Source references are listed at the end of the report.

Executive Summary

Bonifacio Global City (BGC): A Dynamic Hub in Metro Manila

Bonifacio Global City (BGC) has rapidly ascended to become a premier Central Business District (CBD) and a highly sought-after lifestyle destination in Metro Manila, offering a compelling alternative to Makati. Characterized by its contemporary infrastructure, meticulously planned layout, pedestrian-friendly design, and abundant green spaces, BGC has attracted a significant concentration of multinational corporations. The district boasts upscale residential condominiums, renowned international schools, and a dynamic retail and dining scene, establishing itself as a vibrant and modern urban center.

Office Market Overview

BGC’s office market generally demonstrates robust performance, driven by strong demand from the Business Process Outsourcing (BPO) sector and multinational corporations (MNCs). However, this demand is tempered by the substantial influx of new supply.

Vacancy Trends:

While specific figures vary among reports, BGC’s office vacancy rates are a key indicator. Colliers reported a 15.4% vacancy in Q1 2024, representing an increase quarter-on-quarter and year-on-year. In contrast, Leechiu Property Consultants (LPC) indicated a lower 10% vacancy rate for BGC in Q1 2025, positioning it as the lowest among major CBDs and highlighting its lead in live demand. JLL reported a combined Makati/Taguig Grade A office vacancy drop to 16.8% in Q4 2024, while KMC Savills noted BGC’s vacancy was below Makati’s in Q1 2024. A significant challenge for BGC is the projected new office supply for 2024/2025, with BGC expected to absorb 30% of the 634,000 sqm total projected for 2024 (Savills).

Office Vacancy Rates & Key Observations

| Source | Area Covered | Quarter | Vacancy Rate (%) | Key Notes |

|---|---|---|---|---|

| Colliers | BGC | Q1 2024 | 15.4% | Increased QoQ and YoY |

| Leechiu Property Consultants (LPC) | BGC | Q1 2025 | 10% | Lowest among major CBDs; BGC leads in live demand |

| JLL | Makati/Taguig (Grade A) | Q4 2024 | 16.8% | Combined vacancy rate |

| KMC Savills | BGC vs. Makati | Q1 2024 | Not specified | BGC vacancy was lower than Makati’s |

| Savills | Metro Manila (Office Supply) | 2024 forecast | N/A | BGC expected to get 30% of the 634,000 sqm new supply (biggest share) |

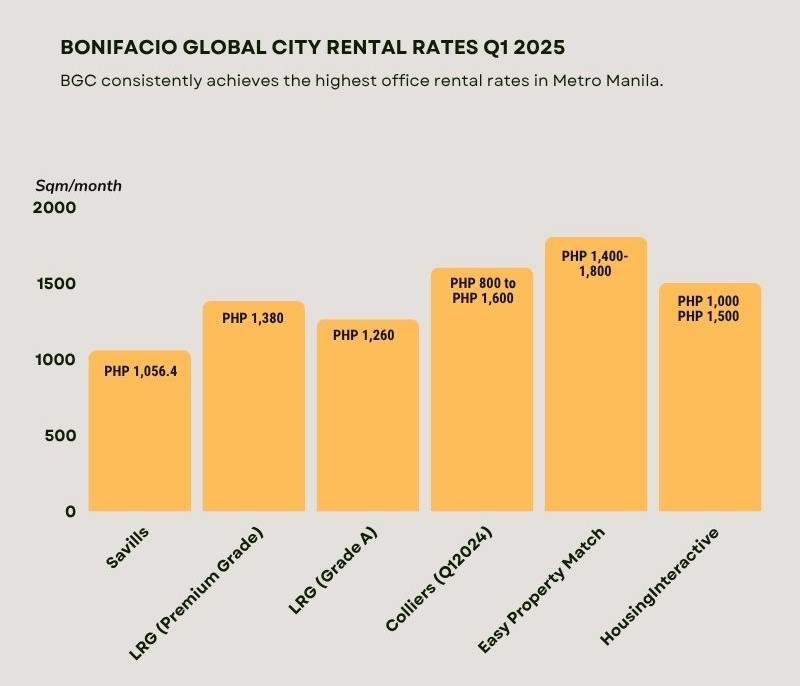

Rental Rates (Q1 2025):

BGC consistently commands the highest office rental rates in Metro Manila.

- Average Rent (KMC Savills): PHP 1,056.4/sqm/month, surpassing Makati.

- Prime Grade (Lobien Realty Group – LRG): PHP 1,380/sqm/month.

- Grade A (LRG): PHP 1,260/sqm/month.

- Headline Rates (Colliers, Q1 2024): Ranged from PHP 800 to PHP 1,600/sqm/month.

- Average Range (Easy Property Match, 2024): PHP 1,400-1,800/sqm/month.

- HousingInteractive Listings: Show rates from PHP 1,000/sqm to over PHP 1,500/sqm, with some outliers.

Key Drivers & Trends:

- Sustained strong demand from the IT-BPM sector and MNCs.

- Significant new office supply entering the market.

- “Flight-to-quality” trend: Tenants are increasingly opting for modern, strategically located buildings.

- Major tenant expansion, exemplified by JPMorgan Chase’s significant increase in footprint and workforce within Uptown Bonifacio.

Residential Market Overview

BGC’s residential market, particularly within its higher-end segments, exhibits greater resilience compared to the broader Metro Manila market.

Vacancy Trends:

While detailed specific data is limited, Colliers observed low oversupply in BGC compared to non-CBD areas and projected a minor uptick in vacancy to 19.6% in Q1 2025, from 19.5% at the end of 2024. This remains considerably lower than the Metro Manila average. JLL reported steady demand in Q4 2024. However, anecdotal evidence suggests a substantial availability of units for sale or rent, potentially indicating softness in specific segments or projects.

Price Levels (Q1 2025):

BGC commands premium residential prices.

| Source / Category | Details | Price / Rate | Notes |

|---|---|---|---|

| BambooRoutes (Est. 2025) | Average Condo Price Range | PHP 220,000 – PHP 270,000/sqm | Highest average in Metro Manila |

| KMC Savills (Jan 2025) | Average Condo Price in Taguig | PHP 275,000/sqm | Higher than BambooRoutes’ estimate |

| The Seasons Residences | One-Bedroom Units | PHP 18M–19M (PHP 390k–415k/sqm approx.) | Indicates top-tier pricing |

| Colliers (2022) | Fort Bonifacio 1-BR Unit Rent | PHP 870/sqm/month | Older data, but the market has likely recovered |

| HousingInteractive Listings | Market Listings Overview | Many listings > PHP 1,000/sqm/month | Confirms continued high rental prices |

| Overall Rental Demand | Driven by expats & high-income locals | High | Maintains upward pressure on prices |

General Trend (Q4 2024): 8% average YoY rental rate increase for 1-BR Units in prime areas, reflecting an ongoing demand.

- Average Condo Price Range (BambooRoutes, 2025 est.): PHP 220,000 – PHP 270,000 per square meter (the highest in Metro Manila).

- Average Condo Price Taguig (KMC Savills, Jan 2025): PHP 275,000 per square meter.

- Specific Projects (e.g., The Seasons Residences): One-bedroom units start around PHP 18 M-19 M (approximately PHP 390k-415k per square meter).

- Rental Rates: Also high, reflecting demand from expatriates and high-income local residents. Q4 2024 saw an average 8% year-on-year increase for one-bedroom units in prime areas like BGC. Colliers’ data from 2022 indicated Fort Bonifacio one-bedroom rents averaged PHP 870 per square meter per month, which has likely recovered since. HousingInteractive data further corroborates numerous high-value unit listings.

Infrastructure & Accessibility

Existing Infrastructure:

BGC boasts a master-planned road network with wide avenues, a highly pedestrian-friendly environment featuring wide sidewalks, dedicated bike lanes, and interconnected walkways like Bonifacio High Street. It benefits from underground utilities, enhancing its clean aesthetic. Accessibility is excellent via C-5, EDSA (through Kalayaan Flyover), and McKinley Road. The BGC-Ortigas Center Link Bridge has significantly reduced travel time to Ortigas Center. The district also has an efficient BGC Bus system and numerous parks and open spaces such as Track 30th, Terra 28th, and High Street Park.

Planned Developments:

BGC is exceptionally well-positioned for future infrastructure enhancements.

- Metro Manila Subway Project (MMSP): This pivotal project includes several stations within or directly serving BGC (Kalayaan Avenue, BGC near Market! Market!/Serendra, and Lawton near McKinley West). While facing delays, its full operation (targeted for 2030-2031) will dramatically improve BGC’s connectivity.

- Makati-BGC Skytrain: The proposed Guadalupe-Uptown Bonifacio link remains uncertain and is currently “held in abeyance” by the government pending further review, especially in light of the MMSP alignment.

- Ongoing Private Developments: New projects like the Pioneer House BGC office building (targeting 2025 completion) continue to enhance the area’s modern infrastructure.

Key Business Presence & Amenities

Major Companies & Industries:

BGC is a significant hub for multinational corporations (MNCs), particularly in the IT-BPM, finance, and technology sectors. Megaworld Corporation is a major landlord, hosting over 100 MNCs and BPOs across its townships in and around BGC (Uptown Bonifacio, McKinley Hill, McKinley West). Notable tenants include Google, Accenture, JPMorgan Chase (significantly expanding its presence), Wells Fargo, Bayer, Cognizant, and Samsung. Prominent locators also exist in retail (SM, Ayala Malls), hospitality (Grand Hyatt, Shangri-La, Seda), and various professional service firms.

Healthcare:

The district’s primary healthcare facility is the world-class St. Luke’s Medical Center – Global City, complemented by numerous specialized clinics and wellness centers.

Dining & Lifestyle:

BGC provides an extensive and diverse culinary scene, ranging from upscale dining in hotels (Grand Hyatt, Shangri-La) and standalone restaurants (Wildflour, Las Flores, Nono’s, Manam) to casual eateries, international chains (Marugame Udon, Brotzeit), and trendy cafes (Because Coffee, Elephant Grounds). Food courts are available in malls like SM Aura and Market! Market!. Bonifacio High Street is a major dining destination with abundant al fresco options. The Venice Grand Canal Mall in McKinley Hill provides unique dining experiences.

Livability Assessment

Strengths:

- Modern, well-planned, clean, and highly walkable urban environment.

- High levels of safety and security.

- Abundant parks, green spaces, and public art installations (e.g., Track 30th, Terra 28th, High Street Park).

- Excellent selection of shopping malls, restaurants, cafes, and bars.

- Presence of top international schools and premier healthcare facilities like St. Luke’s.

- Vibrant cultural scene featuring The Mind Museum and BGC Arts Center.

- Strong sense of community and a diverse, multicultural population.

Challenges:

- Can feel artificial or perceived as lacking the “soul” of older districts.

- High cost of living and property prices.

- Significant traffic congestion when entering or exiting BGC.

- Commercial areas can feel crowded.

- Noticeable social gap between BGC and adjacent areas.

- Some individuals find the highly organized environment “boring”.

HI’s Perspective / Our HI Five score

The Bonifacio Global City neighborhood arguably offers Metro Manila’s most modern, convenient, and safe urban living experience, making it highly desirable for expatriates, families, and professionals. Its exceptional amenities, walkability, green spaces, and top-tier schools and healthcare significantly contribute to its high livability. However, the premium cost, potential traffic bottlenecks, and a perceived lack of organic character are notable trade-offs. BGC’s appeal is strongest for those who prioritize a structured, secure, and amenity-rich environment. The upcoming Metro Manila Subway will further enhance its connectivity and long-term value proposition. For investors, BGC continues to attract significant interest, although the influx of new supply warrants careful consideration.

This report is based on market data as of Q1 2025 and provided by HousingInteractive for informational purposes only.

References

[1] Metro Manila condo launches fell to the lowest level in 5 years; LPC BusinessWorld Online

[2] Live office demand up by 27 percent- LPC – Property Report PH

[3] Colliers: Property market worsens in 2024 – Manila Bulletin

[4] Metro Manila Subway: When Right of Way Gets in the Way | GMA News Online

[5] pdf.savills.asia

[6] Office Market Outlook – Lobien Realty Group

[7] Q1 2024 Office Market Report – Contact Center Association of the Philippines

[8] Hyper-supply of Manila condos? 2025 prospects – Gulf News

[9] Manila Residential Market Dynamics Q4 2024 – JLL Philippines

[10] ‘Condo prices in NCR need correction’ | Philstar.com

[11] What are the average condo prices in Manila in 2025? – Bamboo Routes

[12] 5 Key Developments Transforming Manila’s Rental Market in Q4 2024: Essential Insights for Renters and Landlords – フィリピン、不動産

[13] The Seasons Residences BGC (2024 Pre-Selling Discounts)

[14] Average Office Lease Rates in Metro Manila, Philippines – 2024 – Easy Property Match

[15] Condo rental rates in CBDs still lower than pre-pandemic level – BusinessWorld Online

[16] 6 Perks of Living in Bonifacio Global City – Grand Hya Manila Residences

[17] BGC Living: Why It’s a Top Choice for Manila Property Investors and Rent Seekers

[18] Office Spaces for Rent in BGC – HousingInteractive

[19] US office market sees stability in Q4 as vacancy, sublease rates wane | Facilities Dive

[20] Condos and Flats for Sale in Fort Bonifacio Global City, Taguig | Buy Condominiums | Housinginteractive.com.ph

[21] BGC-Ortigas Link Bridge: What Does It Bring to Taguig City? – Crown Asia Properties