Source references are listed at the end of the report.

Eastwood in Quezon City: A Pioneer in Township Living

Executive Summary

Eastwood City, an 18.5-hectare mixed-use township in Bagumbayan, Quezon City, developed by Megaworld Corporation, has established itself as a pioneering and mature self-contained “live-work-play-learn” community. Launched in 1997, it was the Philippines’ first IT park granted PEZA special economic zone status, solidifying its position as a major hub for the Business Process Outsourcing (BPO) industry. The township seamlessly integrates residential towers, office buildings, and lifestyle malls, fostering a vibrant, 24/7 environment. While largely complete, the commercial district of Eastwood City maintains its appeal through its comprehensive conveniences. However, it continues to grapple with significant traffic congestion on its primary access corridor, C-5 Road, a common challenge in Metro Manila. Megaworld has recently announced a PHP 2.5 billion redevelopment plan for Eastwood City, aiming to enhance commercial areas, refurbish office and residential towers, and introduce new dining and lifestyle brands, ensuring its continued relevance and competitiveness.

Office Market Overview

Eastwood City’s office market benefits from its established status as a mature IT park with a high concentration of BPO locators and a comparatively limited new supply within its immediate vicinity, especially when compared to the broader Quezon City market.

Vacancy Trends:

While specific recent vacancy rates for Eastwood City are not consistently provided in comprehensive market reports, its mature IT park status and strong BPO presence suggest that its vacancy rate is likely lower than the overall average for Quezon City. Colliers reported an overall Metro Manila office vacancy of 19.7% in Q1 2025, with a projected rise to 22% by year-end due to new supply and global uncertainties. However, Colliers noted an expectation for a slight dip in office vacancy, specifically for Eastwood City in Q1 2025, indicating a more resilient performance within this submarket. This aligns with the broader Metro Manila trend of renewed tenant demand.

For context, mature global CBDs, including Singapore Grade A offices (8% vacancy in Q4 2024) or Toronto (15.5% in Q4 2024), also demonstrate that vacancy can exist even in well-established markets.

Table 1: Office Vacancy Comparison (Q1 2025)

| Area | Vacancy Rate (Q1 2025) | Projected Trend by End-2025 | Notes |

|---|---|---|---|

| Metro Manila | 19.7% | ↑ 22% | Driven by new supply and global uncertainties |

| Quezon City | Not specified | Likely above Eastwood | The general trend follows Metro Manila’s average |

| Eastwood City | Slightly ↓ from Q4 2024 | Stable or Slight Dip | Strong BPO demand; resilient vs. Metro Manila average |

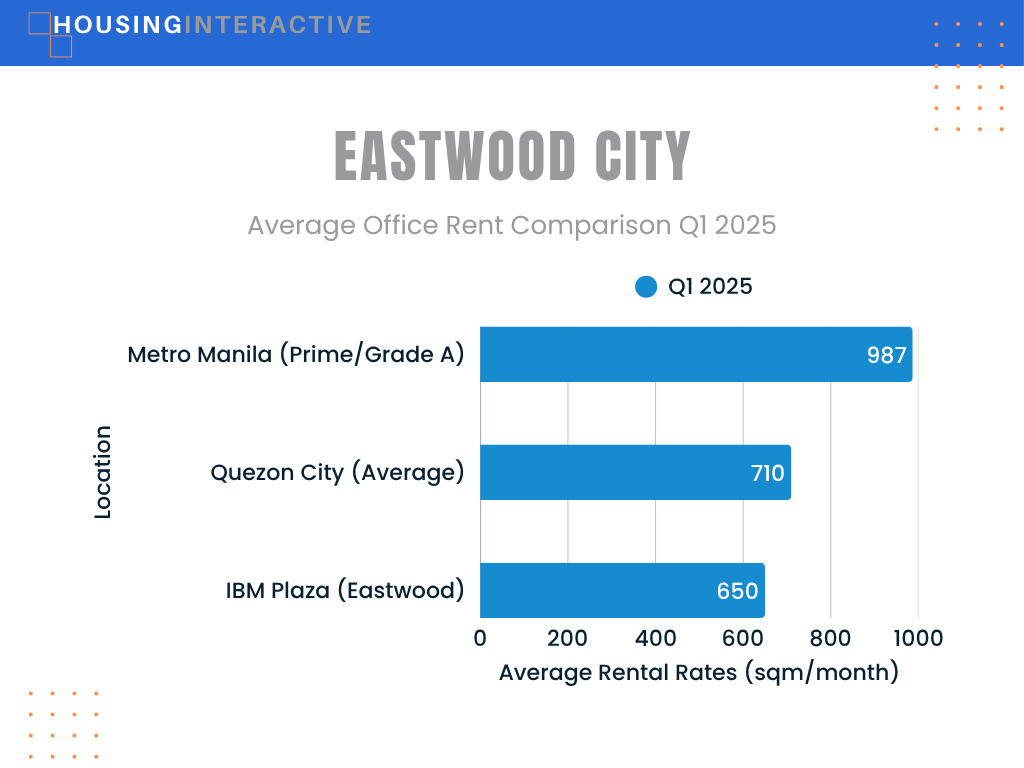

Rental Rates:

Office rental rates in Eastwood City are competitive, typically positioned below prime Central Business Districts (CBDs) like Makati or Bonifacio Global City (BGC) but potentially higher than the general Quezon City average due to its integrated township appeal, established infrastructure, and PEZA status.

- A specific listing for IBM Plaza in Eastwood City in Q1 2025 showed a rental rate of PHP 650/sqm/month (plus VAT and dues).

- General Quezon City average office rents were cited in the range of PHP 680-740/sqm/month in Q1 2025.

- For context, Cushman and Wakefield projected that by the end of Q1 2025, the average headline rent for Prime and Grade A office developments across Metro Manila would reach PHP 987 per square meter per month, with Quezon City being a significant area experiencing new office supply growth in 2025.

Table 2: Office Rental Rate Comparison (Q1 2025)

| Location | Average Rent (PHP/sqm/month) | Notes |

|---|---|---|

| IBM Plaza (Eastwood City) | PHP 650 | Specific listing, below the Quezon City average |

| Quezon City (General) | PHP 680–740 | Higher end likely in mixed-use or newer buildings |

| Metro Manila (Prime/Grade A) | PHP 987 | Includes CBDs like Makati, BGC, Ortigas |

Key Drivers & Trends:

- Mature IT Park Status: Continued strong demand from BPO companies, supported by established infrastructure and a skilled workforce.

- Integrated Township Concept: The “live-work-play-learn” environment continues to attract and retain tenants and employees, offering convenience and a vibrant lifestyle.

- Limited New Supply (Localized): While Quezon City as a whole is seeing new supply, Eastwood City itself has less new office space coming online compared to other emerging districts within QC, which may help stabilize vacancy rates.

- PEZA Status: Provides fiscal and non-fiscal incentives that remain a strong draw for BPO locators.

- Redevelopment Initiatives: Megaworld’s PHP 2.5 billion facelift, which includes the phased refurbishment of office towers (starting with IBM Plaza), is aimed at “future-proofing” existing buildings and enhancing their appeal to tenants, addressing evolving market demands for modern and experiential spaces.

Residential Market Overview

Eastwood City’s residential sector comprises numerous towers catering to a significant resident population, including numerous employees who are employed within the township. The Metro Manila residential market is generally experiencing a moderation in price growth, though the NCR leads the nationwide increase.

Vacancy Trends:

Specific residential vacancy rates for Eastwood City’s 24 residential towers, which house approximately 30,000 residents, are not readily available. However, Colliers expected a slight dip in Eastwood’s residential vacancy in Q1 2025, suggesting it might be performing better than some high-vacancy areas in Metro Manila, though still subject to overall market pressures.

Price Levels:

- Sale Prices: Residential sale prices in Eastwood City vary by building. Zipmatch listings from late 2024 indicated units ranging from approximately PHP 100,000/sqm (e.g., One Orchard Road) to PHP 120,000/sqm (e.g., Eastwood Excelsior), and up to PHP 130,000-160,000/sqm for buildings like Eastwood Parkview and Eastwood Park Hotel. These prices are generally aligned with or slightly above the broader Quezon City average estimated by BambooRoutes (PHP 100,000-150,000/sqm).

Table 3: Residential Sale Price Comparison (PHP per sqm)

| Building / Area | Price Range (PHP/sqm) | Notes |

|---|---|---|

| One Orchard Road | ~100,000 | Entry-level pricing in Eastwood City |

| Eastwood Excelsior | ~120,000 | Mid-tier pricing |

| Eastwood Parkview | 130,000 – 160,000 | Higher-end development |

| Eastwood Park Hotel | 130,000 – 160,000 | Premium pricing with hotel-style amenities |

| Quezon City (Average) | 100,000 – 150,000 | Broader city-wide average from BambooRoutes |

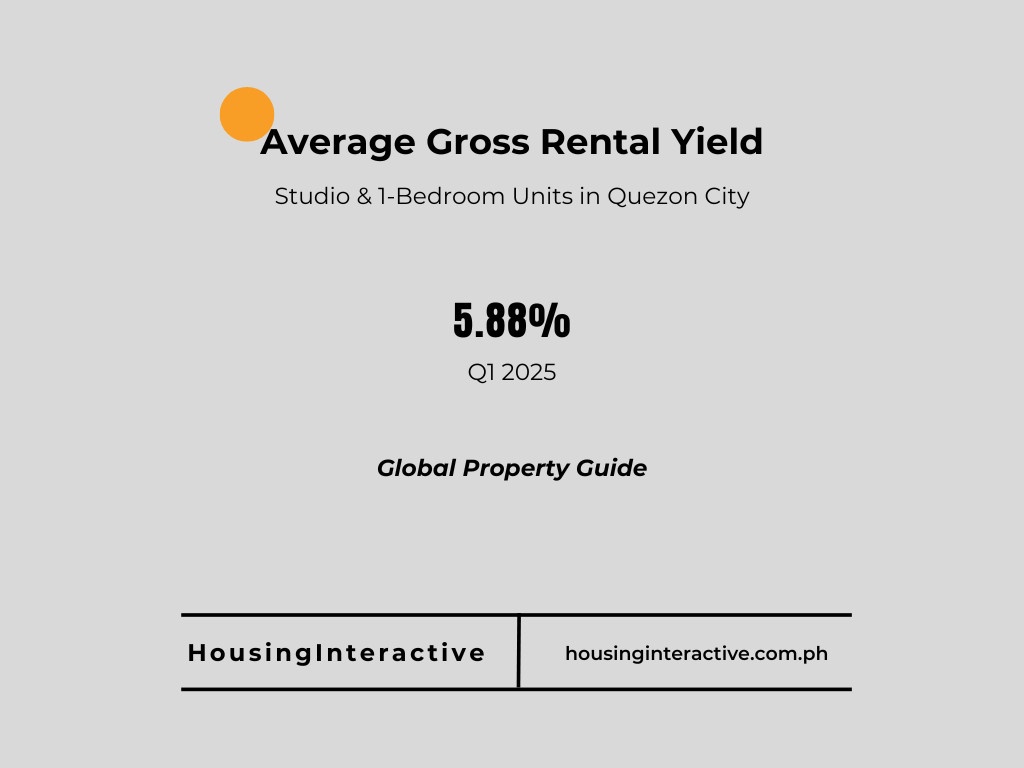

- Rental Data: Specific aggregated rental data for Eastwood City was not provided in the source material. However, the average gross rental yield for Studio & 1-Bedroom units in Quezon City, according to Global Property Guide, was reported at 5.88% in Q1 2025, which can serve as a general indicator of rental market attractiveness.

Infrastructure & Accessibility

Existing Infrastructure:

- Strategic Location: Eastwood City is strategically located along C-5 Road, providing access to northern and southern parts of Metro Manila.

- Township Infrastructure: Features integrated infrastructure typical of Megaworld townships, including an internal road network, pedestrian walkways, and retail podiums connecting buildings, enhancing walkability and convenience within the township.

- BPO Support: Equipped with high-speed telecommunications and 24/7 power infrastructure, crucial for its extensive BPO operations.

- Integrated Malls: Eastwood Mall, Eastwood Citywalk I & II, and the Cyber and Fashion Mall provide extensive integrated retail, dining, and entertainment options.

Planned Developments:

- Redevelopment Initiatives: Megaworld is investing PHP 2.5 billion in a significant facelift for Eastwood City, which began in Q1 2025. This includes enhancements to commercial areas and lifestyle malls (Eastwood Citywalk, Eastwood Mall, Eastwood Mall Open Park), phased refurbishment of office towers (starting with IBM Plaza), and renovation of lobbies, facilities, and amenities of additional office buildings and residential towers. The Eastwood Richmonde Hotel is also undergoing enhancement, and Eastwood Mall’s interiors, cinemas, and tenant mix are being refreshed. These efforts aim to modernize the township and introduce popular new dining and lifestyle brands.

- C-5 Corridor Proximity: Benefits from its location along the C-5 corridor, which may see future infrastructure improvements or connections to planned rail lines (e.g., Metro Manila Subway stations in Ortigas or Katipunan are relatively accessible via C-5). While C-5 is prone to traffic, ongoing and future road network improvements in Metro Manila could indirectly benefit accessibility to Eastwood City.

Key Infrastructure & Developments

| Feature | Status | Key Detail |

| C-5 Road Access | Existing | Primary access corridor for north-south vehicular movement |

| Integrated Mall Network | Existing | Eastwood Mall, Citywalk I & II, Cyber and Fashion Mall |

| PEZA IT Park Infrastructure | Existing | High-speed telecomms, reliable power catering to BPO needs |

| Internal Road & Pedestrian Network | Existing | Designed for convenience within the township |

Key Business Presence & Amenities

Major Companies & Industries:

Eastwood City remains a dominant hub for the Information Technology and Business Process Outsourcing (IT-BPO) industry, attracting various company locators. Key BPO locators include Accenture, IBM Global Services, Dell, WNS Global Services, Atos, eTelecare, MicroSourcing, and Toei Animation Philippines. Beyond BPO, the township houses a wide array of retail, dining, and entertainment businesses within its interconnected malls.

Healthcare:

The Medical City Clinic has a presence within Eastwood City. Major hospitals like The Medical City Ortigas and Quirino Memorial Medical Center are relatively accessible via C-5 Road and Ortigas Avenue. St. Camillus Polyclinic is also conveniently located nearby.

Dining & Lifestyle:

Eastwood City offers extensive and diverse dining options across its various mall components. The ongoing redevelopment initiatives are set to introduce new and popular dining and lifestyle brands, further enhancing the offerings.

- Mall Venues: Eastwood Mall, Eastwood Citywalk I & II, and the Cyber and Fashion Mall host a wide variety of restaurants.

- Variety: Caters to diverse tastes and budgets, from fast food and casual dining popular with BPO workers to more upscale restaurants and bars for residents and visitors.

- Nightlife: Known for its active nightlife scene.

Livability Assessment

Strengths:

- Self-Contained Township: A mature “live-work-play-learn” environment offering exceptional convenience and a complete ecosystem for living, working, and leisure.

- Job Opportunities: High concentration of BPO job opportunities directly within the township, attracting a large workforce.

- Vibrant Amenities: Extensive and diverse shopping, dining, entertainment, and a well-known nightlife scene.

- Pedestrian-Friendly: Features a well-designed internal road and pedestrian network, promoting walkability.

- Pet-Friendly: Notably, its mall environment was the first in the Philippines to be pet-friendly.

- Relative Safety: Generally considered safe compared to some surrounding areas.

- C-5 Accessibility: Good vehicular access via C-5 Road, providing a major artery for connectivity despite congestion.

- Ongoing Redevelopment: Megaworld’s investment in upgrading existing facilities ensures the township remains modern and appealing.

Challenges:

- Traffic Congestion: C-5 Road and surrounding access points continue to experience heavy traffic, especially during rush hours, posing a significant challenge for external commuting.

- Isolation: Can feel like an isolated “bubble” distinct from the rest of Quezon City, potentially limiting interaction with broader urban life for some residents.

- Limited Green Space: Primarily high-rise living with relatively less open green space compared to newer, sprawling townships that prioritize expansive parks.

- BPO-Centric Atmosphere: The environment can be very BPO-centric and busy 24/7, which may not appeal to all residents seeking a quieter or more traditional residential atmosphere.

- Limited Future Appreciation (from new phases): As a largely completed development, the potential for significant capital appreciation driven by large-scale new phases may be less compared to emerging districts with extensive undeveloped land. However, the announced redevelopment may drive some value appreciation.

HI’s Perspective / Our HI Five score

Eastwood City scores Medium-High in terms of livability. It offers exceptional convenience and a comprehensive ecosystem for individuals working within the township, particularly in the BPO sector, due to its highly integrated amenities and 24/7 operational environment. The announced PHP 2.5 billion redevelopment by Megaworld for Eastwood City is a significant positive, indicating a commitment to modernizing the township and enhancing its overall appeal, addressing the need to “future-proof” existing assets and cater to evolving consumer preferences. This proactive approach, including upgrading facilities and services, will help maintain its competitiveness and desirability.

However, its primary reliance on the C-5 Road for external access continues to be a major source of significant traffic challenges. While vibrant, the atmosphere might feel isolating or overly commercial for some residents seeking a more traditional community feel or extensive green spaces in different places. Its maturity means that while infrastructure is well-established, major new growth phases or substantial redevelopment on the scale of an entirely new township are less likely compared to newer, emerging townships, though the current redevelopment aims to refresh and enhance the existing environment.

This report is based on market data as of Q1 2025. HousingInteractive provides this analysis for informational purposes only.

References

[1] Megaworld allots P2.5B for Eastwood City redevelopment – BusinessWorld Online

[2] Colliers: Property market worsens in 2024 – Manila Bulletin

[3] PHL office vacancy soars to 19.8% in 2024, expected to rise in 2025 – Colliers

[4] pdf.Savills.Asia

[5] Office MarketBeat Report – Cushman and Wakefield

[6] Office Market Outlook – Lobien Realty Group

[7] What are the average condo prices in Manila in 2025? – Bamboo Routes

[8] Eastwood City | Megaworld REIT | MREIT | PH’s Most Premium Offices

[9] CBD Grade A Office Vacancy Rate Jumped 1.8 Percentage Points Quarter-on-quarter To 8%, Highest In 6 Years – Savills Singapore

[10] Market Insight Report 2024 – Cresa

[11] Office Space for Rent in IBM Plaza, Eastwood City, Quezon City – Easy Property Match

[12] Condominium for Sale in Eastwood City – Zipmatch

[13] Eastwood Global Plaza Luxury Residences – Megaworld International

[14] Gross rental yields in the Philippines: Quezon City – Global Property Guide