Source references are listed at the end of the report.

Executive Summary

Quezon City & Pasig City: A Modern Mixed-Use Destination Estate

Bridgetowne Estate, a sprawling 30.6-hectare master-planned township by Robinsons Land Corporation (RLC), strategically bridges Quezon City and Pasig City along the C-5 Road and Ortigas Avenue Extension. Positioned as a “destination estate,” it seamlessly integrates modern office buildings, upscale residential condominiums, a luxury mall (Opus Mall), a hotel (Fili Hotel), and its distinctive landmark bridge. While still evolving, Bridgetowne aspires to deliver a comprehensive live-work-play environment. However, its prime C-5 location also presents ongoing challenges, notably significant traffic congestion. This report provides a market analysis as of Q1 2025.

Office Market Overview

Bridgetowne’s office market features contemporary, PEZA-registered IT park towers strategically designed to attract BPO firms and corporate headquarters. Despite its location within the C-5 corridor, an area generally experiencing higher vacancy rates, Bridgetowne’s newer stock and PEZA status offer a competitive edge.

Vacancy Trends:

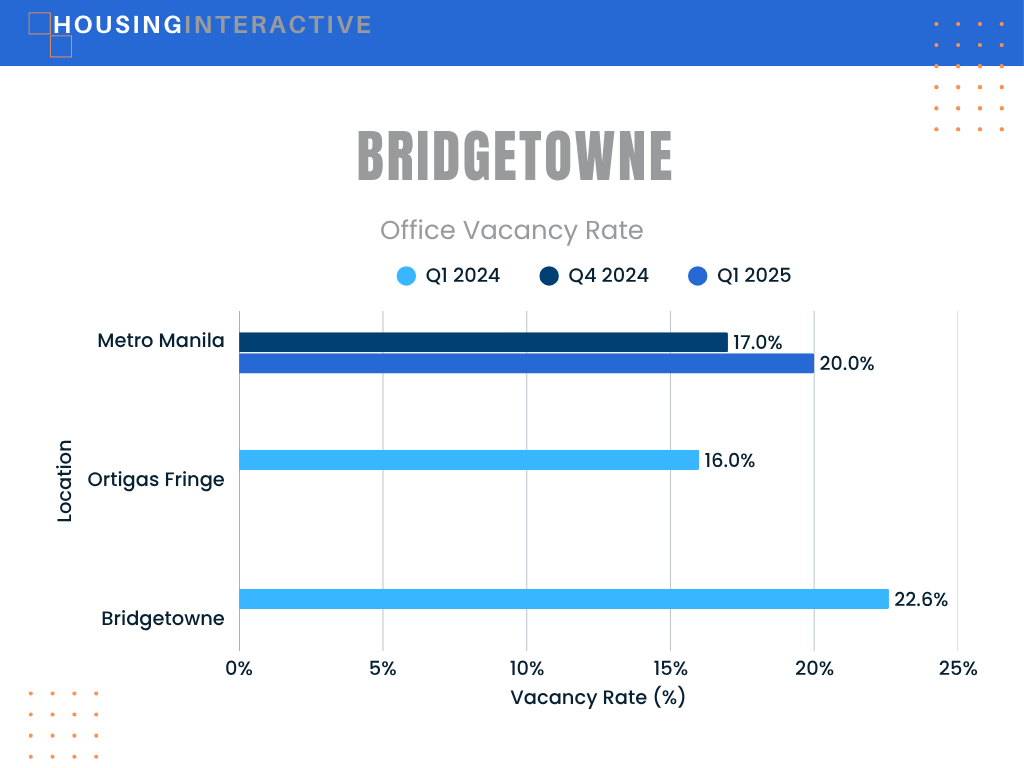

Specific vacancy rates for individual Bridgetowne office towers (Tera, Exxa, Zeta, Giga, Campus One) are not readily available in public market reports. However, the broader Metro Manila office market recorded a high vacancy rate, hovering between 17% and 20% in Q4 2024 and Q1 2025. The Ortigas Fringe, encompassing Bridgetowne, specifically saw a vacancy rate of 22.6% in Q1 2024 (Colliers). While Bridgetowne’s modern facilities and PEZA registration may attract BPO tenants and lead to better occupancy than older structures in the vicinity, it is not immune to the overall market pressures.

Table 1: Office Vacancy Rates – Metro Manila and Bridgetowne Area (2024–2025)

| Area / Market Segment | Vacancy Rate | Period | Notes |

|---|---|---|---|

| Metro Manila (overall) | 17% – 20% | Q4 2024 – Q1 2025 | General office market vacancy rate across all submarkets |

| Ortigas Fringe (Bridgetowne included) | 22.6% | Q1 2024 | Higher than Metro Manila average; includes the Bridgetowne submarket |

| Bridgetowne (individual towers) | Not publicly available | N/A | Likely better than Ortigas Fringe average due to modern amenities |

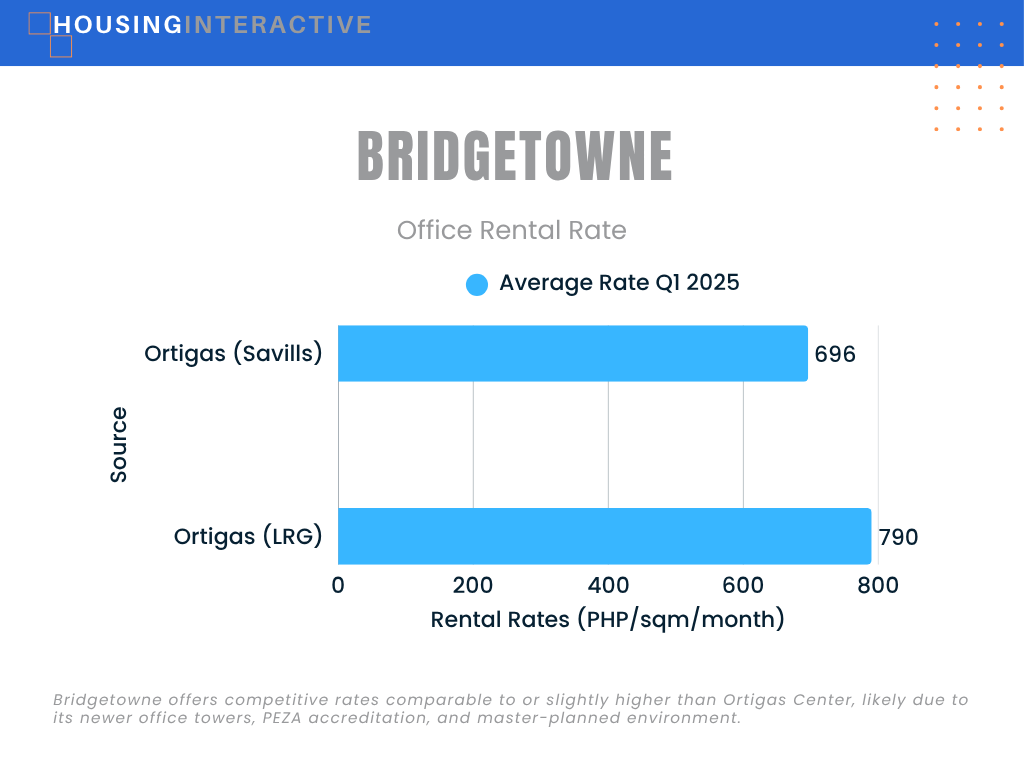

Rental Rates:

Office rental rates in Bridgetowne are expected to be competitive, likely comparable to or slightly above the Ortigas Center/Fringe average, owing to the newer building quality and township amenities. For comparison, Ortigas Center’s average office rent was around PHP 696/sqm/month (Savills Q1 2025) to PHP 790/sqm/month (LRG Q1 2025). Specific rental data for Bridgetowne offices is not widely available; for instance, Megawide’s annual report does not detail specific project rents in such developments.

Table 2: Office Rental Rates – Bridgetowne vs. Ortigas Center (Q1 2025)

| Location | Estimated Rental Rate (PHP/sqm/month) | Source / Notes |

|---|---|---|

| Ortigas Center | PHP 696 | Savills, Q1 2025 |

| Ortigas Center | PHP 790 | Lobien Realty Group (LRG), Q1 2025 |

| Bridgetowne (Estimate) | PHP 700 – 800 | Estimated, based on newer buildings and amenities |

Key Drivers & Trends:

- New, High-Quality Buildings: State-of-the-art office towers are a significant draw for discerning tenants.

- PEZA IT Park Status: Provides attractive incentives for BPO and IT-related enterprises, fostering a conducive business environment.

- Master-Planned Township: Offers a holistic and integrated ecosystem of amenities, enhancing employee convenience and quality of life.

- C-5 Corridor Location: Provides strategic accessibility across Metro Manila, albeit with inherent traffic challenges.

Residential Market Overview

Bridgetowne’s residential developments primarily target the mid-to-luxury market segments, featuring high-rise condominium projects designed to appeal to discerning buyers. These offerings reflect the broader real estate development trends in Pasig and Quezon City, where the market contends with a notable inventory of unsold units across the metropolitan area. The market is subject to broader trends in Pasig and Quezon City, including existing unsold inventory in the wider metropolitan area.

Vacancy Trends:

Specific vacancy data for Bridgetowne’s residential projects, such as Cirrus and The Velaris Residences, is not publicly available. As new units are turned over, initial vacancy is a natural part of the development cycle. Its location within Pasig and Quezon City means it is part of areas noted by Colliers for having a significant share of unsold RFO condominium inventory, suggesting potential vacancy pressures in the broader market context.

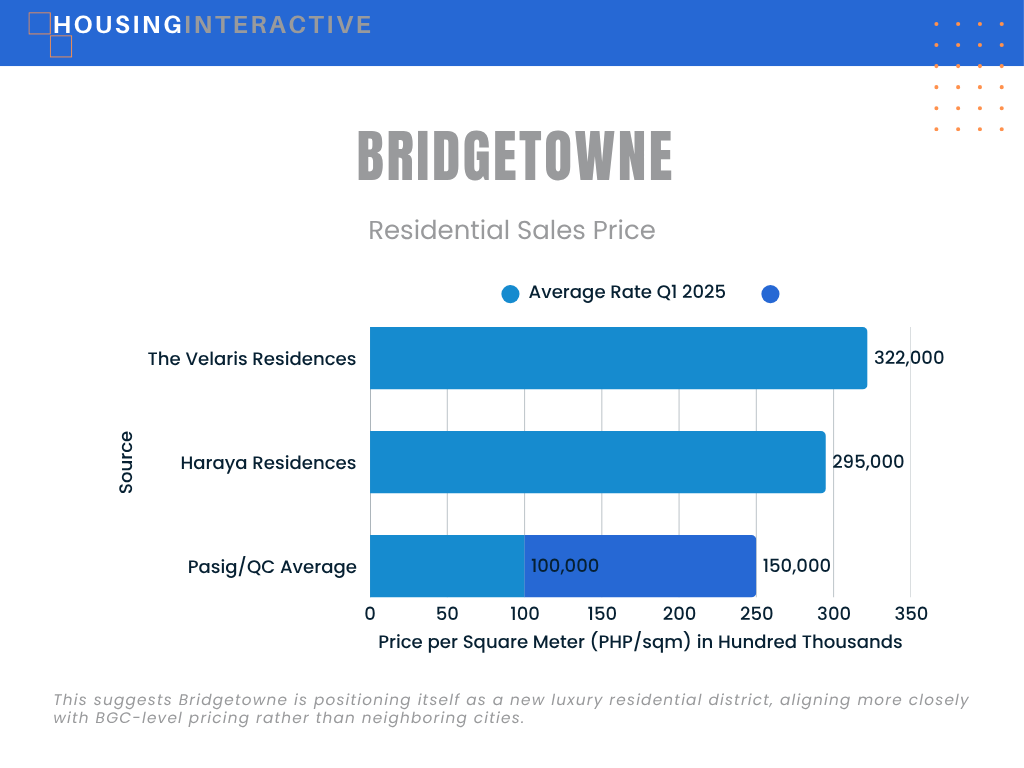

Price Levels:

- Sale Prices: Residential sale prices in Bridgetowne target the mid-to-luxury segments. For example, The Velaris Residences, a joint venture between RLC and Hongkong Land, listed a 1-bedroom unit (46 sqm) at PHP 14.8 million (approximately PHP 322,000/sqm). Haraya Residences by Shang Properties listed a 1-bedroom unit (61.59 sqm) at PHP 18.1 million (approximately PHP 295,000/sqm). These prices are significantly above the general Pasig/Quezon City averages (which are around PHP 100k-150k/sqm ) and are closer to BGC levels, reflecting the premium positioning of these projects.

- Rental Data: Aggregated rental data for Bridgetowne residential units was not provided in the source material.

Infrastructure & Accessibility

Existing Infrastructure:

- Strategic Location: Bridgetowne benefits from its direct frontage along C-5 Road and Ortigas Avenue Extension, key arterial roads.

- Landmark Bridge: The iconic Bridgetowne Bridge serves as a prominent architectural feature, facilitating connectivity between the Pasig and Quezon City sides of the estate for vehicles, bicycles, and pedestrians.

- Internal Network: A well-planned internal road network and integrated utilities are integral to the township’s design.

- Integrated Retail: The recently opened Opus Mall provides convenient, upscale retail and dining experiences within the estate.

Planned Developments:

- Ongoing Projects: The township is under continuous development, with further office towers and residential projects (including Cirrus and The Velaris Residences, with estimated completion in 2024). The Fili Hotel, RLC’s first in Metro Manila, and the “Home of the UAAP” sports venue (construction slated for Q4 2025, opening 2027) are also significant additions.

- Corridor Improvements: The estate stands to benefit from planned infrastructure enhancements along the C-5 corridor and Ortigas Avenue.

- Future Rail Access: Potential for enhanced future connectivity through proposed rail lines, such as the planned MRT-4 along Ortigas Avenue, which could significantly improve accessibility.

Key Infrastructure & Developments

| Feature | Status | Key Detail |

| Bridgetowne Bridge | Existing | The iconic bridge connecting Pasig & QC sides, accommodating vehicles, bikes, and pedestrians |

| C-5 Road & Ortigas Ave Ext Access | Existing | Primary vehicular access corridors |

| Opus Mall | Existing (Opened July 2024) | Upscale retail and dining hub within the township |

| Fili Hotel | Planned/Under Construction | Future hospitality component, first Metro Manila branch (podium of Opus Mall) |

| UAAP Venue | Planned (Construction Q4 2025, Open 2027) | Proposed 6,000-capacity sports and entertainment facility, set to be the “central hub” for UAAP events |

| Proximity to Future MRT-4 | Planned | Potential future access to the MRT-4 monorail along Ortigas Avenue, significantly improving mass transit options |

| The Victor Statue | Completed (Q1 2021) | 55-meter-tall steel statue, one of the tallest lighting projection art installations globally |

| Robinsons DoubleDragon Square | Planned | Joint venture mixed retail and office development (103,000 sqm GLA) on C-5 Road |

Key Business Presence & Amenities

Major Companies & Industries:

- Master Developer: Robinsons Land Corporation (RLC) spearheads the entire Bridgetowne development.

- Key Office Locators: Bridgetowne hosts significant corporate and BPO tenants, including Universal Robina Corporation (headquarters in Tera Tower), Hinduja Global Solutions (Zeta Tower), Concentrix (Exxa Tower), VXI Global (Giga Tower), FinAsia Land Development (Campus One), and Sourcefit BPO (Exxa Tower).

- Target Industries: The estate primarily targets IT-BPO companies and corporate headquarters, leveraging its PEZA IT Park status.

Healthcare:

- While Bridgetowne does not feature a major hospital within its immediate bounds, residents and tenants have convenient access to prominent medical facilities nearby, including The Medical City Ortigas along Ortigas Avenue. Pasig City General Hospital and Rizal Medical Center are also accessible from the township.

Dining & Lifestyle:

The vibrant dining and lifestyle scene within Bridgetowne, enhanced by the addition of green spaces, largely revolves around the newly opened Opus Mall.

- Opus Mall: Positioned as an upscale retail development, it features numerous shops, restaurants, a food hall, and cinemas.

- Variety: The integrated offerings cater to the diverse needs of office workers, residents, and visitors, providing a mix of casual and upscale dining options.

- Proximity to Other Hubs: Its strategic location also provides easy access to the extensive dining and lifestyle choices in nearby areas such as Ortigas Center and Kapitolyo.

Livability Assessment

Strengths:

- Modern Master-Planned Environment: Offers a contemporary, integrated township experience designed for convenience and quality of life.

- New, High-Quality Buildings: Features state-of-the-art office and residential towers with modern architectural designs and premium amenities.

- Integrated Amenities: The presence of Opus Mall and the upcoming Fili Hotel provides essential retail, dining, and hospitality services within the estate, fostering a self-contained environment.

- Strategic Location: Situated along the C-5 corridor, providing critical access to various parts of Metro Manila, both north and south.

- Iconic Bridge: The Bridgetowne Bridge significantly enhances internal connectivity and serves as a distinctive visual landmark for the township.

- PEZA IT Park Status: Attracts substantial BPO investments, creating numerous employment opportunities within the estate.

Challenges:

- Ongoing Development: As a developing township, ongoing construction activities are present, which may lead to some inconveniences for current occupants.

- Traffic Congestion: Severe traffic congestion on C-5 Road and Ortigas Avenue Extension remains a significant hurdle, impacting daily commutes and overall accessibility.

- Limited Direct Rail Access: Currently lacks direct access to existing MRT/LRT rail transit lines, necessitating reliance on road-based transport.

- High-End Residential Market: Current residential offerings are predominantly positioned at the higher end of the market, potentially limiting appeal to a broader demographic.

- Office Market Pressures: Faces potential office vacancy pressures, albeit tempered by its new stock and PEZA status, given the broader market context in non-prime locations.

HI’s Perspective / Our HI Five score

Bridgetowne holds Medium Potential as a livable district. It presents a modern, integrated township experience characterized by high-quality buildings and appealing amenities, particularly with the opening of Opus Mall. Its strategic location on C-5, near the proposed business park, is a double-edged sword, offering excellent vehicular access across the metro but simultaneously posing a major challenge due to severe traffic congestion. Livability is currently influenced by ongoing development activities and the aforementioned traffic issues. The long-term success and appeal of Bridgetowne will significantly depend on its ability to attract a diverse mix of tenants and residents, the full realization and maturation of its planned amenities, and future improvements in mass transit access to the area, such as the potential MRT-4. At present, it appeals most to those working within the township or seeking newer, upscale residential options outside the core Central Business Districts, provided they are prepared to navigate the prevailing access challenges.

This report is based on market data as of Q1 2025. HousingInteractive provides this analysis for informational purposes only.

References

[1] Metro Manila condo launches fell to the lowest level in 5 years LPC BusinessWorld Online

[2] Colliers: Property market worsens in 2024 – Manila Bulletin

[3] pdf.savills.asia

[4] Office Market Outlook – Lobien Realty Group

[5] Q1 2024 Office Market Report – Contact Center Association of the Philippines

[6] What are the average condo prices in Manila in 2025? – Bamboo Routes

[7] Weighing the pros and cons of city life in the Philippines – Assetmart.Global

[8] Robinsons Destination Estates

[9] 17 February 2024 PHILIPPINE DEALING AND EXCHANGE CORPORATION 29th Floor, BDO Equitable Tower 8751 Paseo de Roxas, Makati City Ge – PDS Group (Refers to Megawide, general disclosure context)

[10] Pre-Selling Bridgetowne Condos For Sale (2024 Discounts and Promos)

[11] Our facilities – Sourcefit