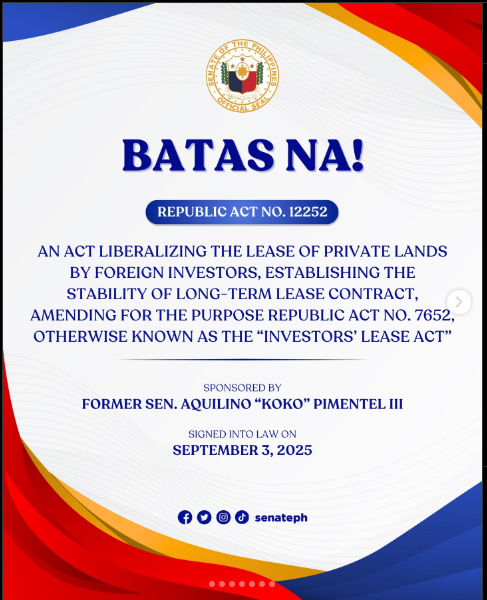

Global investors are turning their attention to the Philippines. This focus is not about short-term market hype. It is based on a major legal change: Republic Act No. 12252, which amends the Investors’ Lease Act.

The Strategic Shift

The new law, RA 12252, was signed by President Ferdinand Marcos Jr. through a presidential decree. This legislative change marks a new era in Philippine investment policy, ushering in a more favorable environment for foreign investors seeking long-term land lease agreements.

This law is simple, but its effect is huge. It removes the single biggest barrier to foreign capital, providing a long-term, stable environment for it.

The Historical Barrier

Before RA 12252 came along, foreign businesses were stuck with tight limits on how long they could lease land. And honestly, that ticking clock? It was a dealbreaker. Who’s going to pour billions into a factory or a fancy resort if the lease is about to expire and they have to start all over? It’s like building a dream house on borrowed time.

These old rules? Earlier laws and presidential decrees set them, and every lease had to comply with whatever was in place at the time. But here’s the thing: that setup crushed big, long-term projects before they even got off the ground. The government knew this was a chokehold on growth and had to fix it fast. Because without that fix, the Philippines was missing out on the kind of investment that really moves the needle.

The 99-Year Solution

The change is straightforward: RA 12252 extends the maximum lease term for private lands to 99 years.

This long-term contract provides secure asset protection. It transforms the investment horizon from short-term planning into generational stability.

To ensure enforceability, there are clear rules:

- Lease contracts, including the main lease contract, must be registered with the Registry of Deeds. Registration is the operative act that makes a binding and enforceable lease against third parties.

- Contracts must comply with the Foreign Investments Act, the original lease terms, and all applicable laws. Only a registered lease contract is legally enforceable.

- Foreign investors are now permitted to lease private lands for up to 99 years, with the leasing process strictly regulated under the provisions of this new legislation.

- Lease renewal is only possible through mutual agreement of both parties, and the leased land or leased area must be dedicated exclusively to an approved investment project or registered investment.

- A minimum investment requirement applies to certain sectors, particularly tourism, and only approved and registered investments qualify for long-term leases.

- The Fiscal Incentives Review Board (FIRB), Investment Promotion Agencies (IPA), and other relevant government agencies oversee compliance, project approval, and the implementation of the law.

The implementing rules and regulations (IRR) will clarify the details of the law. Violations such as unauthorized land use or illegal land activities can result in termination of the lease, possible imprisonment, or the contract being declared invalid.

One important safeguard included in RA 12252 allows for the imposition of shorter lease periods in certain sensitive cases. Specifically, projects that involve industries classified as vital services or critical infrastructure may be subject to a reduced lease term if national security concerns arise. This provision ensures that while the law broadly promotes long-term investments, it also protects the country’s essential services and infrastructure from potential risks associated with extended foreign control.

Additionally, RA 12252 operates within a broader legal framework that includes the Corporate Recovery and Tax Incentives for Enterprises Act (CREATE Act) and other related legislation. These laws collectively support the recovery and growth of enterprises, providing tax incentives and regulatory clarity for foreign lessees and lands leased by foreign investors. By integrating these acts, RA 12252 not only extends lease terms but also aligns with comprehensive policies designed to foster a stable, secure, and attractive environment for foreign capital inflows.

Benefits for the Economy

1. Boosting Investor Confidence

This stability factor is a direct boost to investor confidence. By providing long-term lease contracts, RA 12252 reduces the risks associated with short-term land leases. Investors are more willing to commit significant capital to projects when they know their investments are protected over a reasonable period. Investors engaged in long-term projects are encouraged to coordinate with investment promotion agencies to maximize the benefits of the new law. This assurance encourages foreign investors to pursue long-term investments, fostering a climate of trust and predictability.

2. Economic Growth and Job Creation

The influx of foreign capital resulting from increased investor confidence translates into substantial economic benefits. Long-term leases attract more foreign investors who bring in capital, technology, and expertise. This leads to the development of large-scale projects in key sectors, which in turn generate employment opportunities, stimulate local businesses, and increase government revenues through taxes and other incentives. Over time, these factors contribute to sustained economic growth and national development.

3. Focus on Key Sectors

RA 12252 specifically targets priority sectors that require long-term investments. These include industrial estates, tourism projects, agriculture, agroforestry, and ecological conservation efforts. The law is especially beneficial for projects in these areas, particularly those identified as government priorities. By encouraging investments in these areas, the law aligns with government-identified priorities for national development and sustainable growth. The focus on these key sectors ensures that leased lands are used for approved investment projects that contribute meaningfully to the country’s economic and environmental goals.

Final Positioning

For a long time, the Philippines was behind other countries. Now, it matches its neighbors by offering long-term land leases. RA 12252 establishes the Philippines as a serious, viable investment destination. The message is clear: Stability attracts capital. The global investment map is being redrawn, and the Philippines is firmly on it.

| HousingInteractive is proud to announce a comprehensive series of articles designed to break down the nuances of the amended Investors’ Lease Act. Stay tuned as we analyze how RA 12252 is setting the stage for a new era of long-term, high-impact foreign investment in the Philippines. Next: Will RA 12252 Push Philippine Property Prices Higher? |