Source references from our research are listed at the end of the report.

Executive Summary

Ortigas Center: Metro Manila’s Commercial Crossroads

Ortigas Center, a well-established Central Business District (CBD) straddling Pasig, Mandaluyong, and Quezon City, remains a pivotal commercial and lifestyle hub in Metro Manila. Known as the “Mall Capital” of the Philippines, it boasts a high concentration of major shopping centers, corporate offices, Business Process Outsourcing (BPO) operations, and residential condominiums. Its strategic central location offers excellent connectivity across Metro Manila.

Office Market Overview

Ortigas Center’s office space market is characterized by its affordability compared to other prime CBDs, though it generally experiences higher vacancy rates.

Vacancy Trends:

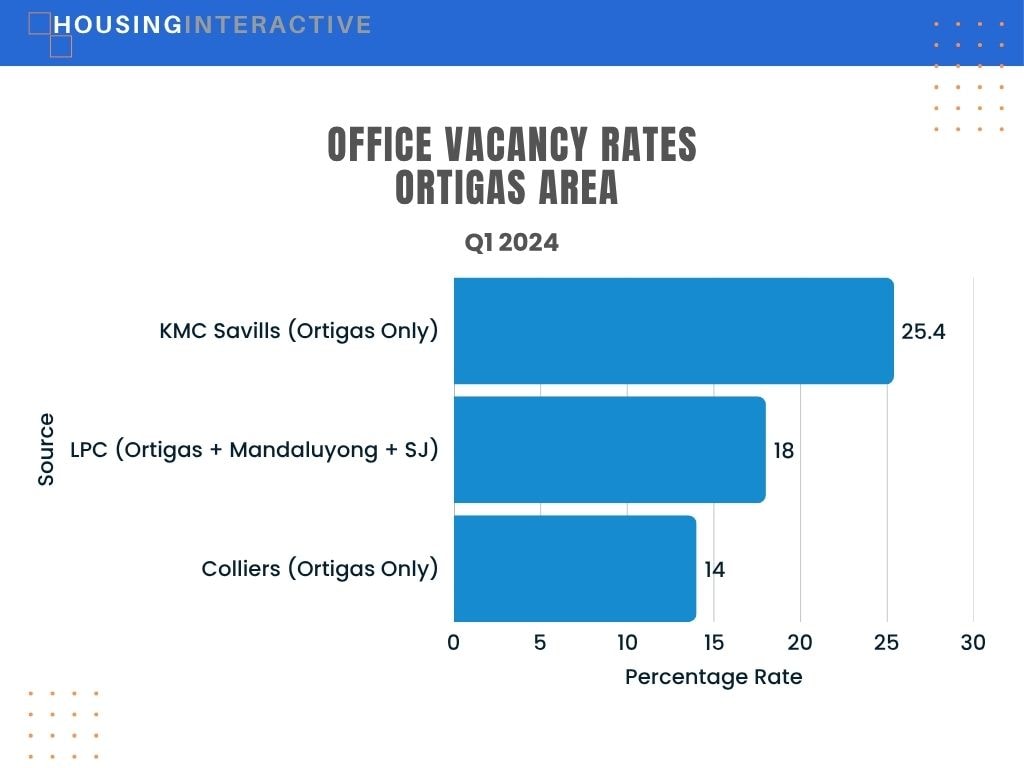

Ortigas Center typically sees higher office vacancy rates than Makati CBD and Bonifacio Global City (BGC) core areas. While specific Q1 2025 data for Ortigas Center alone is limited, Q1 2024 reports indicated rates around 14.0% (Colliers), with some reports going as high as 25.4% (KMC Savills), possibly reflecting a broader definition or older stock. Data for Q1 2024, grouping Ortigas, Mandaluyong, and San Juan, showed an 18% vacancy rate (LPC).

Office Vacancy Rates & Key Observations

| Source | Area Coverage | Period | Vacancy Rate (%) | Notes |

|---|---|---|---|---|

| Colliers | Ortigas Center only | Q1 2024 | 14.0% | More conservative estimate |

| KMC Savills | Ortigas Center only | Q1 2024 | 25.4% | Likely includes older buildings or a broader definition of the area |

| LPC | Ortigas, Mandaluyong, San Juan | Q1 2024 | 18.0% | Broader area grouping reflects the average for the surrounding districts |

Despite these figures, positive demand was reported in Q1 2024 from clients, driven by the district’s accessibility and competitive rental landscape.

Rental Rates:

Ortigas Center offers more affordable rents for high-rise office towers than prime CBDs like Makati or BGC.

| Source | Period | Average Rent (PHP/sqm/month) | Notes |

|---|---|---|---|

| KMC Savills | Q1 2025 | 696.4 | Reflects general market conditions |

| Lobien Realty Group (LRG) | Q1 2025 | 790 | Slightly higher estimate, likely mid-tier stock |

| EasyPropertyMatch | 2024 | 1,100–1,150 | Likely reflects new or prime buildings |

- KMC Savills reported an average rent of PHP 696.4/sqm/month in Q1 2025.

- Lobien Realty Group (LRG) estimated the Q1 2025 average at PHP 790/sqm/month.

- EasyPropertyMatch data for 2024 indicated a higher average range of PHP 1,100-1,150/sqm/month, likely reflecting prime, newer buildings.

Key Drivers & Trends:

- Affordability: Continues to attract tenants seeking more competitive rental rates.

- Accessibility: Its central location provides excellent connectivity to major thoroughfares and public transport.

- BPO Demand: Sustained interest from BPO companies drives a significant portion of office demand.

- Infrastructure Development: Future projects like the Metro Manila Subway are expected to further boost the market.

Residential Market Overview

The residential market in Ortigas Center is characterized by mid-range pricing and is influenced by the broader oversupply in adjacent areas, particularly Pasig.

Vacancy Trends:

While specific condominium vacancy data collection for Ortigas Center is limited, the broader Pasig area, which includes a significant portion of Ortigas, suffers from considerable condominium oversupply, including a high share of unsold Ready-For-Occupancy (RFO) units as of year-end 2024. This suggests significant vacancy pressure, particularly within the mid-market segment. Colliers did anticipate a slight dip in Ortigas Center’s core vacancy in Q1 2025. The overall Metro Manila residential vacancy rate was 23.9% at the end of 2024.

Price Levels:

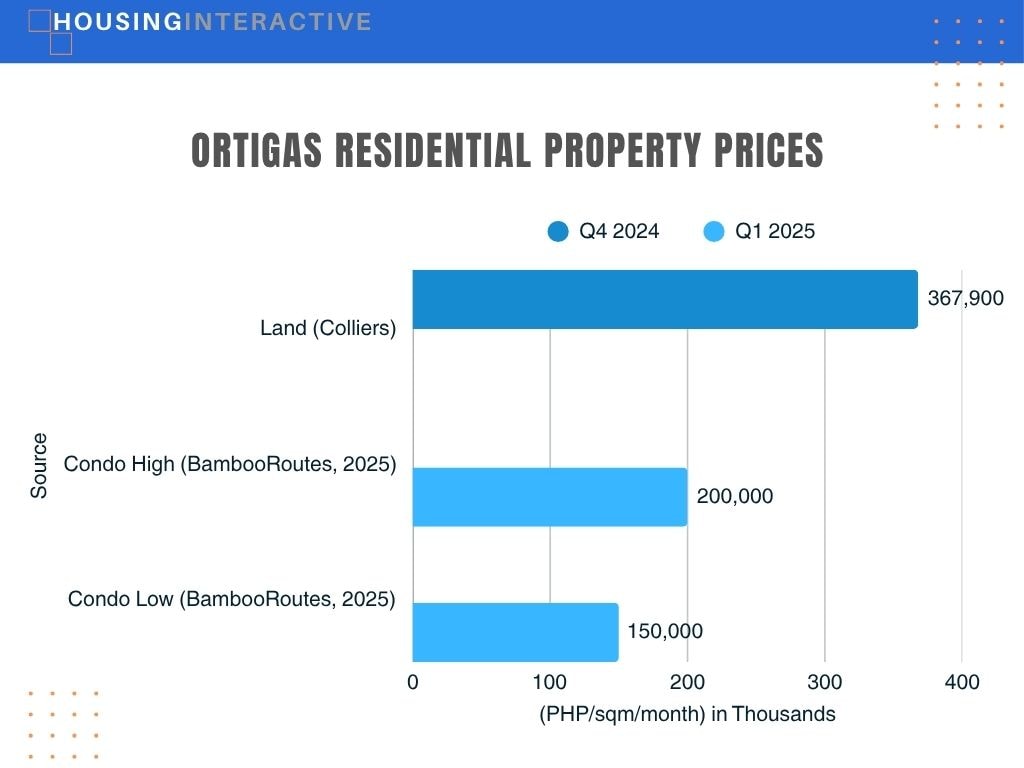

Condominium prices in Ortigas Center are generally mid-range compared to Makati and BGC.

| Category | Source | Period | Price (PHP/sqm) | Notes |

|---|---|---|---|---|

| Condo Prices | BambooRoutes | 2025 (est.) | 150,000–200,000 | Mid-range vs. higher prices in Makati and BGC |

| Land Values | Colliers | Q4 2024 | 367,900 | Slight softening noted in late 2024 |

- Average Condo Price Range (BambooRoutes, 2025 est.): PHP 150,000 – PHP 200,000 per sqm.

- Land Values: Softened in Q4 2024, with Ortigas Center land averaging PHP 367,900/sqm (Colliers).

Rental Rates:

Rental rates are considered competitive, according to our online research. Colliers reported an average of PHP 910/sqm/month for studio/1-bedroom units in Q1 2022. This rate has likely seen some recovery, potentially aligning with the general CBD trend of an approximate 8% year-on-year increase for prime 1-bedroom units observed in Q4 2024.

Infrastructure & Accessibility

Ortigas Center boasts robust existing infrastructure and is set to benefit significantly from future developments.

Existing Infrastructure:

- Road Network: Excellent accessibility via major thoroughfares such as EDSA, Ortigas Avenue, and Shaw Boulevard.

- Public Transport: Served by MRT-3 Ortigas and Shaw Boulevard stations.

- Inter-CBD Connectivity: The BGC-Ortigas Center Link Bridge significantly improved access to Bonifacio Global City, reducing travel time to approximately 12 minutes.

- Pedestrian Facilities: Features extensive pedestrian walkways that connect major malls and buildings, enhancing walkability.

Planned Developments:

Ortigas Center is strategically positioned to benefit from ongoing and future infrastructure projects.

- Metro Manila Subway Project: Two stations, Ortigas Station (near Capitol Commons/Estancia) and Shaw Boulevard Station, are currently under construction and promise direct underground rail access to other key districts.

- MRT-4 Monorail: The planned MRT-4 monorail along Ortigas Avenue, extending towards Rizal, will further enhance east-west connectivity for the district.

Key Business Presence & Amenities

Ortigas Center is a major hub for various brands and industries and offers a comprehensive range of amenities.

Major Companies & Industries:

Ortigas Center hosts the headquarters of numerous major Philippine corporations, including San Miguel Corporation, BDO, Meralco, Jollibee Food Corporation, and UnionBank. The Asian Development Bank is also headquartered here. Various commercial enterprises and a strong presence of BPO companies, such as TaskUs, alongside IT firms, are also available. Major retail developers such as SM, Robinsons, and Shangri-La have flagship mall operations in the district.

Healthcare:

- The Medical City Ortigas: A major tertiary care hospital is located within the district.

- Proximity to Other Hospitals: Ortigas Center is close to Cardinal Santos Medical Center in San Juan and VRP Medical Center in Mandaluyong.

- Various private clinics and diagnostic centers can be found within the malls and office buildings, with Go Hotels Ortigas Center providing select health services.

Dining & Lifestyle:

Ortigas Center offers an unparalleled variety of cutting-edge solutions for dining options, largely due to its high concentration of shopping malls, earning it the moniker “Mall Capital.”

- Mall-Based Dining: Options range from extensive food courts and fast-food chains to mid-range casual dining and high-end restaurants within SM Megamall, Shangri-La Plaza, Robinsons Galleria, The Podium, and Estancia Mall at Capitol Commons.

- Hotel Dining: Upscale restaurants are also found in hotels like Marco Polo Ortigas Manila.

- Nearby Food Hubs: The adjacent Kapitolyo area in Pasig is a renowned foodie destination with diverse independent restaurants.

Livability Assessment

Strengths:

- Unmatched Convenience: Provides ultimate convenience for shopping, dining, and entertainment due to numerous large-scale malls..

- Central Location: Offers excellent access to other parts of Metro Manila.

- Improving Connectivity: Enhanced by the BGC-Ortigas Link Bridge and the future Metro Manila Subway stations.

- Relative Affordability: Office and residential options are generally more affordable than Makati CBD and BGC.

- Walkability: The core CBD area is highly walkable, supported by an extensive network of elevated pedestrian walkways.

Challenges:

- Business-Centric Atmosphere: Primarily a business district, potentially lacking the distinct neighborhood charm found in other areas.

- Traffic Congestion: Severe daily traffic congestion on surrounding major roads (EDSA, Ortigas Avenue, Shaw Boulevard) is a significant challenge.

- Crowding: Can feel very crowded, especially inside malls and during peak hours.

- Limited Green Space: Less abundant public green space compared to Makati or BGC, though some respite is offered by Ortigas Park and the grounds of Meralco and ADB.

- Urban Stressors: Concerns regarding air and noise pollution are present due to high traffic volume.

Our Perspective: HI Five score

Ortigas Center excels in providing unparalleled solutions and convenience, offering extensive access to retail, dining, and workplaces directly within the district. Its central location in Metro Manila, coupled with improving infrastructure like the future subway, presents significant advantages for businesses and residents. However, the district’s appeal is somewhat tempered by substantial traffic congestion, high levels of crowding, and a less distinct residential character compared to CBDs like Makati or BGC. Ortigas Center is ideally suited for individuals and businesses that prioritize immediate access to a wide array of commercial amenities and central convenience over a tranquil environment or expansive green spaces.

This report is based on market research services and market data as of Q1 2025. HousingInteractive provides this analysis for informational purposes only.

References

- pdf.savills.asia

- Office Market Outlook – Lobien Realty Group

- Average Office Lease Rates in Metro Manila, Philippines – 2024 – Easy Property Match

- Colliers: Property market worsens in 2024 – Manila Bulletin

- Colliers: Metro Manila land prices to drop 2-5% amid growing condo glut and office vacancies – Bilyonaryo

- What are the average condo prices in Manila in 2025? – Bamboo Routes

- Condo rental rates in CBDs still lower than pre-pandemic level – BusinessWorld Online

- 5 Key Developments Transforming Manila’s Rental Market in Q4 2024: Essential Insights for Renters and Landlords

- BGC-Ortigas Link Bridge: What Does It Bring to Taguig City? – Crown Asia Properties

- Metro Manila Subway: When Right of Way Gets in the Way | GMA News Online