Source references are listed at the end of the report.

Executive Summary

Filinvest City: A Premier Suburban Hub

Alabang in Muntinlupa City, particularly the meticulously planned Filinvest City Central Business District (CBD), distinguishes itself as a premier suburban alternative in southern Metro Manila. It is lauded for its well-structured environment, abundant green spaces, established upscale residential communities, reputable educational institutions, top-tier healthcare facilities, and popular lifestyle centers. While offering a high-quality suburban lifestyle, Alabang’s office market faces significant challenges, primarily high vacancy rates stemming from the departure of Philippine Offshore Gaming Operators (POGOs). Despite these challenges, Alabang’s strong residential appeal and promising long-term growth are significantly bolstered by ongoing developments and key infrastructure projects, notably the North-South Commuter Railway (NSCR).

Office Market Overview

Alabang’s office market is currently navigating substantial headwinds, characterized by persistently high vacancy rates and highly competitive rental levels.

Vacancy Trends:

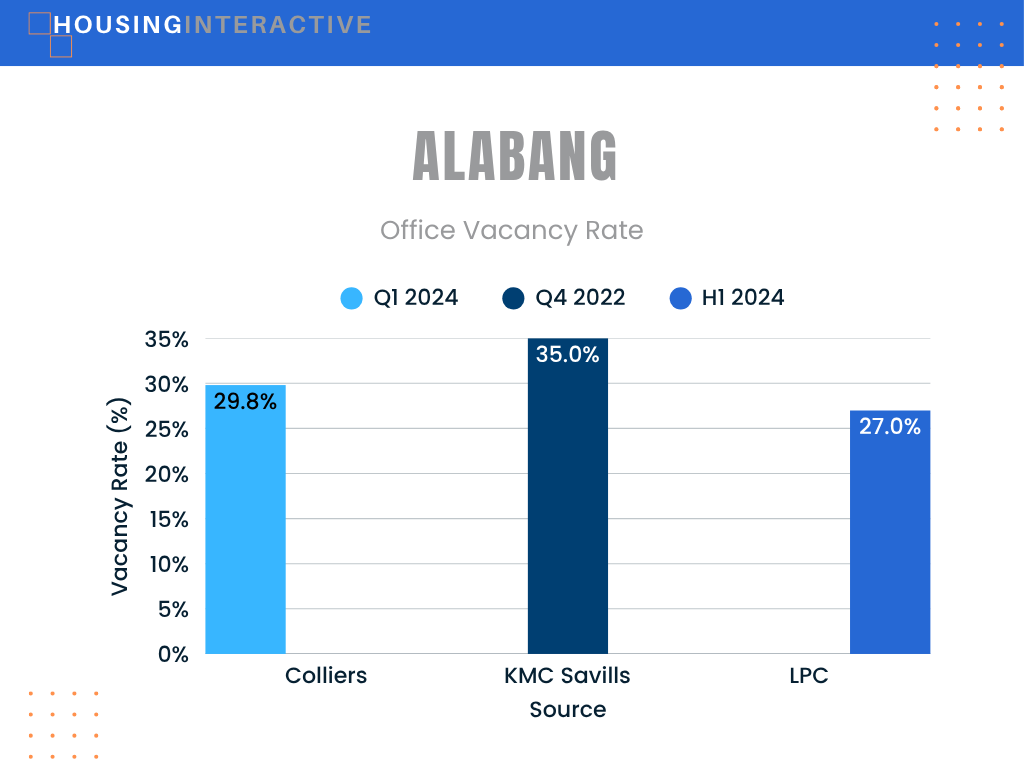

The Alabang office market has been profoundly affected by the exodus of POGOs, leading to a significant and sustained increase in vacant spaces. As of Q1 2024, Colliers reported Alabang’s office vacancy at 29.8%. KMC Savills indicated an even higher persistent vacancy of 35% since Q4 2022, while LPC data for H1 2024 placed it at 27%. These figures position Alabang among Metro Manila’s submarkets with the highest office vacancy rates.

Table 1: Alabang Office Vacancy Rates (2022–2024)

| Source | Period | Vacancy Rate |

|---|---|---|

| KMC Savills | Q4 2022–2024 | 35.0% |

| Colliers | Q1 2024 | 29.8% |

| Leechiu Property Consultants (LPC) | H1 2024 | 27.0% |

Rental Rates:

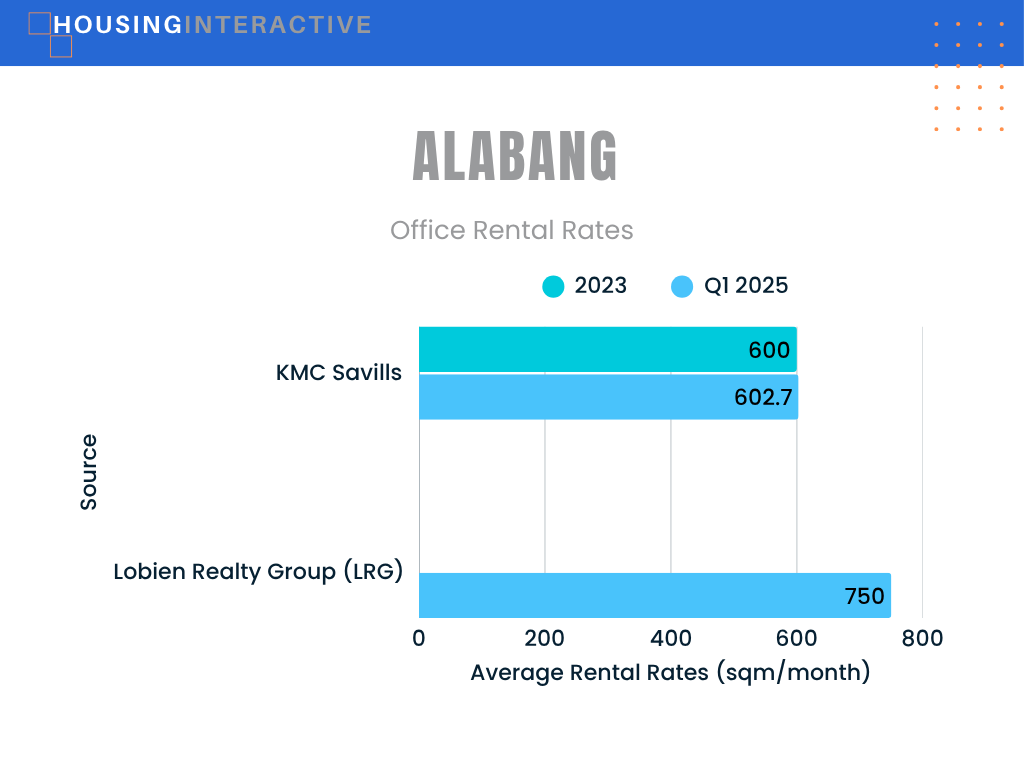

Reflecting the high vacancy, office rental rates in Alabang are among the most competitive across major business districts in Metro Manila.

- KMC Savills reported an average rent of PHP 602.7/sqm/month in Q1 2025 for Alabang CBD, a rate that reportedly dipped below PHP 600/sqm in 2023.

- Lobien Realty Group (LRG) provided a slightly higher estimate of PHP 750/sqm/month for Q1 2025. Landlords in the area are actively reducing rates to attract and retain tenants.

Table 2: Alabang Office Rental Rates (Q1 2025)

| Source | Period | Rental Rate (PHP/sqm/month) | Key Takeaways: |

|---|---|---|---|

| KMC Savills | Q1 2025 | PHP 602.7 | Shows more conservative pricing, aligning with tenant-friendly strategies amid high vacancy. |

| Lobien Realty Group | Q1 2025 | PHP 750.0 | Likely reflects prime or newer inventory still commanding a premium. |

| Historical (KMC Report) | 2023 | Below PHP 600 | Signals aggressive discounting, which landlords continue to use to remain competitive. |

Key Drivers & Trends:

- High Vacancy: The substantial impact of POGO exits continues to exert downward pressure on the market.

- Competitive Rents: Rental rates remain lower than prime CBDs, presenting an opportunity for cost-conscious businesses.

- Suburban Appeal: Alabang continues to attract companies seeking a less congested environment with excellent amenities and a favorable work-life balance for employees.

- Future Infrastructure: The ongoing NSCR project is expected to significantly enhance accessibility, potentially boosting future office demand.

Residential Market Overview

Alabang’s residential market offers a mix of high-end houses and lots in exclusive villages and mid-range condominiums, with varying market dynamics.

Vacancy Trends:

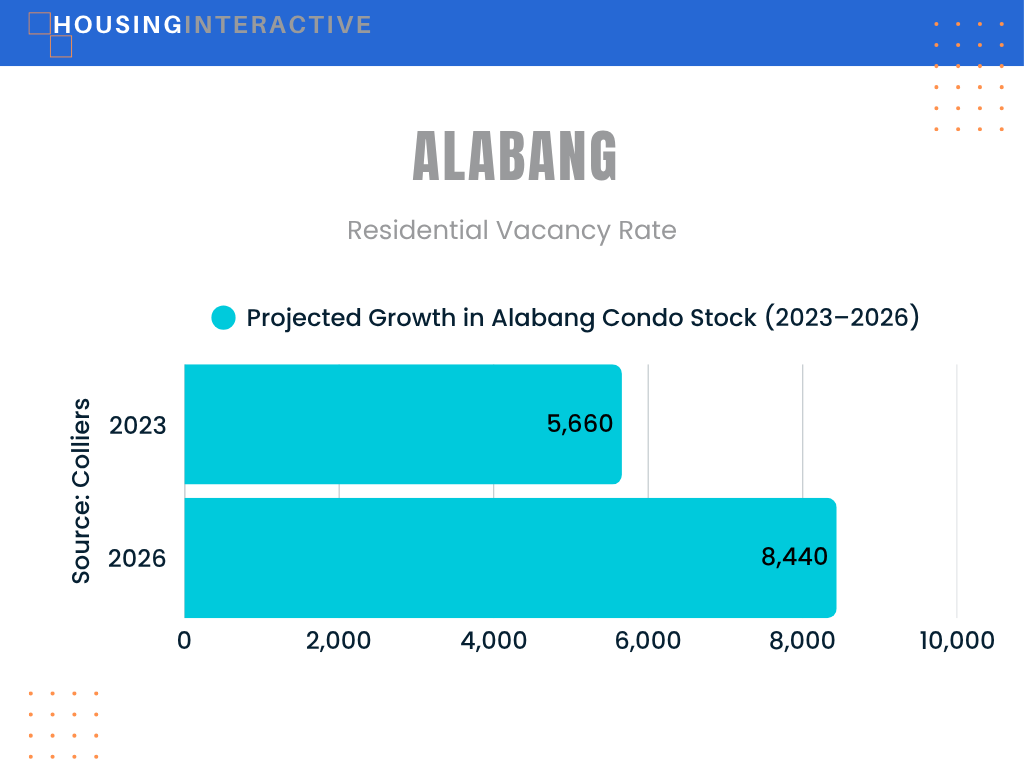

Specific residential vacancy rates for Alabang’s condominiums and houses are not detailed extensively. However, Colliers forecasts significant growth in the condominium stock, from 5,660 units in 2023 to 8,440 units by 2026, suggesting potential future vacancy pressure in the vertical residential segment. Demand for houses within prime villages like Ayala Alabang generally remains strong, likely keeping vacancy lower in that segment. The overall Metro Manila residential vacancy was 23.9% at the end of 2024, providing a broader market context.

Table 3: Alabang Residential Market Snapshot

| Category | Metric | Key Insights: |

|---|---|---|

| Condo Stock (2023) | 5,660 units | |

| Forecast Condo Stock (2026) | 8,440 units | Projected growth of +49.1%, indicating likely pressure on future vacancy rates unless matched by demand. |

| House Demand (Ayala Alabang, etc.) | Strong (low vacancy expected) | Prime house-and-lot communities continue to enjoy strong demand, helping stabilize the low-vacancy end of the residential spectrum. |

| Metro Manila Residential Vacancy (End-2024) | 23.9% | Suggesting overall market softness, especially in vertical developments. |

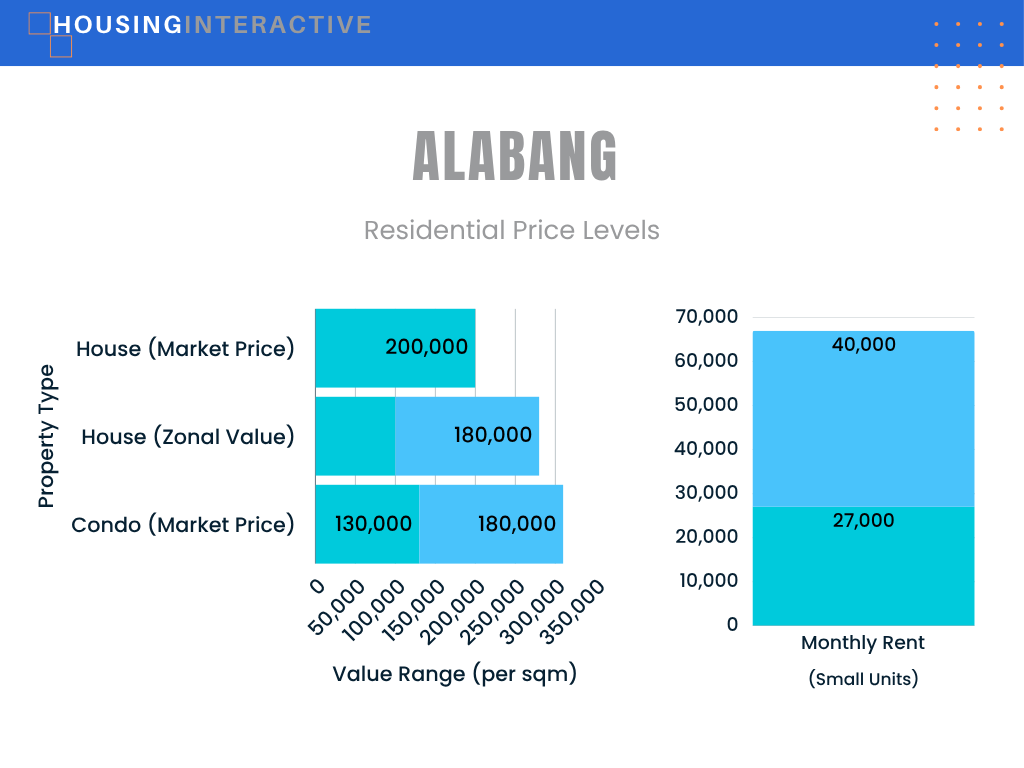

Price Levels:

- Houses and Lots: Prices in prime villages such as Ayala Alabang are exceptionally high. Zonal values typically range from PHP 100,000-180,000/sqm, with market prices for lots reportedly reaching PHP 200,000/sqm. Average house and lot packages are approximately PHP 200 million, though listings show considerable variation.

- Condominiums: Condo prices generally fall into the mid-range. BambooRoutes estimates the 2025 Alabang average condo price between PHP 130,000 and PHP 180,000 per sqm.

- Rental Rates: Condo rentals for smaller units typically range from PHP 27,000 to PHP 40,000 per month. High-end houses in villages command significantly higher average rents, around PHP 220,000 per month.

Table 4: Alabang Residential Price and Rental Snapshot (2025)

| Property Type | Metric | Value Range |

|---|---|---|

| House & Lot | Zonal Value (Land) | PHP 100,000–180,000/sqm |

| Market Price (Land) | Up to PHP 200,000/sqm | |

| Total House & Lot Price | ~PHP 200 million (avg) | |

| Monthly Rent (High-end Houses) | ~PHP 220,000 | |

| Condominiums | Market Price | PHP 130,000–180,000/sqm |

| Monthly Rent (Small Units) | PHP 27,000–40,000 |

Infrastructure & Accessibility

Alabang boasts a robust existing infrastructure and is set for significant enhancements through planned developments.

Existing Infrastructure:

- Expressway Access: Excellent connectivity is provided by the South Luzon Expressway (SLEX), Skyway (including the Skyway Extension, which bypasses the Alabang viaduct), and the Muntinlupa-Cavite Expressway (MCX/Daang Hari link).

- Filinvest City Master Plan: Features a well-designed internal road network, integrated green spaces (Central Park, Creekside Park), dedicated bike lanes, and pedestrian-friendly initiatives like “Carless Sundays.”

- Lifestyle Hubs: Major lifestyle centers such as Alabang Town Center, Festival Mall, and Molito offer integrated amenities and ample parking.

- IT Park: Northgate Cyberzone, a PEZA-registered IT park, is strategically located within Filinvest City.

Planned Developments:

- North-South Commuter Railway (NSCR): Alabang is poised for significant benefits from the NSCR project. The Alabang station (part of Contract Package S-04) is currently under construction and targeted for completion by April 2028. This will establish a modern mass transit link connecting Alabang to Clark in the north and Calamba in the south, significantly reducing travel times.

- Filinvest City Expansion: Ongoing development within Filinvest City includes further infrastructure upgrades and new commercial and residential projects, reinforcing its status as a dynamic urban center.

- PLDT Headquarters: PLDT plans to construct its new campus-style headquarters in Filinvest City, with a target completion in 2028, coinciding with PLDT’s 100th anniversary. This will be a significant new corporate presence in the area.

Key Infrastructure & Developments

| Feature | Status | Key Detail |

| North-South Commuter Railway | Under Construction | Alabang station targeted for April 2028 completion, enhancing mass transit connectivity; partial operations projected for late 2026/early 2027. |

| Skyway Extension | Existing | Improves access to and from SLEX, bypassing Alabang viaduct congestion. |

| MCX (Daang Hari Link) | Existing | Provides direct access to Cavite. |

| Filinvest City Internal Network | Existing | Master-planned roads, bike lanes, parks, and pedestrian initiatives promoting walkability. |

| PLDT Headquarters | Planned | New campus-style headquarters targeted for 2028 completion within Filinvest City, coinciding with PLDT’s centenary. |

Key Business Presence & Amenities

Alabang’s commercial landscape is diverse, hosting major corporations, essential services, and vibrant lifestyle destinations.

Major Companies & Industries:

Filinvest Development Corporation (FDC) and its real estate arm, Filinvest Land Inc. (FLI), are the primary master developers of Filinvest City. Northgate Cyberzone within Filinvest City serves as a hub for numerous BPO and IT companies. Other significant locators in Alabang span the finance, retail, hospitality, and healthcare sectors. PLDT’s planned headquarters represent a major future corporate presence. Key retail operations include Festival Mall (Filinvest), Alabang Town Center (Ayala Mall), and the nearby SM Southmall.

Healthcare:

- Asian Hospital and Medical Center: A top-tier, JCI-accredited private hospital, providing comprehensive medical services.

- Alabang Medical Center: Another prominent private healthcare facility.

- Research Institute for Tropical Medicine (RITM): A government research and specialty hospital, vital for public health initiatives.

- Ospital ng Muntinlupa: Serves the public healthcare needs of Muntinlupa City residents.

Dining & Lifestyle:

Alabang offers diverse dining and lifestyle options, primarily concentrated within its renowned hubs:

- Alabang Town Center (ATC)

- Festival Mall

- Molito Lifestyle Center

- Westgate Center: These centers collectively provide a diverse mix of offerings, from casual cafes and fast-food establishments to mid-range and upscale restaurants, catering to the varied preferences of families and professionals in the area.

Livability Assessment

Strengths:

- Suburban Charm: Offers a more tranquil, green, and less congested environment compared to the bustling central CBDs.

- Family-Friendly Environment: Known for its excellent schools, comprehensive healthcare facilities, and abundant family-oriented amenities.

- High-Quality Lifestyle Centers: ATC, Festival Mall, and Molito provide extensive shopping, dining, and entertainment options.

- Excellent Expressway Access: Well-connected to other parts of Metro Manila and southern provinces via SLEX, Skyway, and MCX.

- Safety and Security: Generally perceived as safe and secure, particularly within its exclusive gated residential villages.

- Strong Sense of Community: Evident, especially within its established residential areas.

Challenges:

- Car Dependency: Movement within Alabang often requires private vehicle use for convenience, although public transport options are available.

- Local Traffic Congestion: Traffic can be an issue on local roads like Alabang-Zapote Road and during peak hours on expressways leading into and out of the area.

- Perceived Distance: For some, its location might feel somewhat distant from the northern parts of Metro Manila.

- Weak Office Market: The current high vacancy in the office sector poses a concern for commercial property investors.

- Parking Challenges: Parking can be difficult at popular commercial spots during peak times.

HI’s Perspective / Our HI Five score

Alabang, particularly Filinvest City, scores High on livability, providing a superior quality of life for those seeking a suburban, family-focused environment. It is distinguished by excellent amenities, reputable schools, and top-tier healthcare, while maintaining relatively convenient access to central business districts like Makati and BGC via expressways. The primary trade-offs include a higher reliance on private vehicles and instances of local traffic congestion. While the current weakness in the office market is a notable point for commercial investors, it does not significantly diminish Alabang’s strong residential appeal. The ongoing development of the North-South Commuter Railway station represents a significant future enhancement, promising to further boost its long-term connectivity and attractiveness.

This report is based on market data as of Q1 2025. HousingInteractive provides this analysis for informational purposes only.

References

[1] Q1 2024 Office Market Report – Contact Center Association of the Philippines

[2] pdf.savills.asia

[3] Office Market Outlook – Lobien Realty Group

[4] Philippines’s Residential Property Market Analysis 2024

[5] Colliers: Metro Manila land prices to drop 2-5% amid growing condo glut and office vacancies – Bilyonaryo

[6] What are the average condo prices in Manila in 2025? – Bamboo Routes

[7] RAIL NEWS: DOTr breaks ground for P73.25-B Alabang-Calamba civil works segment of North-South Commuter Railway system