Source references are listed at the end of the report.

Executive Summary

Triangle Park and Vertis North: A Rising Hub in the North

Quezon City Central Business District, focused on the Triangle Park area and the flagship Vertis North development by Ayala Land, is rapidly emerging as a key business and lifestyle hub in northern Metro Manila. Vertis North is a 29-hectare master-planned estate that integrates residential, office, retail, and hotel components with a significant emphasis on green spaces and sustainability. While offering a modern and accessible alternative, the area currently navigates challenges related to high office vacancy and the absorption of new supply. Its long-term potential is significantly boosted by major infrastructure projects, particularly the development of the Metro Manila Subway.

Office Market Overview

Quezon City’s office market presents a mixed picture, characterized by lower rental rates compared to prime CBDs but also grappling with higher vacancy levels, partly due to a significant pipeline of new supply.

Vacancy Trends:

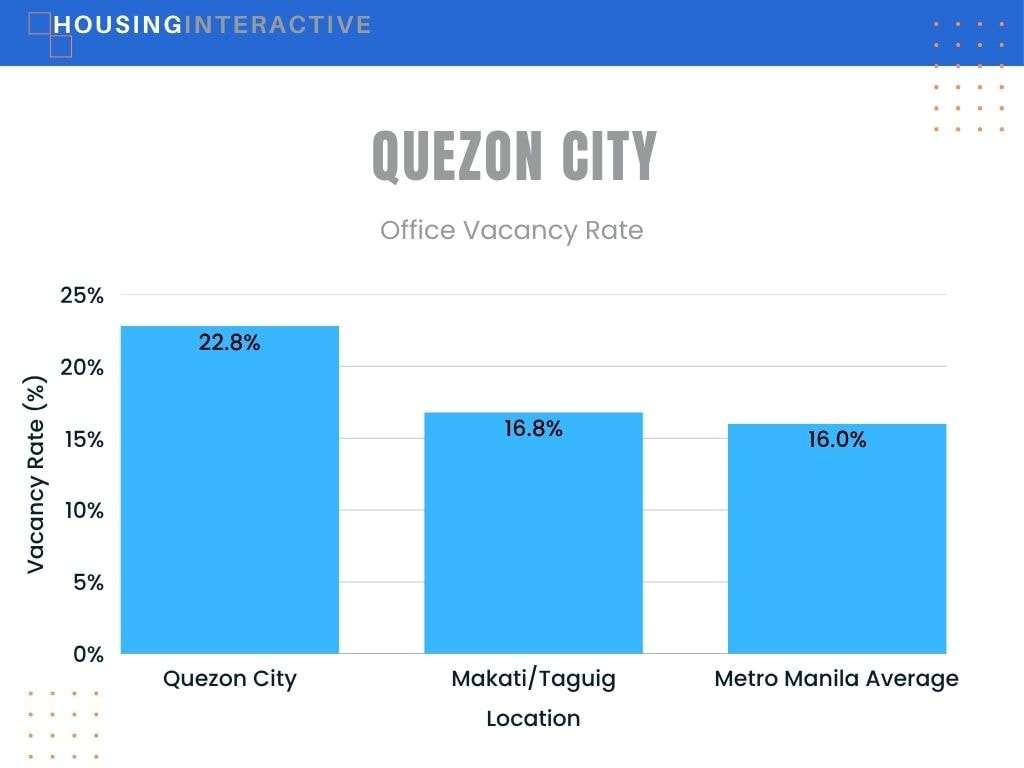

Quezon City generally exhibits higher office vacancy rates than prime CBDs like Makati and BGC. Colliers reported a 22.8% vacancy rate for Quezon City at the end of 2024. This is notably higher than the broader Metro Manila average of 16% in Q1 2025, reported by LPC and JLL’s Makati/Taguig Grade A rate of 16.8% in Q4 2024. A primary factor contributing to this high vacancy is the substantial new office supply expected in Quezon City during 2025, projected by Colliers to be the largest among all submarkets at 202,000 sqm, which could potentially elevate the vacancy rate further in the near term.

Office Vacancy Rates—Q4 2024/Q1 2025 Data Comparison

| Location | Vacancy Rate | Period | Source |

|---|---|---|---|

| Quezon City | 22.8% | Q4 2024 | Colliers |

| Makati/Taguig (BGC) | 16.8% | Q4 2024 | JLL |

| Metro Manila (Overall) | 16% | Q1 2025 | LPC |

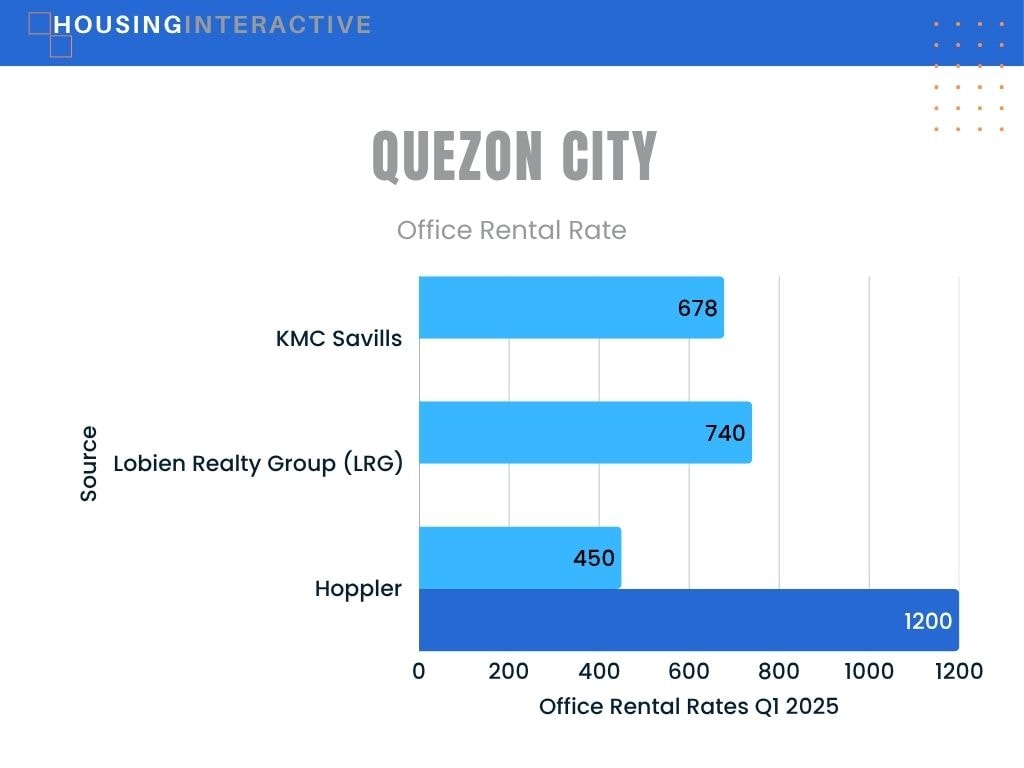

Rental Rates:

Reflecting the higher vacancy, office rental rates in Quezon City are considerably lower than those in Makati or BGC, making it an attractive option for cost-sensitive occupiers, particularly BPOs.

- KMC Savills reported an average rent of PHP 678.3/sqm/month in Q1 2025.

- Lobien Realty Group (LRG) estimated the Q1 2025 average rent slightly higher at PHP 740/sqm/month.

- Listings on Hoppler show a wide range, from PHP 450/sqm to over PHP 1,200/sqm, depending on building grade and location within QC.

Quezon City Office Rental Rates (Q1 2025)

| Source | Average Rent (PHP/sqm/month) |

|---|---|

| KMC Savills | 678.3 |

| Lobien Realty Group | 740 |

| Hoppler (Range) | 450 – 1,200 |

Key Drivers & Trends:

- Cost-Effectiveness: Lower rental rates attract BPOs and other cost-sensitive businesses.

- New Supply: Significant new office inventory is entering the market.

- Infrastructure Development: Future transport links are expected to enhance appeal.

- Master-Planned Developments: Vertis North offers a modern, integrated environment.

Residential Market Overview

The residential market in Quezon City, including the Triangle Park/Vertis North area, is influenced by a broader trend of oversupply in Metro Manila, particularly in the mid-market segment.

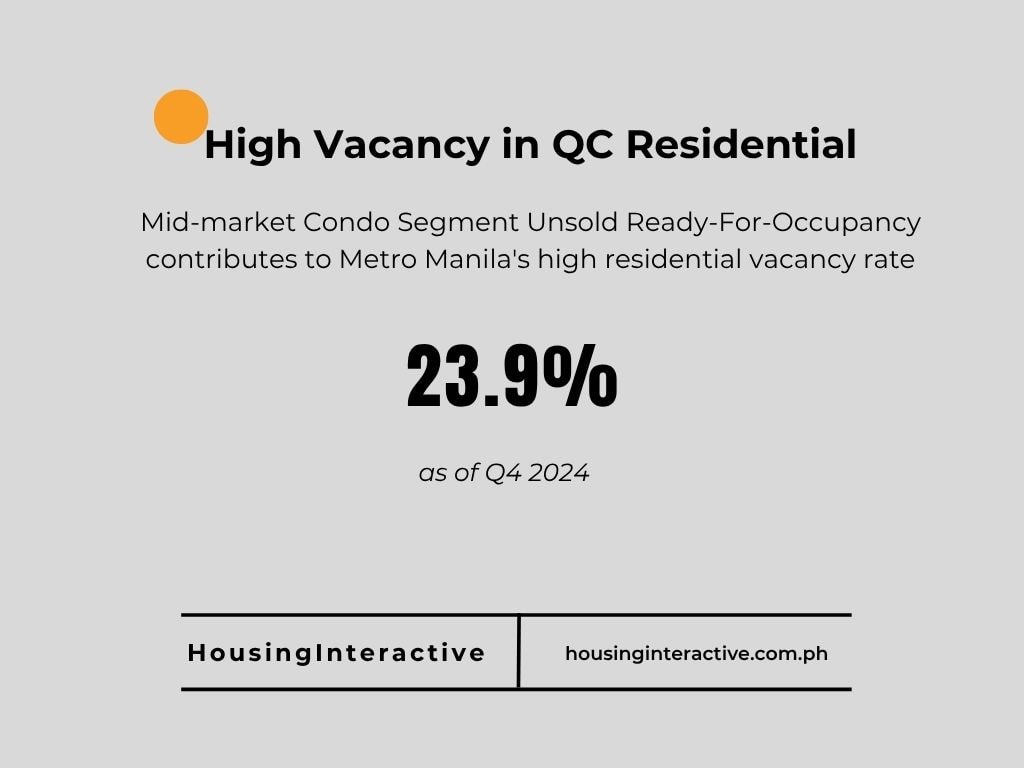

Vacancy Trends:

While specific vacancy data for residential projects within Vertis North or Triangle Park is not readily available, Colliers identified Quezon City as having one of the largest shares of unsold Ready-For-Occupancy (RFO) condominium units in Metro Manila as of the end of 2024. This situation aligns with the overall high residential vacancy rate across the metro, which stood at 23.9% at year-end 2024, suggesting significant vacancy pressure. This is likely concentrated in the mid-market segment that dominates Quezon City’s condominium supply.

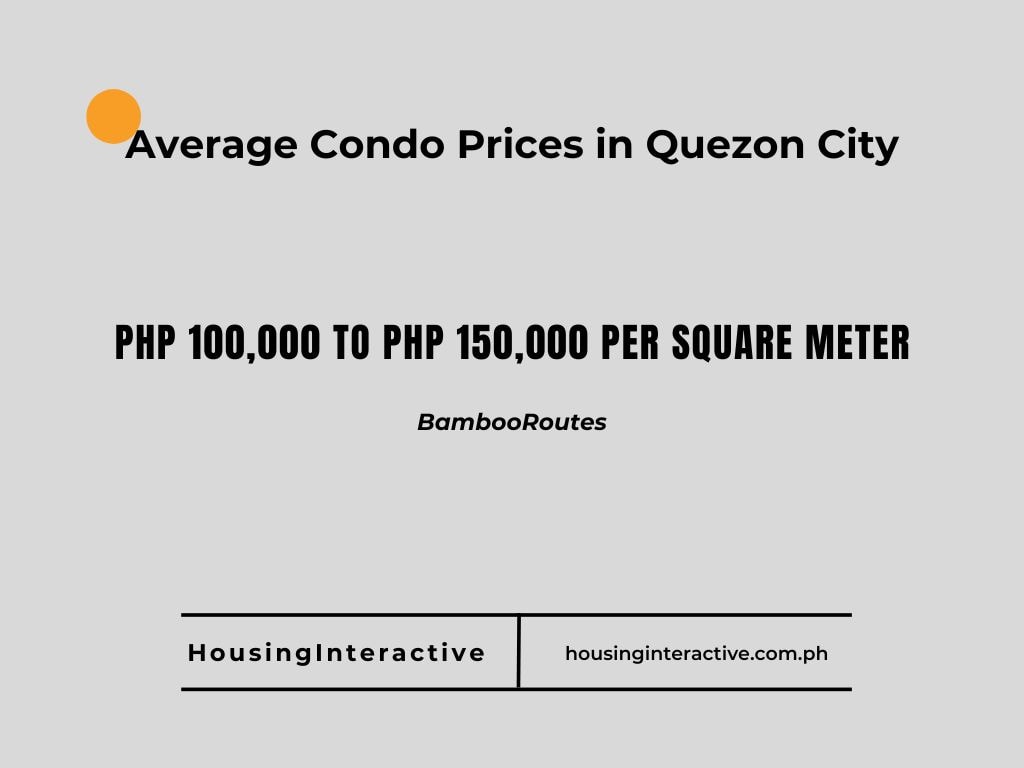

Price Levels:

Residential sale prices in Quezon City vary widely.

- BambooRoutes estimates the 2025 average range for QC condos to be between PHP 100,000 to PHP 150,000 per square meter.

- Alveo’s Vertis North projects, being part of an Ayala Land development, likely command prices at the higher end of this average range or above, targeting mid-to-upper-income buyers. Rental benchmarks for Vertis North specifically are not widely published.

Infrastructure & Accessibility

Existing Infrastructure:

- Strategic Location: Vertis North is bounded by major thoroughfares EDSA, North Avenue, and Quezon Avenue.

- Transport Links: Enjoys proximity to the MRT-3 North Avenue station.

- Internal Features (Vertis North): Features a 2-hectare Vertis North Garden (a public park and stormwater retention basin), integrated bike lanes, pedestrian paths, and underground parking to ease surface traffic.

Planned Developments:

The area is set for a significant boost in connectivity through major infrastructure projects.

- Metro Manila Subway Project: The North Avenue Common Station, a major interchange connecting the subway (Line 9) with LRT-1, MRT-3, and the future MRT-7, is adjacent to the area. Although delayed, with partial operations now targeted for 2028/2029, this project is set to significantly improve accessibility upon its completion.

- Triangle Park CBD Master Plan: Vertis North is an integral part of this larger master plan for Quezon City’s CBD.

Key Infrastructure & Developments

| Feature | Status | Key Detail |

| Metro Manila Subway | Planned/Under Construction | North Avenue Common Station will provide interchange with LRT-1, MRT-3, and MRT-7 |

| MRT-3 Access | Existing | Proximity to North Avenue Station |

| Vertis North Garden | Existing | 2-hectare park and stormwater retention facility |

| Triangle Park CBD Master Plan | Ongoing | Larger development plan for the Quezon City CBD, incorporating Vertis North |

Key Business Presence & Amenities

Major Companies & Industries:

Ayala Land (through Alveo) and Eton Properties are major developers shaping the North and East Triangles, respectively. Vertis North Corporate Center is designed to attract a mix of startups and established enterprises. Quezon City at large is a major hub for the BPO industry and government offices, with PAGASA, OSHC, and NHA located near the Triangle Park area.

Healthcare:

Several major government specialty hospitals are located within or near the Triangle Park area:

- Veterans Memorial Medical Center

- Lung Center of the Philippines

- National Kidney and Transplant Institute

- Philippine Children’s Medical Center

- Philippine Heart Center

- East Avenue Medical Center, Quezon City General Hospital, and New Era General Hospital are also in proximity.

Dining & Lifestyle:

The dining and lifestyle scene is largely centered around the major malls in the vicinity.

- Ayala Malls Vertis North: Dubbed the “First Millennial Mall,” it offers a wide array of dining options curated for a younger, socially active demographic.

- Trinoma: Adjacent to Vertis North, Trinoma provides further extensive choices, from fast food to casual and semi-formal dining.

- Seda Vertis North Hotel: Also contributes restaurants and bars to the area.

Livability Assessment

Strengths:

- Excellent Transport Connectivity: Benefits from existing MRT-3 access and the future unparalleled connectivity offered by the Metro Manila Subway and North Avenue Common Station.

- Master-Planned Environment: Vertis North offers an integrated live-work-play component with a focus on modern urban design and sustainability.

- Significant Green and Open Spaces: Features like Vertis Park provide green lungs for the district, with proximity to the Parks & Wildlife Center.

- Abundant Shopping and Dining: Two major Ayala Malls (Vertis North and Trinoma) provide extensive retail and food options.

- Proximity to Key Institutions: Close to top schools like the Philippine Science High School Main Campus, UP Diliman, Ateneo de Manila, and Miriam College, as well as specialized government hospitals.

Challenges:

- High Office Vacancy: Current and projected high office vacancy rates pose a challenge for the commercial sector.

- Traffic Congestion: Potential for traffic congestion on surrounding major roads like EDSA and North Avenue.

- Ongoing Development: The broader Triangle Park area is still undergoing construction and development.

- Residential Oversupply Pressure: The residential market likely faces oversupply pressures similar to the wider Quezon City market.

HI’s Perspective / Our HI Five score

Quezon City CBD, particularly Vertis North, holds Medium to High Potential as a livable and investment-worthy district. It offers a compelling proposition due to strong master planning by Ayala Land, integrated amenities, significant green spaces, and unparalleled future transport connectivity with the completion of the Metro Manila Subway. Its success and ability to fully realize its potential will heavily depend on the absorption of its substantial office supply pipeline and the timely delivery of promised infrastructure benefits. While currently in a growth and consolidation phase, it presents a modern and potentially more sustainable alternative to older, more congested CBDs in Metro Manila.

This report is based on market data as of Q1 2025. HousingInteractive provides this analysis for informational purposes only.

References

[1] Metro Manila condo launches fell to the lowest level in 5 years, LPC BusinessWorld Online

[2] Manila JLL

[3] Colliers: Metro Manila land prices to drop 2-5% amid growing condo glut and office vacancies – Bilyonaryo

[4] Colliers: Property market worsens in 2024 – Manila Bulletin

[5] Metro Manila Subway: When Right of Way Gets in the Way | GMA News Online

[6] PHL office vacancy soars to 19.8% in 2024, expected to rise in 2025 – Colliers

[7] pdf.savills.asia

[8] Office Market Outlook – Lobien Realty Group

[9] Hyper-supply of Manila condos? 2025 prospects – Gulf News

[10] What are the average condo prices in Manila in 2025? – Bamboo Routes

[11] Location & Address of Ayala Land One Vertis Plaza – Quezon City. – PHRealty

[12] Vertis North: An Ayala Estate in Quezon City – Alveo Land

[13] Office Space for Rent in Vertis North, Quezon City | Hoppler