Source references are listed at the end of the report.

Executive Summary

Pasay & Parañaque: A Waterfront Entertainment and Business Hub

Bay City, a vast reclaimed area along Manila Bay spanning parts of the commercial districts of Pasay and Parañaque City, has rapidly transformed into a major commercial, entertainment, and emerging residential district. It is characterized by large-scale developments including the SM Mall of Asia complex, the Entertainment City casino and resort hub, and Aseana City, a mixed-use CBD. While offering modern infrastructure and world-class attractions, Bay City’s real estate market, particularly its office and residential leasing segments, has been significantly impacted by the exodus of Philippine Offshore Gaming Operators (POGOs), leading to high vacancy rates.

Office Market Overview

Bay City’s office market has been most affected by the POGO exodus, resulting in elevated vacancy rates. Despite this, it still attracts some leasing activities, and its newer building stock commands higher rents than some other non-prime districts.

Vacancy Trends:

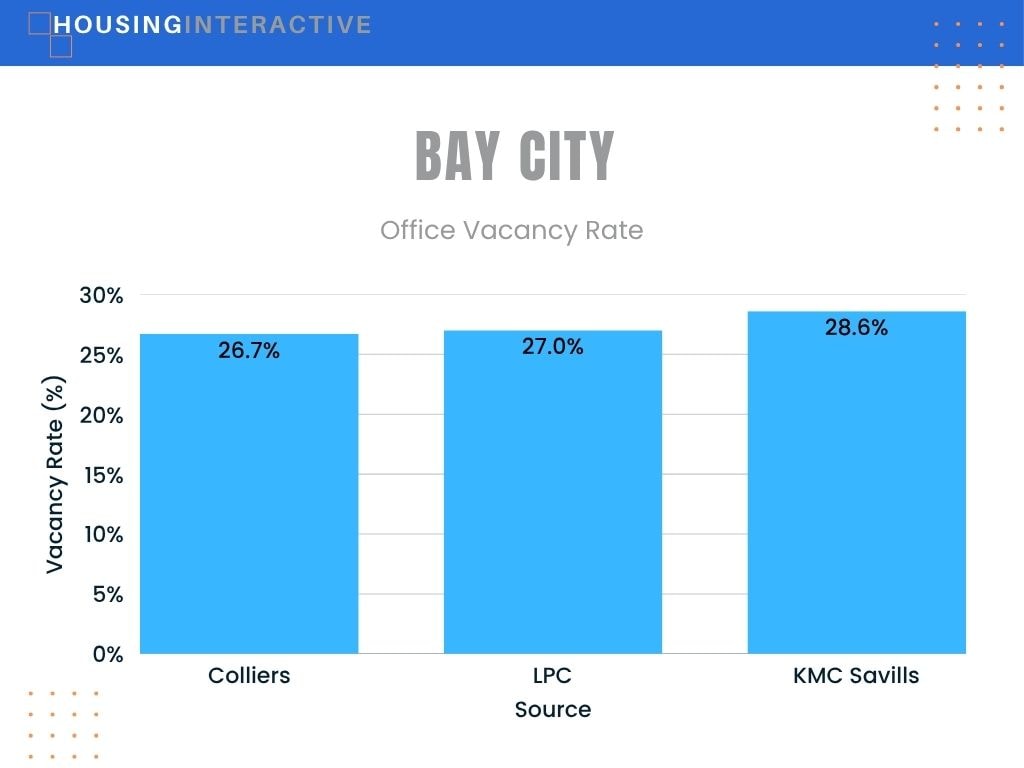

Bay City has been significantly impacted by the POGO exodus, leading to very high office vacancy rates. Colliers reported a Bay City vacancy rate of 26.7% in Q1 2024, though this marked an improvement from the previous quarter due to strong leasing activity, including from government agencies. LPC data from Q1 2024 showed Bay Area vacancy at 27%, while KMC Savills reported 28.6% vacancy in Q1 2024. Despite some absorption, the area is projected to receive a significant portion of the new office supply in 2025, suggesting vacancy could remain elevated. The area was specifically mentioned as being POGO-exposed with elevated vacancy.

Table 1: Bay City Office Vacancy Rates (Q1 2024)

| Source | Vacancy Rate (%) | Notes |

|---|---|---|

| Colliers | 26.7% | Slight improvement from the previous quarter due to government leasing |

| Leechiu (LPC) | 27.0% | Confirms elevated rates post-POGO exodus |

| KMC Savills | 28.6% | The highest reported vacancy among the three |

| General Outlook | High | New 2025 office supply may keep vacancy rates elevated |

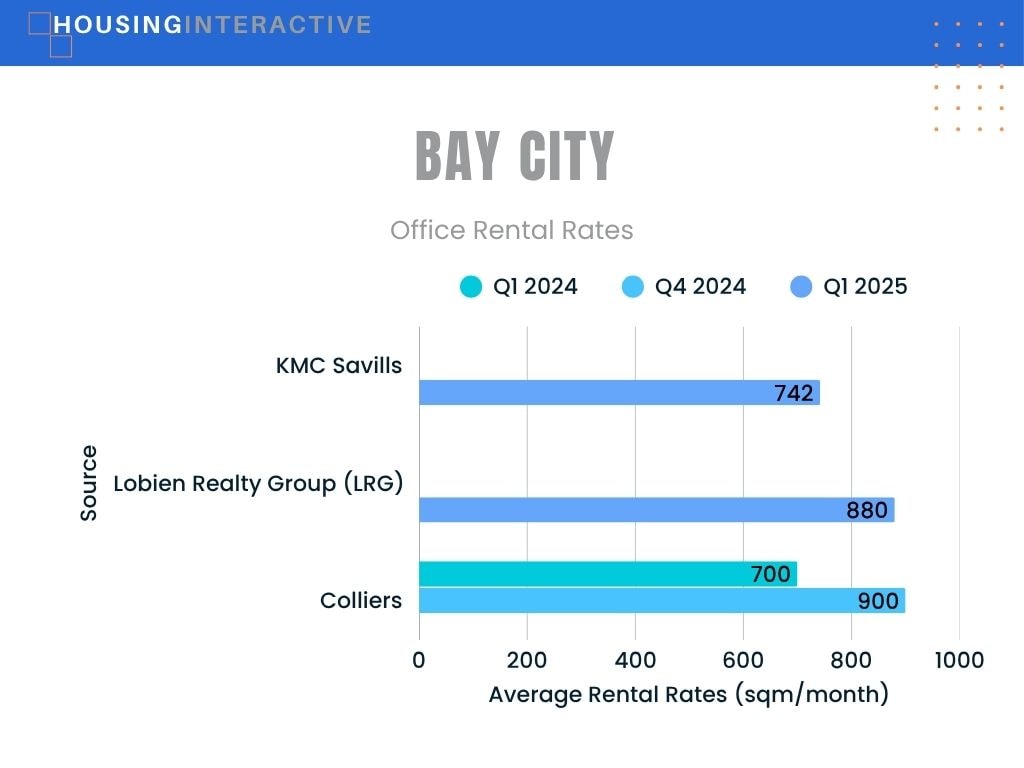

Rental Rates:

Rental rates in Bay City are generally lower than in prime CBDs like Makati and BGC but higher than in areas like Quezon City or Alabang, reflecting its newer building stock despite the high vacancy.

- KMC Savills reported an average rent of PHP 742.0/sqm/month in Q1 2025.

- Lobien Realty Group (LRG) estimated the Q1 2025 average at PHP 880/sqm/month.

- Colliers noted headline rates between PHP 700-900/sqm/month in Q1 2024 and projected potential rent declines by year-end 2024 due to POGO exposure.

- OfficePro listings show a wide range of rent requests.

Table 2: Bay City Office Rental Rates (Q1 2024–Q1 2025)

| Source | Period | Average / Range | Notes |

|---|---|---|---|

| KMC Savills | Q1 2025 | PHP 742.0/sqm/month | Reported average rental rate |

| Lobien Realty Group | Q1 2025 | PHP 880.0/sqm/month | Higher estimate compared to KMC |

| Colliers | Q1 2024 | PHP 700–900/sqm/month | Noted wide range; projected decline due to POGO exposure |

| OfficePro Listings | Ongoing | Wide range (unspecified) | Asking rents vary significantly across buildings |

Key Drivers & Trends:

- POGO Impact: The exit of POGOs is the primary factor for high vacancy.

- New Supply: Ongoing and future supply additions may continue to pressure vacancy rates.

- Competitive Rents: Attracts tenants looking for modern spaces at relatively lower costs than prime CBDs.

- Integrated Developments: Large-scale, mixed-use projects offer a comprehensive environment.

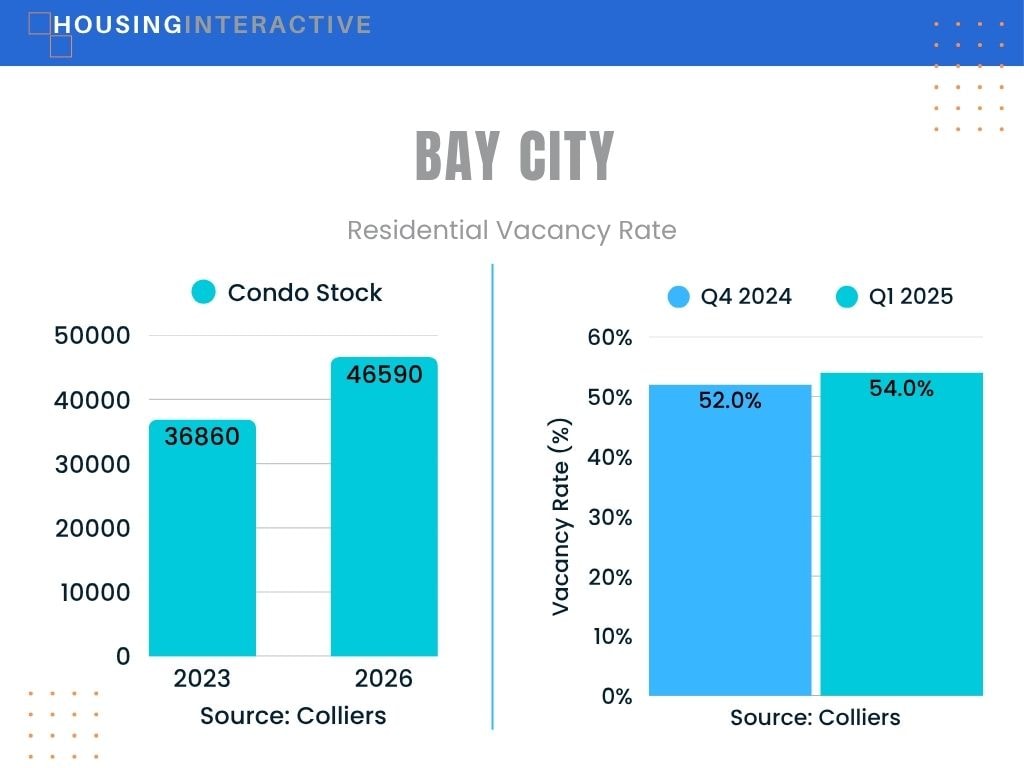

Residential Market Overview

The residential leasing market in Bay City has been severely impacted by the POGO departure, leading to extremely high vacancy rates, the highest in Metro Manila.

Vacancy Trends:

Colliers reported a staggering 52% residential vacancy rate in the Bay Area at the end of 2024, projecting it to rise further to 54% in Q1 2025. This makes it the highest vacancy area in Metro Manila by a significant margin. Colliers also forecasts Bay Area condominium stock to reach 46,590 units by 2026, a substantial increase from 36,860 units in 2023.

Price Levels:

- Sale Prices: BambooRoutes estimates 2025 condominium sale prices in Parañaque (which includes parts of Bay City) to average between PHP 80,000 and PHP 130,000 per square meter. Prices vary by project.

- Rental Rates: Rental rates are under significant downward pressure due to the extremely high vacancy rate. Colliers projected an overall Metro Manila rental decline of 1.5% in Q1 2025, likely driven heavily by areas like Bay City.

Infrastructure & Accessibility

Bay City benefits from a well-developed road network and strategic transport links, with further enhancements planned.

Existing Infrastructure:

- Road Network: Bay City benefits from its location along major roads such as Roxas Boulevard, EDSA Extension, and Macapagal Boulevard. Key internal roads include J.W. Diokno Boulevard and Seaside Boulevard.

- Transport Links: It has access to the LRT-1 Baclaran and EDSA stations, and the MRT-3 Taft Avenue station via connecting routes. The NAIA Expressway provides direct airport access.

- Integrated Developments: Large complexes like SM Mall of Asia and Aseana City feature their internal road networks and parking.

Planned Developments:

- LRT-1 Cavite Extension: This project, including stations like Redemptorist, will significantly improve connectivity to southern parts of Bay City and Parañaque.

- Ongoing Development: Continuous infrastructure upgrades within Aseana City and Entertainment City. The area is also near the alignment of the planned Pasay Monorail.

Key Infrastructure & Developments

| Feature | Status | Key Detail |

| LRT-1 Cavite Extension | Under Construction | Stations like Redemptorist to enhance southern connectivity |

| NAIA Expressway | Existing | Provides direct access to Ninoy Aquino International Airport |

| Major Arterial Roads | Existing | Roxas Blvd, EDSA Ext., Macapagal Blvd provide key access |

| Aseana City Development | Ongoing | Continuous infrastructure upgrades within this mixed-use CBD |

Key Business Presence & Amenities

Bay City is home to a diverse array of major companies and offers extensive amenities, from healthcare to dining.

Major Companies & Industries:

Bay City hosts a diverse range of major locators. These include SM Prime Holdings (with its headquarters and the SM Mall of Asia), Metropolitan Bank and Trust Company (in Metropolitan Park), and DoubleDragon Properties (DD Meridian Park). The Philippine Amusement and Gaming Corporation (PAGCOR) regulates Entertainment City, which houses major integrated resorts and casinos such as Solaire Resort & Casino, City of Dreams Manila, Okada Manila, and Newport World Resorts (formerly Resorts World Manila). Numerous BPO companies (though some POGO-related ones have exited), logistics firms, government agencies like the Department of Foreign Affairs’ Consular Affairs office, and retail giants also have a significant presence.

Healthcare:

- San Juan de Dios Educational Foundation Inc. – Hospital: Located nearby on Roxas Boulevard.

- Ospital ng Parañaque (District 1) and Pasay City General Hospital serve the local communities.

- Unihealth-Parañaque Hospital and Medical Center: Accessible from the south.

- Proximity to major hospitals in Makati is possible via EDSA and the Skyway.

Dining & Lifestyle:

The dining scene in Bay City is extremely diverse, catering to all budgets and tastes.

- Mall Dining: Extensive options from fast food and food courts in SM Mall of Asia and Ayala Malls Manila Bay.

- Casual Dining Strips: Areas like SM By the Bay and Blue Bay Walk offer numerous casual dining restaurants.

- High-End Restaurants: Located within the integrated resorts in Entertainment City (Solaire, City of Dreams, Okada, Newport World Resorts), offering diverse international and local cuisines.

Livability Assessment

Strengths:

- World-Class Shopping and Entertainment: Home to SM Mall of Asia, Ayala Malls Manila Bay, and the entire Entertainment City complex, offering unparalleled retail and leisure options.

- Modern Infrastructure: Features new buildings and well-planned road networks within its developed areas.

- Airport Proximity: Close to the Ninoy Aquino International Airport (NAIA), especially via the NAIA Expressway.

- Waterfront Location: Offers bay views and SM By the Bay promenade.

- Growing Business Hub: Aseana City continues to develop as a significant business district.

Challenges:

- Extreme Residential Vacancy: The highest residential vacancy rate in Metro Manila poses risks of rental market instability.

- High Office Vacancy: Primarily due to the POGO exodus, impacting the commercial real estate sector.

- Traffic Congestion: Significant traffic issues on surrounding major roads (EDSA, Roxas Blvd) and within the area, especially during peak hours and major events.

- Urban Character: Can feel vast and less like a traditional neighborhood compared to older, more established districts. Some find it lacks character outside the main commercial and entertainment complexes.

- Potential Environmental Concerns: Being a reclamation area may raise long-term environmental and geohazard concerns for some residents and investors.

HI’s Perspective / Our HI Five score

Bay City scores Medium (with caveats) in terms of livability. It offers an unmatched concentration of shopping, dining, and entertainment amenities within a modern, large-scale setting. This makes it highly attractive for tourism and leisure-focused activities. However, its overall livability is significantly impacted by the extremely high residential vacancy rates, which could lead to rental market instability and a transient atmosphere. Severe traffic congestion and a less traditional neighborhood feel also detract from its appeal as a stable, long-term residential community for many. It is best suited for those prioritizing proximity to entertainment venues, specific workplaces within the district (such as BPOs or casinos), or the airport.

This report is based on market data as of Q1 2025. HousingInteractive provides this analysis for informational purposes only.

References

[1] From uncertainty to opportunity: Key trends shaping the 2025 office market

[2] Colliers: Property market worsens in 2024 – Manila Bulletin

[3] Philippines’ Residential Property Market Analysis 2024

[4] Metro Manila office vacancy rate to rise to 20.5% by year-end – Colliers – BusinessWorld

[5] PHL office vacancy soars to 19.8% in 2024, expected to rise in 2025 – Colliers

[6] pdf.savills.asia

[7] Office Market Outlook – Lobien Realty Group

[8] Q1 2024 Office Market Report – Contact Center Association of the Philippines

[9] What are the average condo prices in Manila in 2025? – Bamboo Routes

[10] Reclamation | PRA Website

[11] The San Juan de Dios Educational Foundation, Inc.

[12] How to Get to Unihealth-Parañaque Hospital and Medical Center by Bus? – Moovit

[13] How to Get Around Pasay City: Life in the Manila Bay Area | Anchor Land