The first of four packages of the Comprehensive Tax Reform Program (CTRP), the TRAIN Act, or Republic Act No. 10963, changed how taxes work in the Philippines. It became law on December 19, 2017, and took effect on January 1, 2018. The main goals were to give most Filipinos a break on their income taxes and raise money for important projects like new roads and better services.

This law updated many taxes, including income, inheritance, gift, sales tax (VAT), and other specific taxes. For real estate, TRAIN made some big differences. For example, it changed how much a residential property could cost before VAT was added, updated fees for property documents, and made it easier and cheaper to pay taxes on inherited or gifted properties. Beyond the direct tax changes, TRAIN also affects real estate by giving people more money to spend and the government spending a lot on new buildings and infrastructure. This can make property values go up and change how the market works. This report will look closely at these changes and what they mean for anyone involved in real estate.

Introduction to the TRAIN Law (Republic Act No. 10963)

What It Is and When It Started

The TRAIN Act, which stands for Tax Reform for Acceleration and Inclusion and is officially known as Republic Act No. 10963, was signed into law by President Duterte on December 19, 2017, and took effect on January 1, 2018. This landmark legislation marked the first major step toward modernizing and enhancing the Philippine tax system to make it simpler, fairer, and more efficient.

The Problem It Fixed

For two decades, income tax rates remained unchanged, creating an unfair burden for many Filipinos. The TRAIN Law addressed this by reducing income taxes for nearly all taxpayers, increasing their disposable income. Additionally, it generated revenue to fund major infrastructure projects such as the “Build, Build, Build” program, which includes new roads, bridges, and other developments, as well as to enhance social services across the country.

Objectives and Changes Introduced by the TRAIN Law

The main aims of the TRAIN Law were to simplify the tax system, make it fairer, and enhance its overall efficiency for the benefit of all Filipinos. It sought to stimulate economic growth by attracting more businesses, generating employment opportunities, and reducing poverty. Additionally, the law was designed with a long-term vision to secure sufficient revenue for sustainable economic development and to invest in crucial sectors like health and education, ultimately improving the quality of life for the population.

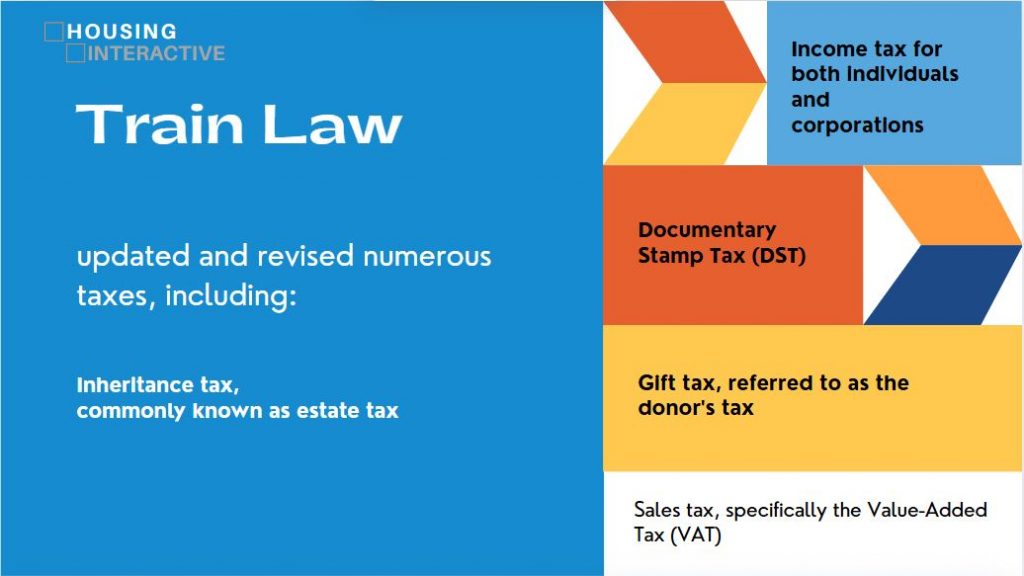

The TRAIN Law updated and revised numerous taxes, including:

- Income tax for both individuals and corporations

- Inheritance tax, commonly known as estate tax

- Gift tax, referred to as the donor’s tax

- Sales tax, specifically the Value-Added Tax (VAT)

- Documentary Stamp Tax (DST)

Taxes include automobiles, petroleum products, sugary beverages, tobacco products, and mineral resources. Additionally, the law introduced new excise taxes targeting invasive cosmetic procedures and sweetened drinks to promote public health and generate additional government revenue. These excise taxes are part of the broader effort under the TRAIN Law to create a more equitable tax system while funding vital infrastructure and social programs.

Key Concepts & Presidential Vetoes

The government aimed to establish a tax system that benefits everyone by increasing people’s disposable income and enabling the provision of essential services such as infrastructure, healthcare, education, and employment. Over the first five years of the TRAIN Law’s implementation, the majority of the additional revenue—up to 70%—is allocated to infrastructure projects under the “Build, Build, Build” program, which includes the construction of new roads, public transportation systems, military facilities, school sports amenities, and the provision of clean water in public areas. The remaining 30% is dedicated to social programs that support education, healthcare, food security, social protection, job creation, and housing, focusing on assisting poorer families through direct cash transfers and fuel subsidies.

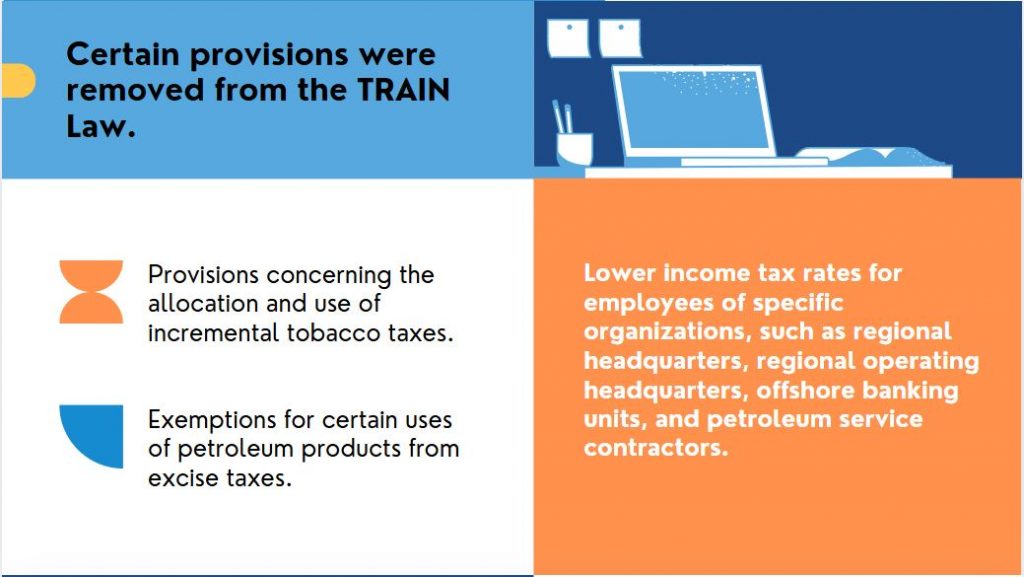

Certain provisions were removed from the TRAIN Law. These vetoed items included:

- Lower income tax rates for employees of specific organizations, such as regional headquarters, regional operating headquarters, offshore banking units, and petroleum service contractors.

- Exemptions for certain uses of petroleum products from excise taxes.

- Provisions concerning the allocation and use of incremental tobacco taxes.

These vetoes aimed to ensure that the government maintains enough revenue to effectively fund its key infrastructure and social service programs.

Why These Principles Are Important in Real Estate

This investment in new roads, bridges, and transportation networks directly impacts real estate by increasing land values in newly accessible areas and stimulating demand for housing and commercial developments along these routes. However, the vetoes of certain provisions, such as specific tax breaks for particular groups, highlight the government’s need to balance targeted relief with the broader objective of securing sufficient funds to benefit the nation.

TRAIN Law’s Effect on Real Estate

This section details the direct impacts of the TRAIN Law on real estate, including changes to VAT regulations, documentary stamp taxes, estate and donor’s taxes, and property valuation methods.

A. Changes to Value-Added Tax (VAT) on Real Properties

The TRAIN Law made some big changes to when you pay Value-Added Tax (VAT) on selling or renting real properties.

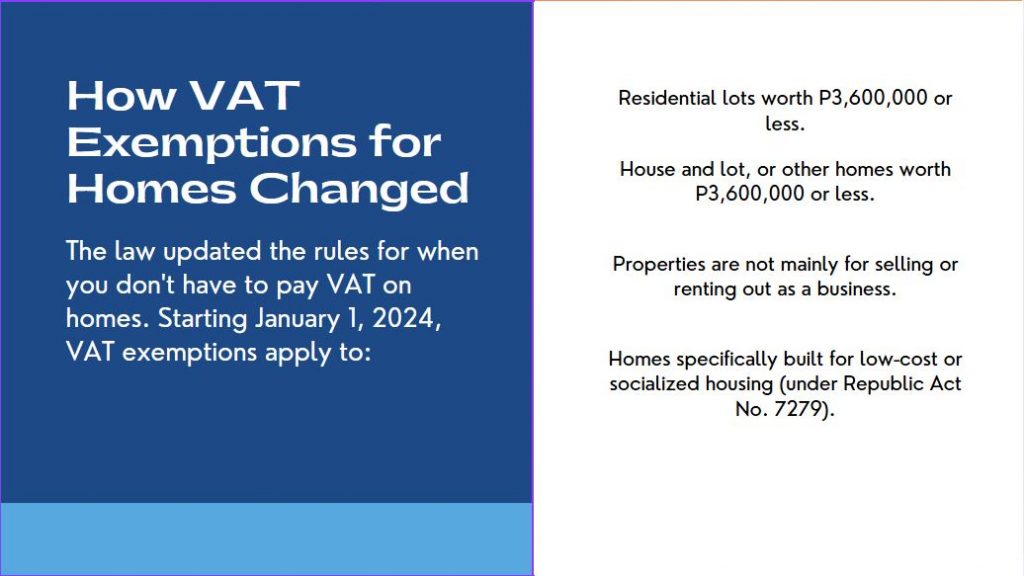

1. How VAT Exemptions for Homes Changed

The law updated the rules for when you don’t have to pay VAT on homes. Starting January 1, 2024, VAT exemptions apply to:

- Residential lots worth P3,600,000 or less.

- House and lot, or other homes worth P3,600,000 or less.

- Properties are not mainly for selling or renting out as a business.

- Homes specifically built for low-cost or socialized housing (under Republic Act No. 7279).

To keep these amounts fair and up to date, the law requires them to be adjusted every three years starting January 1, 2021. This adjustment will be based on the Consumer Price Index (CPI) published by the Philippine Statistics Authority (PSA) to reflect changes in the cost of living.

2. VAT Exemption for Lease of Residential Units

Regarding residential rentals, the TRAIN Law continues to exempt from VAT the lease of residential units with monthly rentals not exceeding fifteen thousand pesos (P15,000). This represents an increase from the previous threshold of P12,800, thereby extending the VAT exemption to a broader range of residential leases.

What the VAT Changes Mean for Homes

The TRAIN Law lowered the VAT exemption limit for homes from P3,199,200 to P2 million, starting January 1, 2021. This directly affects how affordable mid-range houses are and can change what kind of homes people look for.

1. How the VAT Exemption Change Works

In line with this mandate and based on the 2023 Consumer Price Index (CPI) published by the Philippine Statistics Authority (PSA), the updated price ceiling for VAT-exempt sales of house-and-lot packages and other residential dwellings has been adjusted to ₱3,600,000.00, rounded up. This new threshold took effect on January 1, 2024.

2. Why Future Adjustments Might Still Lag

Even though the law plans to adjust VAT exemption limits based on general inflation (using the Consumer Price Index, or CPI), this might not fully keep up with how much real estate costs increase.

- Higher Real Estate Costs: Things like land, building materials, and labor often get more expensive faster than the general CPI.

- Gradual Impact: If CPI adjustments are too slow, more and more properties will naturally go over the VAT-exempt limit over time, even if their real value (after factoring in building costs) stays the same.

- Result: This adjustment means that over time, more homes will become subject to VAT, which will likely contribute to ongoing upward pressure on housing prices for consumers.

Here’s a summary of the VAT exemption thresholds for residential properties in the Philippines for 2024:

| Type of Property Transaction | VAT Exemption Threshold (2024) | Notes |

|---|---|---|

| Sale of House and Lot and Other Residential Dwellings | Up to PHP 3,600,000 | This applies to sales of residential units like house and lot packages and condominium units. The threshold was increased from PHP 3,199,200. If multiple adjacent properties are sold to the same buyer for a single residential area, the aggregate value must not exceed this threshold. |

| Sale of Real Properties Not Primarily Held for Sale or Lease in the Ordinary Course of Trade or Business | Exempt (no specific monetary threshold) | This applies to real properties classified as capital assets, meaning they are not intended for sale or use in a business. The seller must not be engaged in the real estate business. |

| Sale of Real Property Utilized for Socialized Housing | Exempt (no specific monetary threshold, but subject to price ceilings) | Socialized housing refers to projects for underprivileged and homeless citizens. Price ceilings for socialized housing can range from PHP 300,000 to up to PHP 3 million, as set by DHSUD and NEDA. |

| Lease of Residential Units (monthly rental) | Up to PHP 15,000 per month | This applies even if the total annual rental payments exceed the general VAT threshold (currently PHP 3,000,000 for annual gross receipts). |

Important Considerations:

- Adjustment Every Three Years: The VAT exemption threshold for the sale of houses & lots, and other residential dwellings is mandated by law to be adjusted every three years using the Consumer Price Index.

- Other Taxes Still Apply: Even if a property sale is VAT-exempt, other taxes such as capital gains tax, documentary stamp tax, and transfer tax may still apply.

- Purpose of Use: To qualify for the VAT exemption, the property must generally be used for residential purposes.

- Lessor VAT Threshold: For lessors of residential units, while individual monthly rentals below PHP 15,000 are VAT-exempt, if their total annual gross receipts from all business activities (including leasing) exceed PHP 3,000,000, they are generally subject to VAT (unless specifically exempted).

This information is based on Revenue Regulations No. 1-2024, which took effect beginning January 1, 2024.

B. Documentary Stamp Tax (DST) on Real Estate Deals

The TRAIN Law changed several Documentary Stamp Tax (DST) rates, affecting the total cost of buying, selling, or leasing real estate.

1. Mortgages and Loans (Section 195)

When you take out a mortgage (loan using property as collateral), pledge, or deed of trust:

- If the loan is up to P5,000, the DST is P40.00.

- For every extra P5,000 (or part of it) over P5,000, you pay an additional P20.00.

These taxes add to the overall cost of getting a loan for property.

2. Sales, Transfers, and Gifts of Property (Section 196)

When selling, transferring, or gifting real property, the DST is calculated based on the higher of these two amounts:

- The price you agree to pay for the property.

- The property’s fair market value (FMV) is set by the tax Commissioner (often called “zonal value”).

Exception: If the government is one of the parties, the tax is only based on the actual agreed price.

Rates:

- If the price or value is up to P1,000, the DST is P15.00.

- For every extra P1,000 (or part of it) over P1,000, you pay an additional P15.00.

Exemptions: Transfers that are exempt from the donor’s tax are also exempt from this DST.

Commissioner’s Power: The Commissioner can check if the declared price is too low and demand the correct tax based on the true market value.

This tax is now based on the higher sale price or government valuation, helping to ensure properties are taxed fairly.

3. Leases and Rental Agreements (Section 194)

For renting land or buildings, the DST is figured out for each year of the rental agreement.

Rates:

- For the first P2,000 (or part of it) of the yearly rent, the DST is P6.00.

- You pay an additional P2.00 for every extra P1,000 (or part of it) over P2,000 of the yearly rent.

Renting property also comes with a yearly DST based on the rental amount.

4. What These DST Changes Mean

| Higher Costs: | The adjustments to DST rates for sales, mortgages, and leases generally mean that buying, selling, or renting property now costs more in taxes. |

| Revenue Goal: | Since TRAIN aimed to raise more money for the government, these new rates likely mean higher taxes compared to before. |

| Cumulative Effect: | While a single transaction might seem to have a small extra cost, these added taxes can add up for expensive properties or developers handling many properties. |

| Consumer Impact: | This higher cost for real estate businesses could eventually lead to higher property prices or rental rates for consumers. |

| Accurate Valuation: | The rule to use the higher of the declared price or the government’s fair market value (zonal value) for sales helps stop people from undervaluing properties to pay less tax. |

| Future Increases: | This, along with the Commissioner’s power to regularly update zonal values, means that the tax paid on property sales will likely go up over time as market values increase. |

| Planning: | This means that people involved in real estate deals need to be careful to declare realistic property values or be ready for higher tax bills based on government valuations, making careful tax planning very important. |

5. Key Table: Key Documentary Stamp Tax (DST) Rates on Real Property Transactions

| Sectionin TaxCode | Transaction Type | Tax Base | New DST Rate | Key Conditions/Exemptions |

|---|---|---|---|---|

| 194 | Leases and Other Hiring Agreements | For each year of a term | P6.00 for 1st P2,000;P2.00 for each nextP1,000 | N/A |

| 195 | Mortgages, Pledges, Deeds of Trust | Amount secured | P40.00 for 1st P5,000;P20.00 for each nextP5,000 | N/A |

| 196 | Deeds of Sale, Conveyances, and Donations of Real Property | Higher of consideration or FMV (Sec. 6(E)) | P15.00 for 1st P1,000;P15.00 for each nextP1,000 | Exempt if exempt from donor’s tax (Sec. 101(a) & (b)); Government as party uses actual consideration |

| 189 | Warehouse Receipts | Per warehousereceipt | P30.00 | N/A |

C. Estate Tax Changes for Property Transfers

The TRAIN Law made big changes to the estate tax, making it simpler and offering bigger deductions. These changes significantly affect how:

1. New Flat Estate Tax Rate

- The tax rate used to vary from 5% to 20%, depending on the estate’s size.

- Now, there’s a single, flat rate of 6% applied to the total net value of the estate. This applies to everyone, whether they live in the Philippines or not.

This makes the tax more predictable and generally lowers the tax for larger estates.

2. Bigger Deductions (Standard & Family Home)

- Standard Deduction: This was greatly increased from P1,000,000 to P5,000,000 for citizens or residents.

- Family Home Deduction: The deduction for the family home jumped from P1,000,000 to a huge P10,000,000.

- Simpler Process: You no longer need a certification from a barangay captain to prove it’s the family home.

Some old deductions (like funeral and medical expenses) were removed, as their benefits are now included in the much larger standard deduction.

These much larger deductions mean many estates, especially those with a family home, might pay much less or even no estate tax.

3. Easier Estate Settlement Rules

| No “Notice of Death”: | You no longer need to file a notice of death within two months. |

| Longer Filing Time: | The time to file the estate tax return is now one year (instead of six months) after death, giving heirs more time. |

| Installment Payments: | If there isn’t enough cash, you can now pay the estate tax in installments over two years without extra penalties or interest. |

| Bank Withdrawals: | The old P20,000 limit for withdrawing money from a deceased person’s bank account without BIR approval is gone. You can now withdraw any amount, but a 6% final tax will be withheld. |

| CPA Requirement: | An estate tax return only needs to be certified by a CPA if the gross value is over P5,000,000 (up from P2,000,000), reducing paperwork for smaller estates. |

These changes make settling an estate much easier, giving heirs more time and flexibility, especially with finances.

4. What These Estate Tax Changes Mean

- More Affordable Transfers: The 6% flat tax and the large P5 million standard and P10 million family home deductions make passing on real property much cheaper and easier for most families.

- Tax Savings: For example, an estate worth P15 million with a P10 million family home and P5 million in other assets might end up paying no estate tax at all.

- Protecting Assets: This helps families keep inherited properties instead of being forced to sell them just to pay taxes.

- Less Stress for Heirs: The longer filing period, installment options, and easier bank withdrawals give heirs much-needed breathing room. This helps avoid quick, forced sales of inherited property at low prices to cover tax bills.

- Immediate Funds: Being able to withdraw bank funds (with the 6% tax) provides cash for immediate expenses like funerals, easing financial pressure during a difficult time.

Overall, these estate tax reforms make it simpler, cheaper, and less stressful to inherit and transfer real property.

D. Donor’s Tax Changes for Property Transfers

The TRAIN Law also updated the donor’s tax rules, similar to the new estate tax rules. These changes are important when you give real property away during your lifetime.

1. New Flat Donor’s Tax Rate and Exemption

- The tax rate used to be complex, from 2% to 15% for gifts to family and a high 30% for gifts to non-family.

- Now, there’s a single, flat rate of 6%. This 6% is applied to the total gifts you give after the first P250,000, which is tax-exempt. This applies whether the person receiving the gift is family or not.

This makes giving gifts of property much simpler and generally cheaper, especially for gifts to non-family members.

2. Clarity on “Selling” Property for Less Than Full Value

- Business Sales: The law now clearly states that if you sell, exchange, or transfer property as a true, arm’s-length business deal, it’s considered to be for its full value, even if the price seems low. So, these types of transactions are not subject to the donor’s tax. This helps separate real business deals from hidden gifts.

- Dowries/Marriage Gifts: The old rule that exempted gifts made by parents to their children due to marriage has been removed. These kinds of transfers are now subject to the standard donor’s tax.

True business transactions are safe from donor’s tax, but specific marriage gifts are now taxed.

3. What These Donor’s Tax Changes Mean

| Cheaper Lifetime Gifts: | The big drop in donors’ tax (especially from 30% to 6% for gifts to non-family) makes giving away real property while you’re alive much more tax-efficient. |

| Encourages Planning: | This could encourage people with a lot of real estate to give it away or donate it during their lifetime, rather than waiting until their death. This can help manage future estate taxes and distribute assets as planned. |

| Importance of Proper Valuation: | Even though business sales are exempt, it’s very important to make sure the selling price of real property accurately reflects its fair market value. |

| Avoiding Problems: | If a property is sold for much less than its true value (as determined by the tax Commissioner or an appraiser) and it doesn’t look like a clear business deal, the Bureau of Internal Revenue (BIR) could still charge donor’s tax on the difference. |

| Careful Planning: | Anyone involved in real estate deals, especially between related parties, must ensure prices are fair and reflect the market to avoid unexpected donors’ tax bills. |

The new rules encourage lifetime property transfers due to lower taxes but stress the need for accurate property valuations to avoid unexpected tax issues.

4. Key Table: Key Donor’s Tax Changes Affecting Real Property

| Aspect | Old Provision (Pre-TRAIN) | New Provision (TRAIN Law) | Implications for Real Property Transfer |

|---|---|---|---|

| Tax Rate | 2-15% (relatives), 30% (strangers) | Flat 6% on gifts exceeding P250,000 | Significantly lower tax for gifts to strangers; simplified and more favorable for all donees. |

| Exemption Threshold | P100,000 (relatives), P0 (strangers) | P250,000 (uniform) | Higher universal exemption, benefiting smaller gifts. |

| Treatment of “Below Market” Sales | Assumed gift if the consideration is inadequate | Not subject to tax if bona fide, arm’s length, no donative intent in the ordinary course of business | Clarifies that commercial transactions are not gifts, but emphasizes the need for fair market value and genuine commercial intent. |

| Dowry Exemption | Exempted | Repealed | Dowries are now subject to the 6% donor’s tax. |

E. Who Sets Property Values for Tax? (Zonal Values)

Section 6(E) of the NIRC, changed by the TRAIN Law, gives the Commissioner of Internal Revenue much more power to set real property values for tax purposes.

1. Commissioner’s Increased Power

- Dividing Areas: The Commissioner can now divide the Philippines into different zones or areas.

- Setting Values: For each zone, they can set the fair market value (FMV) of properties.

- Regular Updates: These values aren’t fixed. They will be automatically updated every three years based on current Philippine valuation standards. This means government values will be more in line with real market prices.

The tax chief now has the strong authority to set property values for tax, and these values will be updated regularly.

2. Rules for Transparency

- Public Notice: Any changes to these values (zonal values) are only valid if they are published in a newspaper in the affected area or posted in important public places like the provincial capital.

- Open Records: The reasons behind any valuation, including notes from meetings with private and public groups, must be public records that taxpayers can look at.

The law requires transparency by making zonal value changes public and their basis accessible to taxpayers.

3. How Taxes Are Calculated

When calculating any tax that depends on property value (like Capital Gains Tax, DST on sales, Estate Tax, and Donor’s Tax), the government uses the higher of these two amounts:

- The fair market value (zonal value) is set by the Commissioner.

- The fair market value from the Provincial and City Assessors.

Taxes on property deals are always based on the higher of the government’s set value or the local assessor’s value.

4. What This Means for Zonal Values

| Higher Taxes Over Time: | The mandatory update of zonal values every three years means that the government’s official property values will generally go up. This directly leads to higher taxes on property deals. |

| Catching Up with the Market: | Historically, zonal values were often much lower than actual market prices because they weren’t updated often. TRAIN’s rule for automatic updates means these values will better reflect how much properties are worth. |

| Built-in Revenue Increase: | Since taxes are based on the higher of the selling price or the zonal value, regular increases in zonal values will automatically mean higher tax bills for property transactions, even if the selling price doesn’t go up as fast. This gives the government a steady way to increase its real estate tax income. |

| More Transparency: | The rules for public consultations and publishing zonal value changes are meant to make the process more open and fair. |

| Better Planning for You: | By announcing changes beforehand, publishing them, and making records public, property owners, developers, and investors can better predict and understand why values change. This helps with financial planning and assessing risks. |

| Fairer System: | It also gives people a formal way to get involved and potentially question values that seem unfair, leading to a more predictable and equitable tax system for real property. |

What TRAIN Means for Real Estate: Summary and Advice

The TRAIN Law brought many changes that are reshaping how real estate is taxed and developed in the Philippines.

1. Good News for Transfers:

- Simpler, Cheaper Estate & Donor’s Tax: The tax on inherited or gifted property is now a flat 6% (down from up to 20-30% before).

- Bigger Deductions: You can now deduct P5 million (standard) and P10 million (family home) from the estate’s value, which means many families will pay much less or even no tax.

- Easier Process: Heirs get more time to file taxes and can pay in installments, making it less stressful.

These changes make it easier and more affordable to pass on or give away real property, helping families keep their assets.

2. Higher Costs for Some Deals:

- VAT on Mid-Range Homes: Homes priced above P3.6 million, which used to be VAT-free, now have a 12% VAT starting January 1, 2024. This makes them more expensive for buyers.

- Increased Stamp Taxes: Documentary Stamp Tax rates for sales, mortgages, and leases are generally higher, adding to the overall cost of these transactions.

These increases will likely push up property prices for certain segments, affecting how affordable they are.

3. Dynamic Property Values for Tax:

- Regular Updates: The government’s tax agency (BIR Commissioner) now has more power to set property values (zonal values) and must update them every three years.

- Impact: This means property taxes will be based on more up-to-date market values, leading to higher tax bills over time as property values generally increase.

4. Boost in Home Buying Power:

- More Money in Pockets: Most Filipinos got income tax cuts from TRAIN, meaning they have more money to spend.

- Increased Demand: This extra money can lead to more people being able to afford homes, especially in the affordable and mid-market ranges.

5. Growth Driven by Infrastructure:

- A large part of the money raised by TRAIN goes into huge infrastructure projects (like roads, bridges, and public transport).

- These projects will significantly increase land values and lead to new property developments, especially in areas that become easier to access. This creates new growth areas beyond just major cities.

Tips and What to Consider Moving Forward

Given these changes, here’s advice for different groups in the real estate world:

1. For Home Buyers and Sellers:

- Check Property Values Carefully: Since taxes are based on the higher of your selling price or the government’s zonal value (which changes every three years), make sure your property values are realistic and well-documented. Consider getting an independent appraisal.

- Mind the VAT Threshold: If buying a home, be very aware of the P3.6 million VAT exemption limit (as of Jan 1, 2024) and how it will adjust. This helps you budget correctly and might lead you to look for homes below that price or in socialized housing.

- Plan Your Estate/Gifts: Talk to a tax or estate planning expert. The new, lower 6% flat estate and donor’s tax rates, plus the big deductions (5M standard, 10M family home), offer great opportunities. The extended time to file and installment options for the estate tax make planning more flexible.

2. For Real Estate Developers and Investors:

- Adjust Your Projects: Think about building more socialized housing or homes priced under the P2 million VAT limit to tap into the VAT-exempt market.

- Invest Smartly: Look for and invest in land or projects in areas where big “Build, Build, Build” infrastructure projects are happening. These areas are set to see big jumps in land value and demand for all types of properties.

- Update Your Budgets: Make sure you include the higher DST rates (for sales, mortgages, leases) and the potential VAT on mid-market projects in your financial plans to ensure your projects remain profitable.

- Stay Informed: Keep in touch with local tax assessors and the BIR about zonal value adjustments. This helps you know what’s coming and plan for future tax impacts on your properties.

3. General Real Estate Market Outlook:

While some transaction costs have gone up, the long-term impact of TRAIN on real estate is expected to be good. Income tax cuts give people more money, which should increase demand for homes, especially for first-time buyers and those in the mid-market.

The government’s huge spending on infrastructure, powered by TRAIN revenues, will be a major driver for growth. This means new areas will open up for development, accessibility will improve, and land values will increase across the country. The real estate market will likely see more investment and development in areas benefiting from new infrastructure and in properties that fit within the new VAT-exempt rules.