exchange, stock brokerage, investment banking, and asset management.

- Boasts a network of 316 branches and 789 ATMs nationwide.

Performance and Strategy

- Ranks among the top universal banks in the Philippines based on assets, loans, and capital.

- Known for superior financial performance, including high ROE, ROA, and asset quality.

- Prioritizes customer service and satisfaction through the “BetterBanking” initiative.

- Strategic partnership with MUFG for capital injection and collaboration.

- Focuses on expanding retail banking, distribution channels, and digital services.

A. Security Bank Home Loan Features

B. Security Bank Home Loan Requirements

19. Standard Chartered Bank (Standard Chartered)

Global Footprint and Core Business

- A leading international banking and financial services organization with a presence in over 52 markets.

- Specializes in corporate, commercial, and institutional banking, offering services in transaction banking, corporate finance, financial markets, and lending.

- Committed to driving commerce and prosperity globally through its “here for good” brand promise.

Philippine Operations and Expertise

- A longstanding presence in the Philippines, established in 1872.

- Leverages its global network to provide comprehensive banking solutions to local clients.

- Recognized as a leader in corporate financing, loan syndication, custody, and fund administration services.

- Demonstrates a strong commitment to supporting the Philippine economy and its clients.

Strategic Focus and Innovation

- Prioritizes digital innovation to enhance client experience and service delivery.

- Emphasizes transparency and operational excellence.

- Contributes to economic inclusion through corporate social responsibility initiatives.

- Maintains a strong focus on delivering value-added products and services to clients.

In 2016, EastWest Bank expanded its retail banking operations by acquiring Standard Chartered Bank Philippines’ portfolio, which encompassed credit cards, personal loans, wealth management, and retail deposits, enabling EastWest to broaden its customer base and strengthen its position in the retail banking market.

20. Union Bank of the Philippines (UnionBank)

Digital Innovation and Recognition

- Pioneered online banking, e-savings accounts, chatbots, and fully digital account opening.

- Recognized as a leading digital bank by numerous institutions for the past six years.

- Established UBX, a fintech subsidiary, to drive further innovation.

- Launched UnionDigital, the only digital bank owned by a publicly listed bank in the Philippines.

Acquisition and Growth

- Acquired Citigroup’s consumer banking business in the Philippines in 2022.

- Grew retail customer base to over 14 million, surpassing larger competitors.

- Aims to become the “Greatest Retail Bank” in the Philippines.

Strategic Shift and Financial Success

- Shifted focus from corporate to retail banking, increasing retail loans to 58% of the portfolio (exceeding the industry average).

- Achieved a high Net Interest Margin (NIM) of 5.5% and increased fee-based income by 54%.

- Diversified revenue streams for greater profitability.

A. UnionBank Home Loan Features

B. UnionBank Home Loan Requirements

Securing the lowest possible interest rate on your home loan is crucial to achieving the dream of homeownership. A seemingly small difference in interest rates can translate to substantial savings over the life of your mortgage. By understanding the factors influencing interest rates, comparing lenders, and exploring available options, you can significantly reduce your monthly payments and overall borrowing costs. Armed with knowledge and a strategic approach, you can confidently navigate the mortgage market and find the best deal to suit your financial goals.