Extrajudicial settlements refer to agreements made outside of court to resolve property disputes or transactions, often concerning real estate. These settlements are common in real estate dealings, as they offer a less formal, cost-effective, and time-saving method of resolving issues without a lengthy judicial process.

Extrajudicial settlements are valuable alternatives to litigation, especially in cases involving personal relationships or sensitive matters like property division. Parties can find a more amicable and efficient resolution by avoiding the time, expense, and stress related to court proceedings when dividing among heirs.

Legal Basis for Extrajudicial Settlements

The legal foundation for extrajudicial settlements in real estate is rooted in various laws, depending on the jurisdiction. For instance, inheritance laws, property laws, and civil codes often offer frameworks through which individuals can resolve disputes privately. In contrast to judicial settlements, where a court ruling determines the outcome, extrajudicial settlements are flexible, providing involved parties more control over the process and outcome.

Key Scenarios for Extrajudicial Settlements of Real Property

Several situations warrant the use of extrajudicial settlements, especially in the real estate industry:

| Property inheritance | When family members inherit real estate, disputes can arise about how to divide the property among heirs. |

| Property disputes among family members | Disagreements over property ownership or rights often lead families to pursue extrajudicial methods of resolution. |

| Co-ownership disputes | When co-owners of a property have conflicting interests, an extrajudicial settlement can help resolve these issues amicably. |

Benefits of Extrajudicial Settlements of Real Property

The benefits of extrajudicial settlements are numerous. Primarily, they are much more cost-effective than taking disputes to court. They are also faster, as the lengthy judicial process is avoided. Additionally, extrajudicial settlements provide more privacy for the parties involved, as the agreement details remain confidential.

Common Challenges in Extrajudicial Settlements

While extrajudicial settlements offer many advantages, they are not without challenges. One major challenge is reaching an agreement among all parties, particularly in cases involving multiple heirs. Additionally, unresolved issues regarding property titles or unclear ownership can complicate the process.

Understanding Extrajudicial Settlements in Real Estate

Extrajudicial settlements are voluntary agreements between parties to resolve a dispute outside the court system. In real estate, they are often used to settle disagreements related to property ownership, transactions, or contracts.

Types of Extrajudicial Settlements in Real Estate

| Purchase Agreements | These contracts outline the terms and conditions of a property sale, including price, payment terms, closing date, and any contingencies or conditions precedent. |

| Deed of Sale | A legal document that transfers property ownership from one party to another. It typically includes details about the property, the parties involved, the purchase price, and any encumbrances or liens on the property. |

| Deed of Absolute Sale | A deed that transfers complete property ownership without any conditions. This is the most common type of deed used in real estate transactions. |

| Deed of Conditional Sale | A deed where ownership is transferred upon certain fulfillment of conditions. For example, a deed of conditional sale might be used if the buyer needs to obtain financing or complete a specific renovation before taking full ownership. |

| Deed of Exchange | A document that exchanges one property for another. This can be useful for parties to swap properties, such as in a 1031 exchange in the US or a tax-free property exchange in the Philippines. |

| Deed of Partition | A document that divides a property among multiple owners. This is often used when co-owners want to separate their interests in a property. |

| Deed of Donation | A document that transfers property ownership as a gift. This can be used for various purposes, such as transferring property to family members or charitable organizations. |

Key Elements of an Extrajudicial Settlement

| Parties Involved | The individuals or entities involved in the dispute. These may include property owners, buyers, sellers, tenants, landlords, or other interested parties. |

| Agreement Terms | The specific terms and conditions that the parties agree to abide by. This may include the resolution of the dispute, the exchange of property or money, and any other relevant terms. |

| Consideration | The value exchanged between the parties. In real estate, this is often the property itself or a monetary payment. |

| Acknowledgment | A declaration by the parties that they are signing the agreement voluntarily and that they understand the terms and consequences of the settlement. |

| Notarization | A certification by a notary public that the signatures on the agreement are genuine. This is typically required to make the agreement legally binding. |

By understanding the different types of extrajudicial settlements and their key elements, parties can effectively negotiate and document their agreements, efficiently resolving real estate disputes.

Necessary Documents for Extrajudicial Settlements

Ensuring that all necessary documents are in order is crucial when engaging in an extrajudicial settlement for real estate property. These documents are required to validate the settlement and ensure that the transfer of ownership or division of property complies with legal requirements. Below is a list of essential documents typically needed for an extrajudicial settlement:

List of Essential Documents

1. Property Title or Deed

The Certificate of Title or Deed of Sale proves the legal ownership of the property. This document must be up to date and free of any encumbrances, such as mortgages or liens. For inherited properties, the title must reflect the deceased owner.

2. Death Certificate

In cases of inheritance, the death certificate of the deceased property owner is required. This document proves that the owner is no longer alive, making the estate eligible for distribution among the heirs.

3. Last Will and Testament (If Applicable)

If the deceased property owner left a Last Will and Testament, it must be presented to verify how the property should be distributed. If no will exists, the property will be distributed according to the applicable inheritance laws of the jurisdiction.

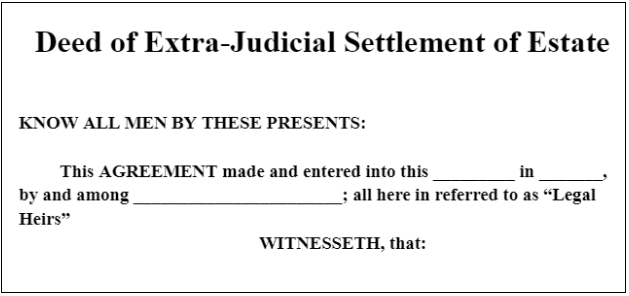

4. Affidavit of Self-Adjudication or Extrajudicial Settlement Agreement

An Affidavit of Self-Adjudication is necessary if only one heir inherits the property. An Extrajudicial Settlement of Estate Agreement is required in cases involving multiple heirs. This agreement details how the property will be divided or transferred among the heirs or co-owners.

5. Tax Clearance

A Tax Clearance Certificate ensures that all taxes on the property have been paid, including real estate taxes, estate taxes (for inheritance), and any other outstanding tax obligations. This document is critical to prevent future legal or financial complications.

6. Certificate of No Mortgage (if applicable)

A Certificate of No Mortgage should be secured if the property is not under any mortgage or lien. This certificate shows that there are no claims against the property that could affect the transfer of ownership.

7. Notice to Creditors

A Notice to Creditors may be required, especially in inheritance cases, to ensure that the estate has no outstanding debts that could affect the property settlement. This notice allows creditors the opportunity to file claims before the property is distributed.

8. BIR Tax Identification Number (TIN)

The Tax Identification Number (TIN) for each heir or new owner must be provided. This is necessary for tax filing purposes, particularly in transferring property ownership and paying estate or capital gains taxes.

9. Certificate of Landholdings or Tax Declaration

For real estate properties, the Tax Declaration is an important document that shows the assessed value of the property, which is used in calculating property taxes, estate taxes, and transfer taxes.

10. Payment of Documentary Stamp Tax (DST)

Documentary Stamp Tax (DST) must be paid on the settlement documents, particularly when transferring ownership of real estate property. The receipt of payment or certification that this tax has been paid is necessary.

11. Proof of Payment of Estate Tax (for inheritance)

In the case of inheritance, Proof of Payment of Estate Tax is required. The amount of estate tax due depends on the value of the estate and the jurisdiction in which the property is located.

12. Acknowledgment of Co-Heirs

For settlements involving multiple heirs, it may be necessary to have a formal Acknowledgment of Co-Heirs, stating that all parties agree to the terms of the settlement. This can be a crucial step in preventing future disputes.

13. Notarization Documents

The extrajudicial settlement agreement and other legal documents must be notarized to be legally binding. Notarization ensures that the signatures of all involved parties are authentic and the agreement is valid in court if needed.

14. Real Estate Transfer Certificate of Title (TCT)

For the actual transfer of property ownership, a new Transfer Certificate of Title (TCT) may need to be issued in the name of the new owner(s). This document is registered with the local land registry or Registry of Deeds.

15. Land Registration or Transfer Documents

After the settlement is completed, it’s essential to file the necessary land registration or transfer documents with the appropriate government offices, such as the Registry of Deeds. This finalizes the ownership transfer and updates public records.

Proper documentation is essential. Proper documentation is key to ensuring that an extrajudicial settlement is legally binding and enforceable. Missing or incomplete documents can cause significant delays or even invalidate the settlement. By preparing all necessary documents and seeking legal advice when needed, you can ensure a smooth and efficient settlement process.

The Process of Extrajudicial Settlement in Real Estate

Extrajudicial settlements in real estate are used to resolve property disputes or distribute assets outside the courtroom, typically involving property inheritance or co-ownership issues. Below is a detailed step-by-step guide outlining how the process unfolds:

A Step-by-Step Guide

1. Identify and Gather All Interested Parties

The first and most crucial step in an extrajudicial settlement is identifying all individuals who have a legal interest in the property. This often includes heirs, co-owners, or any other stakeholders involved in the real estate.

| For inherited properties | This means gathering all legal heirs, which could be immediate family members such as spouses, children, or other relatives specified by law. |

| For co-owned properties | All owners must be involved in the discussions. |

Failure to involve every rightful party can lead to disputes later, potentially invalidating the agreement.

2. Verify and Prepare Property Documents

Before proceeding, all essential property documents must be reviewed and gathered. This ensures that all parties have a clear understanding of the property’s status and ownership. Important documents include:

| Property titles or deeds | To confirm ownership. |

| Tax declarations | To verify that all real estate taxes have been paid. |

| Property appraisals | If the property is to be sold or divided, an updated valuation may be needed. |

| Proof of ownership or inheritance | In the case of inherited property, legal documents that verify the rights of the heirs must be provided. |

Accurate documentation helps ensure the validity of the settlement and prevents future disputes over ownership or boundaries.

3. Draft a Settlement Agreement

Once all interested parties are identified and documents are in order, the next step is drafting the extrajudicial settlement agreement. This document outlines how the property will be divided or resolved. Here’s what it generally includes:

| Identification of the property | A clear description of the real estate being settled, including boundaries and any structures or assets included. |

| List of the parties | Names and details of all individuals involved in the settlement. |

| Proposed division of property | The specific distribution of the property, whether by sale, partition, or transfer of ownership to specific individuals. |

| Signatures of all parties | Each individual involved must agree to and sign the settlement for it to be valid. |

This agreement is critical and should be precise, avoiding ambiguity in the division or transfer of property rights.

4. Seek Legal Assistance

While drafting the settlement agreement, it’s advisable to involve a lawyer. A lawyer ensures that the settlement complies with local real estate laws and is legally binding. Their role includes:

| • | Drafting the agreement in a way that protects the interests of all parties. |

| • | Ensuring compliance with inheritance and property laws. |

| • | Offering advice on tax implications or potential legal hurdles. |

A well-drafted legal document will prevent the agreement from being challenged or invalidated in the future.

5. Execute and Notarize the Agreement

Once the settlement agreement is drafted and all parties have agreed to the terms, the next step is to execute the agreement. This means that all parties will sign the document in the presence of a notary public, who will verify the authenticity of the signatures and ensure that the agreement is legally binding.

Notarization is crucial for making the document official and enforceable under law. Without notarization, the agreement may not be accepted in legal proceedings or disputes.

6. Pay Applicable Taxes

Depending on the specifics of the settlement, certain taxes may be due. These could include:

| Estate taxes | If the property is inherited, heirs may be required to pay estate or inheritance taxes. The amount depends on the jurisdiction and the value of the estate. |

| Capital gains taxes | If the property is sold as part of the settlement, capital gains tax may apply to the sale proceeds, depending on how long the property was held and the local tax laws. |

| Real estate transfer taxes | If the property is being transferred to new owners as part of the settlement even if no money changes hands. Some jurisdictions impose a transfer tax when ownership of a property is transferred. |

| Documentary Stamp Tax | This tax is often required on settlement documents, especially in real estate transfers, and its rate varies by location. |

Taxes must be calculated and paid promptly to avoid penalties and ensure that the property transfer or division is legally recognized. A lawyer or tax advisor can help determine the applicable taxes in each case.

7. Register the Settlement with the Local Registry of Deeds

Once the taxes are paid, the settlement agreement needs to be registered with the Registry of Deeds or local land registry to formally transfer ownership or rights. This is the final step in making the settlement official and ensuring that the new ownership records are updated. To register the settlement, you will need:

| • | The notarized settlement agreement. |

| • | Proof of payment of applicable taxes. |

| • | Identification documents for all parties involved. |

This step ensures that the settlement is reflected in public records, making it legally enforceable and preventing future disputes over ownership.

8. Transfer of Property or Distribution of Assets

Once the extrajudicial settlement is registered, the property can be officially transferred to the agreed-upon parties. This may include:

| • | Transferring title to a specific heir or co-owner. |

| • | Selling the property and distributing the proceeds among the stakeholders. |

| • | Dividing the property into separate lots, if applicable, with each party receiving a share. |

The transfer of property must also be updated with local tax offices to ensure that the new owners are responsible for future real estate taxes.

9. Post-Settlement Considerations

Once the settlement is finalized and property transfers or distributions have occurred, there are a few additional considerations:

| Record keeping | Ensure that all parties retain copies of the notarized agreement, property documents, and tax filings. |

| Future property management | If the property is being held by multiple parties, clear agreements about property management or future sale plans should be made. |

Following these steps ensures that the extrajudicial settlement is complete and legally binding, avoiding future disputes and ensuring a smooth transition of ownership or distribution of property.

Proof of Publication of Notice: A Brief Explanation

Proof of publication of notice is a legal requirement in some extrajudicial settlements, particularly those involving estate settlements. It refers to the evidence that a public notice has been published in a newspaper of general circulation, informing the public—especially potential creditors—about the ongoing settlement of an estate or property.

Why is it Necessary?

The publication of a notice serves two main purposes:

| Notify Creditors | It alerts any creditors of the deceased or the property that they must present their claims within a specified period. If no claims are made, the settlement proceeds without legal complications. |

| Prevent Future Disputes | It provides transparency, reducing the risk of future legal challenges from parties claiming they were not informed about the settlement. |

How is Proof of Publication Obtained?

After the notice is published, the newspaper provides a certificate of publication along with copies of the published notice. This certificate proves that the required public notice was made and is usually submitted as part of the settlement documents.

The proof of publication of notice is an essential step in protecting the integrity of an extrajudicial settlement, ensuring that all potential creditors and stakeholders have been properly informed.

Common Mistakes to Avoid in Extrajudicial Settlements

Extrajudicial settlements offer a quicker and less costly way to resolve real estate disputes and divide property, but mistakes during the process can lead to significant issues. Below are some common errors to avoid when entering into an extrajudicial settlement to ensure a smooth and legally sound resolution:

Avoid These Common Pitfalls

1. Failing to Involve All Legal Heirs or Stakeholders

One of the most frequent mistakes is not including all the rightful parties in the settlement process. In cases of property inheritance, all legal heirs must be involved, even those who may not reside locally or are difficult to contact. Similarly, in disputes over co-owned property, all co-owners must participate.

| Why this is important | If any party is left out, they may challenge the settlement later, leading to legal complications, the invalidation of the agreement, and potential litigation. |

| How to avoid it | Make sure to identify and notify all stakeholders, even if they are not actively involved in the property’s day-to-day management. |

2. Poor Documentation of Property Ownership

Another common mistake is proceeding with a settlement without proper documentation. Missing, outdated, or inaccurate property records can lead to disputes over ownership or the division of assets.

| Why this is important | Proper documentation is crucial to verifying who owns the property and what portion each party is entitled to. Without this, the settlement may be challenged. |

| How to avoid it | Gather all relevant documents, such as the property title, tax declarations, inheritance documents, and any legal records related to ownership. If any documents are missing or incorrect, address these issues before proceeding. |

3. Inadequate Legal Consultation

Attempting to draft or execute an extrajudicial settlement without legal advice is a significant mistake. While the goal is to avoid court, an improperly drafted agreement can lead to serious legal issues down the road.

| Why this is important | A lawyer ensures the settlement is legally sound, protects the interests of all parties, and complies with local real estate and inheritance laws. |

| How to avoid it | Always consult a lawyer, even if the settlement seems straightforward. They can help with drafting the agreement, resolving disputes, and ensuring all legal requirements are met. |

4. Overlooking Tax Obligations

One of the most overlooked aspects of extrajudicial settlements is taxation. Whether the property is being inherited, sold, or transferred to new owners, taxes such as estate taxes, capital gains, or transfer taxes may apply.

| Why this is important | Failing to pay the appropriate taxes can result in penalties, fines, or even the invalidation of the property transfer. |

| How to avoid it | Consult with a tax advisor or legal professional to determine what taxes apply to your settlement. Ensure that all taxes are calculated, paid, and documented before finalizing the agreement. |

5. Using Ambiguous or Incomplete Language in the Agreement

An extrajudicial settlement agreement must be clear, precise, and comprehensive. Using vague language or leaving out key details can lead to confusion and disputes among the parties later.

| Why this is important | Ambiguous terms can be interpreted differently by the parties involved, potentially leading to disagreements and challenges to the settlement. |

| How to avoid it | Work with a lawyer to ensure the agreement is carefully worded and addresses all relevant issues, such as how the property will be divided, the timeline for payment of any financial obligations, and what happens if disputes arise. |

6. Ignoring Potential Future Disputes

Many settlements focus solely on the immediate division of property without considering potential future issues. This can be problematic, especially if the property is co-owned or if there are plans to sell or develop the land.

| Why this is important | Future disagreements about property management, sale proceeds, or other issues can arise if these matters aren’t addressed during the settlement process. |

| How to avoid it | Include clauses in the settlement that outline how future decisions about the property will be made. For instance, you can specify the process for selling the property, maintaining it, or dealing with future ownership disputes. |

7. Failing to Have the Agreement Notarized

In some cases, parties might overlook the importance of notarizing the settlement agreement. Without notarization, the document may not be legally binding or enforceable.

| Why this is important | A notarized document is essential for proving the authenticity of the agreement, and without it, the settlement may not be accepted by legal authorities. |

| How to avoid it | Ensure that all parties sign the agreement in front of a notary public, who will officially validate the document. This makes the settlement legally binding and enforceable. |

8. Not Registering the Settlement with the Land Registry

Once the agreement is finalized, many people forget to register the settlement with the local land registry. This step is crucial for updating public records and formalizing the transfer of ownership.

| Why this is important | If the settlement is not registered, the transfer of ownership may not be recognized, leading to disputes or complications if the property is sold or inherited in the future. |

| How to avoid it | After the agreement is signed and notarized, submit it to the local land registry or Registry of Deeds to ensure the ownership transfer is officially recorded. |

9. Rushing the Settlement Process

Another common mistake is rushing through the settlement to resolve the issue quickly. This can lead to oversight of important details or failure to consider all potential consequences.

| Why this is important | Settlements that are rushed are more prone to errors, omissions, or incomplete documentation, which can lead to disputes later. |

| How to avoid it | Take the time necessary to carefully review all aspects of the settlement, consult with legal professionals, and ensure all parties are in full agreement before finalizing the process. |

10. Ignoring Dispute Resolution Clauses

Extrajudicial settlements should include provisions for resolving future disputes, but this is often overlooked or left out entirely. Without these clauses, parties may end up in court if disagreements arise later.

| Why this is important | Dispute resolution clauses provide a framework for handling future disagreements, often using mediation or arbitration to avoid going to court. |

| How to avoid it | Include a dispute resolution clause in the settlement agreement, specifying how future issues will be handled and ensuring that parties have a way to resolve conflicts without resorting to litigation. |

Avoiding common mistakes for a smooth settlement. Extrajudicial settlements offer an efficient alternative to court, but they require careful planning and attention to detail. To avoid the most common mistakes, involve all stakeholders, consult with legal professionals, ensure proper documentation, and clearly outline the terms of the agreement. Taking these precautions helps ensure that the settlement is legally sound, protects the interests of all parties, and avoids complications down the road.

How to Resolve Disputes in Extrajudicial Settlements

While extrajudicial settlements aim to avoid legal disputes, disagreements can still arise during the process. However, several methods can help resolve conflicts without resorting to court action.

Alternative Dispute Resolution Methods

In situations where parties cannot reach an agreement through direct negotiation, they may turn to alternative dispute resolution (ADR) methods like mediation and arbitration. These methods are often more efficient and less confrontational than traditional court proceedings, allowing the parties to resolve their real estate disputes more amicably.

1. Mediation

The mediator doesn’t make a decision but helps the parties communicate and explore options for settling their dispute.

2. Arbitration

An arbitrator acts similarly to a judge, hearing both sides and making a binding decision that the parties agree to follow.

These methods have gained popularity in real estate disputes because they save time and money while often resulting in solutions that work for all parties involved.

Is an Extrajudicial Settlement Right for You?

Extrajudicial settlements are a valuable tool for resolving real estate disputes without the need for costly and time-consuming court proceedings. However, whether or not it is the right choice for you depends on the specifics of your situation. If the parties involved are open to negotiation and wish to maintain control over the outcome, an extrajudicial settlement may be the best route.

However, in cases where disputes are too severe or legal complexities are overwhelming, a judicial settlement might be necessary. Ultimately, consulting a legal expert can help you weigh the pros and cons and make the best decision for your real estate matter.

Frequently Asked Questions (FAQs)

1. What is an extrajudicial settlement in real estate?

An extrajudicial settlement in real estate is a process where parties resolve disputes or divide property outside of court, typically through negotiation or mediation.

2. How do extrajudicial settlements differ from court settlements?

Extrajudicial settlements are done privately, without court intervention, while court settlements involve a legal ruling. The former is often faster, cheaper, and less formal.

3. Are extrajudicial settlements legally binding?

Yes, if all parties agree to the terms and the settlement is properly documented and notarized, it can be legally binding.

4. Can an extrajudicial settlement be reversed?

Reversing an extrajudicial settlement can be difficult, especially if all parties have agreed and the settlement is finalized. However, it may be possible in certain circumstances if the agreement was made under duress or fraud.

5. What happens if there is a disagreement in an extrajudicial settlement?

If parties cannot agree, they may opt for mediation or arbitration to resolve the conflict. If disputes continue, they may need to proceed to court.

6. How much does an extrajudicial settlement typically cost?

The cost varies depending on the complexity of the property and the legal counsel involved. Generally, it is much cheaper than going through the courts.

If you’re facing real estate disputes or property inheritance issues, don’t wait for conflicts to escalate. Consider an extrajudicial settlement to save time, and money, and preserve relationships. Consulting a legal expert can help you understand your options and create a fair, legally binding agreement. Take control of your property matters today and choose a smoother, faster resolution process!

For personalized advice or assistance with extrajudicial settlements, contact a real estate services provider like HousingInteractive or a reputable lawyer and ensure your property disputes are settled efficiently and effectively.