What if the rules of the game suddenly changed in your favor?

A Game Changer

That’s what happened with Republic Act No. 12252 (RA 12252). This new law makes a fundamental change to how foreign entities can lease private land in the Philippines. It’s a major update, especially if you are considering large, long-term investments here.

This law tells the world that the Philippines is moving past short-term investment cycles. It now welcomes global capital for long-term, legacy-building projects.

The biggest change is the duration.

- Old System: Leases were capped at 50 years. You could renew them once, for a maximum of 25 more years. That meant a total of 75 years, but it required extra paperwork and waiting for the renewal approval.

- New System (RA 12252): You can now get a single, straight 99-year lease right from the start. No renewal steps needed for the initial term. This makes things much simpler.

RA 12252: The New Legislation on Lease of Private Lands

A. What RA 12252 is

The official name is long: “An Act Liberalizing the Lease of Private Lands by Foreign Investors, Establishing the Stability of Long-Term Lease Contracts, Amending for the Purpose Republic Act No. 7652, Otherwise Known as the ‘Investors Lease Act.'”

President Ferdinand R. Marcos Jr. signed this law on September 3, 2025. It takes effect shortly after its official publication.

The law is focused. It specifically aims to encourage investment in key sectors: industrial estates, tourism, agriculture, agroforestry, ecological conservation, and related commercial ventures.

B. The Old Rule vs. The New Rule

| Feature | Old Rule (Pre-RA 12252) | New Rule (RA 12252) |

|---|---|---|

| Term Duration | Max of 75 years (50 + 25 renewal) | Max of 99 years |

| Renewal Process | Requires bureaucratic renewal after 50 years | Streamlined, one contract for the full term |

C. Who Benefits from RA 12252: Foreign Investors and Others

This law is for foreign investors and foreign-owned corporations who want to lease private land for investment purposes.

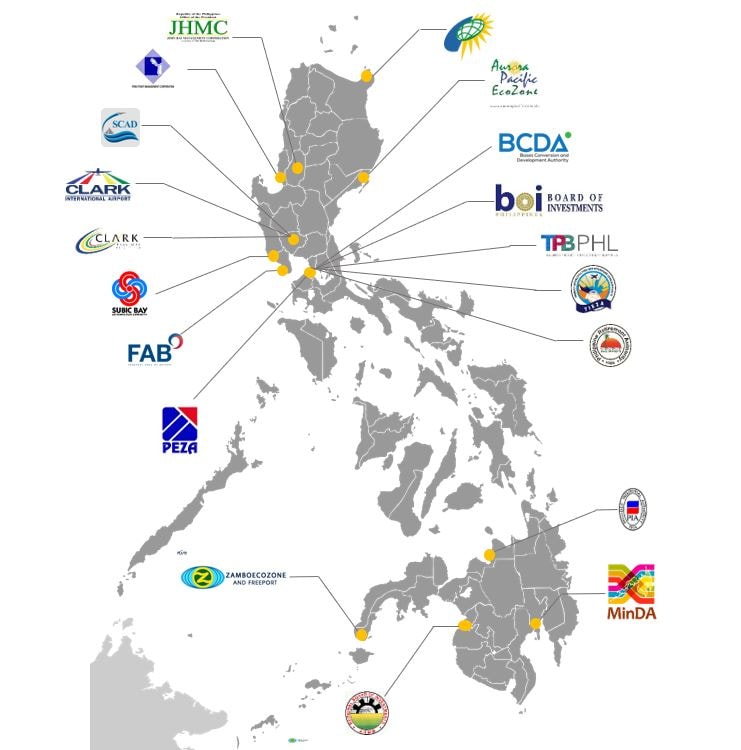

You must have an approved and registered investment under the Foreign Investments Act (FIA) or any relevant Investment Promotion Agency (IPA) to get the 99-year lease. Foreign investors must also meet specific investment requirements prescribed by law, including minimum investment thresholds for certain projects, such as tourism-related ventures. These investment requirements are designed to align with government-identified priorities for national development and strategic industries.

This law sets limits for foreign entities. It does not apply to Filipino citizens or Filipino-owned companies. It only addresses the limits placed on foreign investment leases.

The Investor Impact: Long-Term Confidence

A. Planning for 99 Years: Generational Security

A 99-year lease term offers generational security. Most major project cycles and the careers of initial investors will end before the lease does.

The period provided under the new law ensures a reasonable period for project development and return on investment, giving both lessors and lessees a clear and practical timeframe for fulfilling contractual obligations.

“Before RA 12252, foreigners had 50 years plus 25 renewal. Now? A straight 99 years. That’s generational security…”

This long-term is a huge factor in project valuation. It increases the stability of the asset. Once registered, the lease’s binding effect on the contract provides legal certainty for investors, making the project look much better to banks and investors, increasing its collateral value and access to financing.

B. Boosting Investor Confidence

A straight 99-year contract is far more attractive than a 50+25 structure.

- No Renewal Stress: Investors don’t have to worry about the time, cost, or risk of getting that 25-year extension approved after five decades. The risk of bureaucratic rejection or tough renegotiation is simply removed.

- Better Planning: It allows for the development of massive infrastructure projects—think resorts, large-scale industrial parks, or major energy facilities—that need many decades to deliver returns.

Investors engaged in long-term projects must coordinate with the appropriate investment promotion agency to ensure compliance with legal requirements and maximize available benefits. Investment promotion agencies, such as the Board of Investments (BOI) and the Fiscal Incentives Review Board (FIRB), play a key role in facilitating and regulating foreign investment projects under the new law.

C. Scope of the Lease

This law mainly applies to private lands used for specific investment purposes like industry, commerce, tourism, and farming. The leased land must be clearly described in the lease contract and follow legal rules. It must have a valid land title, which is important for registering the lease and making it legally binding. This law does not cover leasing homes for living. It opens up the chance for foreign investors to lease private lands for approved business projects. Examples include industrial estates and factories, which are among the main types of properties that can have long-term leases under this law. The land has to be used only for the approved project and nothing else.

| Specific Rules for Tourism: For tourism projects, the investment must be at least $5 million (USD). Also, 70% of that money must be put into the project within three years of signing the lease contract. |

Practical Applications and Questions

A. Legal and Lease Contract Details

- What about existing 50-year leases? The law does not automatically “convert” old contracts. If you have an existing 50-year lease, you must talk to your legal counsel. You might be able to negotiate an amendment or a new contract based on the new 99-year maximum.

- Making the Contract Binding: For the contract to be fully protected and enforceable against third parties, you must register the lease contract with the Registry of Deeds where the property is located. This registration is key. Once registered, the contract cannot be changed or challenged except through a formal legal process.

- Transferring the Lease: Yes, you can sell, assign, or transfer the lease to another foreign investor during the 99-year term. The new foreign lessee must still comply with all the original lease terms.

- Subleasing: You can sublet the property, as long as the original landlord agrees and the main lease contract does not forbid it. Any sublease must also be registered.

B. Accountability and Penalties

- Termination: If you use the leased land for anything other than what was agreed upon, or if you pull out your investment, this is considered unauthorized land use or illegal activity. In these cases, the lease contract will be automatically ended right away, and you will lose all the rights given under the law. The landowner can still ask for compensation for any damages caused.

- Starting the Project: If you fail to start the approved investment project within three years of signing the lease, the Fiscal Incentives Review Board (FIRB) or other relevant agencies can ask you to explain the delay. If the investor fails to meet the required investment obligations or project timelines, the lease may be subject to automatic termination.

- Fines: The penalties for serious violations, like unauthorized or illegal land use, have been raised significantly: fines now range from ₱1 million to ₱10 million, plus possible imprisonment (six months to six years).

C. Law Boundaries and Next Steps

- Does this change foreign land ownership? No. This law is strictly about leasing. The constitutional ban on foreign ownership of private land in the Philippines remains in place.

- Shorter Leases: The President, with a recommendation from the FIRB or other agencies, can impose a shorter lease period if the investment involves vital services or industries, or industries considered critical for national development, especially when the interest of national security is at stake.

- Recommendations for Investors:

- Get Legal Help. Talk to a lawyer who knows Philippine property law and foreign investment rules well.

- Check the Land. Verify the land’s classification and zoning. Make sure it matches your long-term plan.

- Plan Your Capital. Start mapping out your capital strategy, knowing you have time on your side.

Building a Legacy

RA 12252 is a huge step forward. It removes red tape, lowers long-term risk for foreign capital, and formally extends the investment horizon to nearly a century. This simple extension is a strong signal of stability.

“With time on their side, investors can now think beyond decades: planning for legacies, not just projects.”

We think this change opens up big possibilities. If you have questions about how this law affects your current or planned projects, reach out to an investment specialist. Start planning your long-term Philippine strategy today. For expert guidance and comprehensive property solutions, visit HousingInteractive, the Philippines’ first property portal, dedicated to helping investors navigate the evolving landscape of foreign land leases and make informed decisions with confidence.

HousingInteractive is proud to announce a comprehensive series of articles designed to break down the nuances of the amended Investors’ Lease Act. Stay tuned as we analyze how RA 12252 is setting the stage for a new era of long-term, high-impact foreign investment in the Philippines.