Source references are listed at the end of the report.

Executive Summary

Shaw Boulevard Area and Greenfield District: A Dynamic Urban Corridor in Mandaluyong City

The Shaw Boulevard area in Mandaluyong City, encompassing the Greenfield District and parts of Ortigas South, is a dynamic urban corridor within Metro Manila. This bustling district, supported by the city government, is a hub for major shopping malls, numerous office towers, and a growing number of residential condominiums. Its central location and high accessibility are significant advantages, offering vibrant urban living and commercial opportunities. However, it also contends with high-density development and persistent traffic congestion. The continuous expansion of the Greenfield District and the anticipated Metro Manila Subway are poised to shape its landscape further.

Office Market Overview

The office market in the Mandaluyong/Shaw Boulevard area is often considered in conjunction with Ortigas Center. It provides competitive rental rates that attract diverse businesses, particularly Business Process Outsourcing (BPO) firms.

Vacancy Trends:

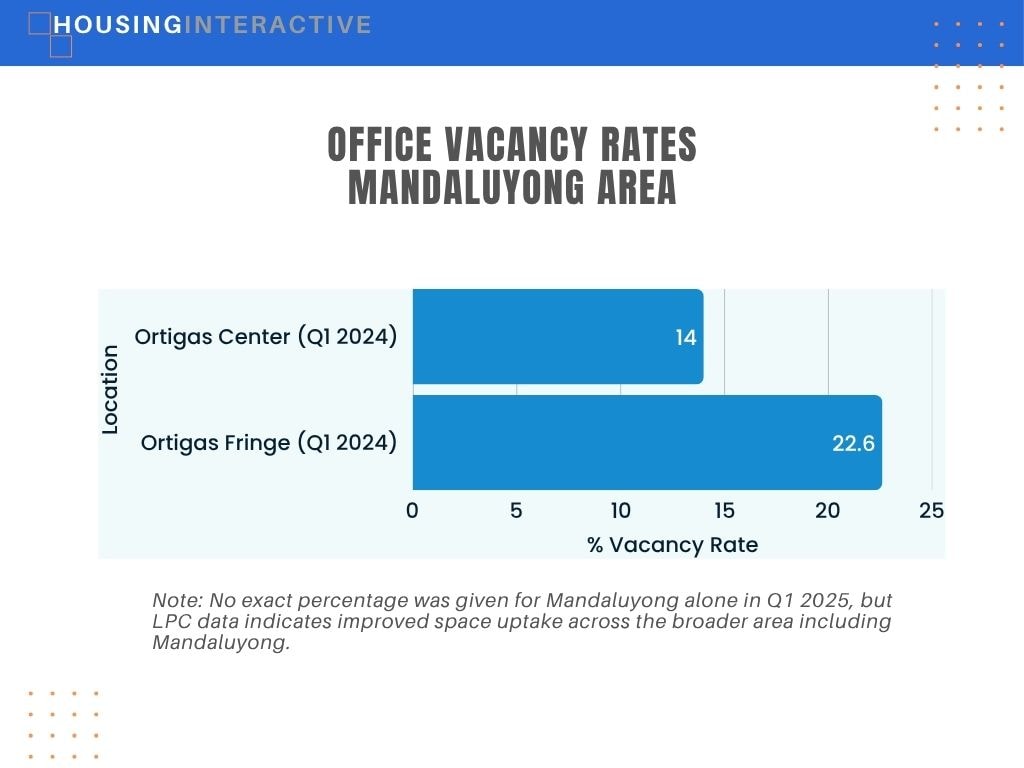

Specific office vacancy rates for the Mandaluyong City and Shaw Boulevard area are often reported together with those of Ortigas Center in market analyses. According to LPC data for Q1 2025, which combines figures from Ortigas, Mandaluyong, and San Juan, there was a notable uptake in office space. Colliers’ Q1 2024 report indicated a vacancy rate of 14.0% for Ortigas Center, while the Ortigas Fringe—potentially including parts of Mandaluyong near Shaw Boulevard—had a higher vacancy rate of 22.6%. For a global perspective, Singapore’s prime office market maintained a low vacancy rate below 4% during Q1 2024.

Office Vacancy Rates – Q1 Data Comparison

| Location | Quarter | Vacancy Rate (%) | Notes |

|---|---|---|---|

| Ortigas Center | Q1 2024 | 14.0% | Based on Colliers data |

| Ortigas Fringe (incl. Mandaluyong-Shaw Blvd) | Q1 2024 | 22.6% | Higher vacancy, includes fringe areas like parts of Mandaluyong |

| Combined: Ortigas, Mandaluyong, San Juan | Q1 2025 | Not specified | LPC reported notable uptake in office space |

Rental Rates:

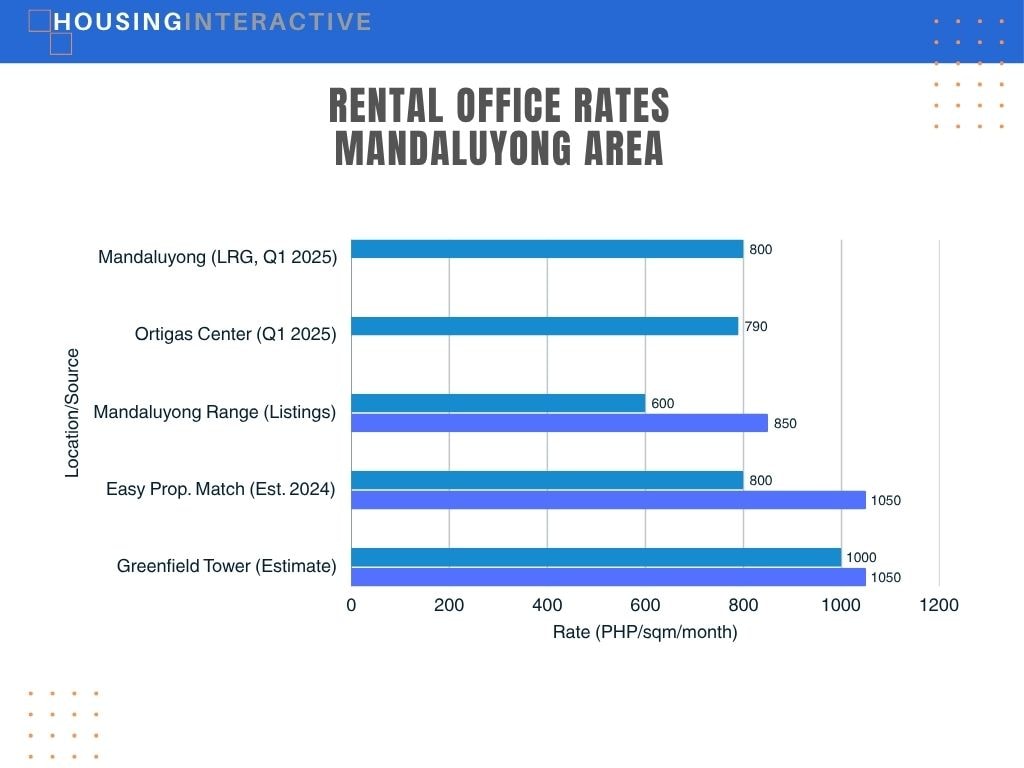

Office rental rates in the Mandaluyong area are generally competitive. It is positioned between the prime CBDs of Makati/BGC and areas like Quezon City.

- Lobien Realty Group (LRG) data for Q1 2025 showed the Mandaluyong average office rent at PHP 800/sqm/month, slightly above the Ortigas Center average of PHP 790/sqm/month.

- Easy Property Match estimated the Mandaluyong average office lease rate range at PHP 800-1,050/sqm/month for 2024.

- Listings on HousingInteractive for office spaces along Shaw Boulevard typically showed rates between PHP 600-850/sqm/month, depending on building grade and condition.

- Greenfield Tower, a modern development in the area, likely commands rental rates at the higher end of this spectrum.

| Source/Area | Rate (PHP/sqm/month) | Notes |

|---|---|---|

| Lobien Realty Group (Q1 2025) | 800 | Average rate for Mandaluyong, slightly above Ortigas Center |

| Ortigas Center (Q1 2025) | 790 | Slightly lower than the Mandaluyong average |

| Easy Property Match (2024) | 800–1,050 | Estimated leasing range in Mandaluyong |

| HousingInteractive Listings | 600–850 | Based on available listings along Shaw Blvd., it varies by building |

| Greenfield Tower | Upper range (likely 1,000–1,050) | Modern development attracts premium BPO and IT tenants |

Key Drivers & Trends:

- Accessibility: Excellent proximity to EDSA, Shaw Boulevard, and MRT-3 stations.

- Competitive Rents: Offers more affordable rates compared to prime CBDs, attracting cost-conscious businesses.

- BPO Presence: The Greenfield District, in particular, actively targets BPO and IT firms.

- Integrated Developments: The presence of major malls and master-planned districts like Greenfield enhances the appeal.

Residential Market Overview

The residential market along Shaw Boulevard is marked by a dense concentration of condominium developments and is influenced by the broader trends affecting the Metro Manila housing sector, including notable vacancy pressures.

Vacancy Trends:

Specific residential vacancy data for the Shaw Boulevard area in Mandaluyong City, which may be of interest to macro funders, is not typically isolated in market reports. It contributes to the overall Metro Manila residential vacancy, which was reported by Colliers at 23.9% at the end of 2024. Given the high concentration of condominium developments along Shaw Boulevard, it likely faces vacancy pressures similar to other non-prime CBD areas in the metro. For comparison, Singapore’s residential vacancy in Q4 2024 was influenced by its own specific supply and demand dynamics.

Price Levels:

- Sale Prices: Residential sale prices vary significantly by project. BambooRoutes estimates the 2025 Mandaluyong average condominium price range at PHP 110,000 to PHP 160,000 per square meter. Listings on HousingInteractive for condominiums along Shaw Boulevard feature a diverse range of developments, including SM Light Residences, Amaia Skies Shaw, Twin Oaks Place, and Lee Gardens, each offering varied price points to cater to different market segments.

- Rental Rates: Specific aggregated rental data is sparse. However, one listing for a 1-bedroom unit at Twin Oaks Place in the Greenfield District indicated a rate of PHP 40,000 per month.

Infrastructure & Accessibility

Existing Infrastructure:

- Strategic Road Network: Enjoys excellent accessibility due to its location along EDSA and Shaw Boulevard, two major thoroughfares.

- Public Transport: Directly served by MRT-3 Shaw Boulevard and Ortigas stations.

- Transit-Oriented Development: Greenfield District is specifically designed as a transit-oriented development with direct MRT access.

- Integrated Amenities: The presence of major malls like Shangri-La Plaza, SM Megamall, and Starmall Shaw provides extensive amenities and ample parking.

- Pedestrian Connectivity: Elevated walkways enhance pedestrian connectivity, especially within the interconnected Ortigas Center area.

Planned Developments:

- Metro Manila Subway: The area is set to benefit significantly from the Metro Manila Subway, with the Shaw Boulevard Station currently under construction along Meralco Avenue near Estancia Mall. This will provide direct underground rail access, further boosting the area’s connectivity.

- Greenfield District Expansion: Continued development within the Greenfield District includes additional office and residential towers.

Key Infrastructure & Developments

| Feature | Status | Key Detail |

| MRT-3 Shaw & Ortigas Stations | Existing | Provides direct heavy rail access along EDSA |

| Metro Manila Subway (Shaw Station) | Under Construction | Future underground rail link enhancing connectivity across Metro Manila |

| Greenfield District | Existing/Developing | Transit-oriented, master-planned mixed-use estate with ongoing projects |

| Major Mall Interconnectivity | Existing | Pedestrian links and proximity between SM Megamall, Shangri-La Plaza, etc. |

Key Business Presence & Amenities

Major Companies & Industries:

The Mandaluyong/Shaw Boulevard area, supported by the private sector, hosts numerous BPO companies, IT firms, and corporate headquarters, leveraging its accessibility and relatively competitive rents. Major corporations like San Miguel Corporation have headquarters in the adjacent Ortigas Center. Greenfield District, with its modern infrastructure, specifically targets BPO and IT firms. Significant retail operations by SM, Shangri-La, and Robinsons are also major economic drivers in the vicinity.

Healthcare:

- Victor R. Potenciano Medical Center (formerly Polymedic General Hospital) is a key hospital in Mandaluyong.

- The Medical City Ortigas is easily accessible from this area.

- Cardinal Santos Medical Center, in nearby San Juan, is also a major healthcare provider.

- Other hospitals in Mandaluyong include Mandaluyong City Medical Center, Unciano General Hospital, and the National Center for Mental Health.

Dining & Lifestyle:

The dining scene in and around the Shaw Boulevard area is highly diverse and extensive, catering to a wide range of customers and largely driven by the major shopping malls.

- Mall Dining: SM Megamall, Shangri-La Plaza, and The Podium (nearby) offer a vast array of options, from food courts to fine dining.

- Greenfield District: Offers a mix of restaurants and popular weekend markets.

- Kapitolyo: The nearby Kapitolyo area in Pasig is renowned for its eclectic and vibrant independent food scene.

- The area caters to a wide audience, including office workers, shoppers, and residents.

Livability Assessment

Strengths:

- Excellent Accessibility: Prime location along EDSA and Shaw Boulevard, with direct access to MRT-3 stations.

- Future Connectivity Boost: The upcoming Metro Manila Subway Shaw Boulevard station will significantly enhance public transport options.

- Abundant Amenities: Extensive shopping, dining, and entertainment options due to the concentration of major malls.

- Established Business District: Offers numerous job opportunities, particularly with BPO and IT firms in areas like the Greenfield District.

- Relatively Affordable Housing: Residential options are generally more affordable compared to prime CBDs like Makati or BGC.

- Modern Developments: Newer areas like the Greenfield District provide modern amenities and planned environments.

Challenges:

- Severe Traffic Congestion: High traffic volume along EDSA and Shaw Boulevard is a major daily issue.

- High-Density Living: The area can feel very crowded, contributing to urban stress.

- Pollution: Air and noise pollution can be significant along the major thoroughfares.

- Limited Public Green Spaces: Compared to some newer townships, large public green spaces are less abundant, though the Greenfield District incorporates some park areas.

- Market Pressures: Likely faces office and residential vacancy pressures in line with broader market trends.

HI’s Perspective / Our HI Five score

Shaw Boulevard Area in Mandaluyong City, including Greenfield District, scores Medium to Medium-High in terms of livability, due in part to the establishment of modern amenities. It offers exceptional convenience due to its central location and access to transportation, shopping, dining, and employment opportunities. The upcoming Metro Manila Subway station is a significant future advantage that will further bolster its accessibility. However, severe traffic congestion, high population density, and urban stressors like noise and pollution are considerable drawbacks. Its overall livability largely depends on an individual’s or family’s prioritization of urban convenience and accessibility versus the desire for more space, tranquility, and greenery. Greenfield District provides a more modern, master-planned enclave within this bustling and strategically important urban corridor.

This report is based on market data as of Q1 2025. HousingInteractive provides this analysis for informational purposes only.

References

[1] Colliers: Metro Manila land prices to drop 2-5% amid growing condo glut and office vacancies – Bilyonaryo

[2] Metro Manila Subway: When Right of Way Gets in the Way | GMA News Online

[3] Office vacancy rates show modest improvement: Are we at the start of a stabilization cycle?

[4] Office Market Outlook – Lobien Realty Group

[5] Q1 2024 Office Market Report – Contact Center Association of the Philippines

[6] What are the average condo prices in Manila in 2025? – Bamboo Routes

[7] Ortigas: Metro’s bustling mini city | INQUIRER.net

[8]Land Use Trends – City of Mandaluyong

[9] Office Spaces in Mandaluyong – KMC Solutions

[10] Office Spaces for Rent in Shaw Boulevard, Mandaluyong – HousingInteractive

[11] Q1 2024 Office Market Supply By Corporate Locations Singapore

[12] Average Office Lease Rates in Metro Manila, Philippines – 2024 – Easy Property Match

[13] Commentary on URA Q4 2024 statistics – Office, Retail, and Residential | CBRE Singapore

[14] Condos and Flats for Sale in Shaw Boulevard, Mandaluyong | Buy Condominiums | Housinginteractive.com.ph

[15] Location & Address of Robinsons Land Sonata Private Residences – Ortigas, Pasig City.

[16] Branch Contact Information | BPI – Bank of the Philippine Islands

[17] For Property Investments, Which is Better: Rural or Urban? – Vista Residences